What Is The Accounting Cycle?

The accounting cycle is a

series of activities that compiles an organizationís transactions at the end of

a reporting period in order to prepare important financial statements.

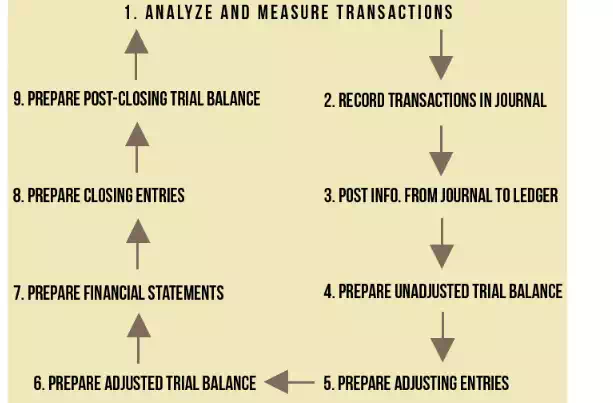

Since there are quite a few steps involved in the accounting cycle, feel free to print off the following graphic for your future needs:

Steps of the Accounting Cycle

1. Analyze and measure transactions.

Obviously in this phase, your business collects their transactions for analysis, measurement, and recording. But here's the first hang-up: what do you have to record?

As a general rule of thumb, a business should minimally record:

1. All cash sales.

2. All purchases (no matter how small).

3. Anything that's measurable, relevant, or reliable.

4. All events:

o External transactions: are between the entity and its environment, such as exchanges with another company or a change in the cost of goods your business purchases.

o Internal transactions: are exchanges that occur within the organization.

In short, a company records as many transactions as possible that affect its financial position.

2. Record transactions in the journal.

This is also known as journalizing. A journal chronologically lists transactions and other events in terms of debits and credits to accounts. Each journal entry consists of four parts:

1. The accounts and amounts to be debited.

2. The accounts and amounts to be credited.

3. The date of transaction.

4. A transaction explanation.

3. Post information from the journal to the ledger.

This is the act of transferring information from the journal to the ledger. Posting is needed in order to have a complete record of all accounting transactions in the general ledger, which is used to create a company's financial statements.

4. Prepare an unadjusted trial balance.

The unadjusted trial balance is a list of the accounts and their balances at a given time, before any adjusting entries are made to create financial statements. The accounts are listed in the order which they appear in the ledger, with debit balances listed in the left column and credit balances in the right column. The totals of these two columns must match.

5. Preparing adjusting entries.

Adjusting entries are journal entries recorded at the end of an accounting period that alter the final balances of various general ledger accounts. These adjustments are made in order to more closely align the reported results and the actual financial position of a business. Adjusting entries follow the principles of revenue recognition and matching.

6. Prepare an adjusted trial balance.

After journalizing and posting all adjusting entries, many businesses prepare another trial balance from their ledger and accounts. This is called the adjusted trial balance. It shows the balance of all accounts, including those adjusted, at the end of the accounting period. Therefore, the end result of this adjusted trial balance demonstrates the effects of all financial events that occurred during that particular reporting period.

7. Prepare financial statements.

Financial statements can be prepared directly from the adjusted trial balance. A financial statement is an organization's financial results, condition, and cash flow.

8. Prepare closing entries.

In the closing phase, temporary balances are reduced to zero in order to prepare the accounts for the next period's transactions. This process empties the entity's temporary accounts and deposits anything remaining into a permanent account.

9. Prepare a post-closing trial balance.

The post-closing balance consists only of assets, liabilities, and owners' equity, also known as real or permanent accounts. This balance provides evidence that the company has properly journalized and accurately posted the closing entries.

Now that your company has performed a complete accounting cycle, it's ready for the next reporting period.