Managing Sales

Sales made by businesses can be broken down into the following main categories:

• Cash sales

• Sales on account

Cash Sales

Some businesses sell merchandise for cash only, while others sell merchandise either for cash or on account. A variety of practices are followed in the handling of cash sales. If such transactions are numerous, it is probable that one or more types of cash registers will be used. In this instance, the original record of the sales is made in the register.

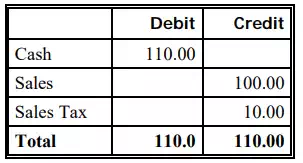

Often, registers have the capability of accumulating more than one total. This means that by using the proper key, each amount that is punched in the register can be classified by type of merchandise, by department, or by salesperson. Where sales tax is involved, the amount of the tax may be separately recorded. In accounting terms, a cash sale means that the asset Cash is increased by a debit and the income account Sales and a liability account Sales Tax Payable are credited. This displays in the table below:

In many retail establishments, the procedure in handling cash sales is for the sale clerks to prepare sale tickets in triplicate. Sometimes the preparation of the sales tickets involves the use of a cash register that prints the amount of the sale directly on the ticket. Modern electronic cash registers serve as input terminals that are online with computers, that is, in direct communication with the central processor. At the end of each day, the cash received is compared with the record that the register provides. The receipts may also be compared with the total of the cash-sales tickets, if the system makes use of the latter.

Sales on Account

Sales on account are often referred to as charge sales because the seller exchanges merchandise for the buyer’s promise to pay. In accounting terms, this means that the asset Accounts Receivable of the seller is increased by a debit or charge, and the income account sales is increased by a credit. Selling goods on account is common practice at the retail level of the distribution process.

Firms that sell goods on account should investigate the financial reliability of their clients. A business of some size may have a separate credit department whose major function is to establish credit policies and decide upon requests for credit from persons and firms who wish to buy goods on account. Seasoned judgment is needed to avoid a credit policy that is so stringent that profitable business may be refused, or a credit policy that is so liberal that uncollectable account losses may become excessive.

Generally, no goods are delivered until the salesclerk is assured that the buyer has established credit - that there is an account established for this client with the company. In the case of many retail businesses, clients with established credit are provided with credit cards or charge plates, which provide evidence that the buyer has an account. These are used in mechanical or electronic devices to print the client’s name and other identification on the sales tickets. In the case of merchants who commonly receive a large portion of their orders by mail or by phone, this confirmation of the buyer’s status can be handled as a matter of routine before the goods are delivered.