Underwriting Agreement

After the determination of the Issue Price and allocation of our Equity Shares but prior to filing of the Prospectus with ROC, our Company will entered into an Underwriting Agreement with the Underwriters for the Equity Shares proposed to be offered through this Issue. It is proposed that pursuant to the terms of the Underwriting Agreement, the BRLMs shall be responsible for bringing in the amount devolved in the event that the Syndicate Members (other than ESL) do not fulfill their underwriting obligations. Pursuant to the tem1s of the Underwriting Agreement, the obligations of the Underwriters are several and are subject to certain conditions precedent to closing, as specified therein.

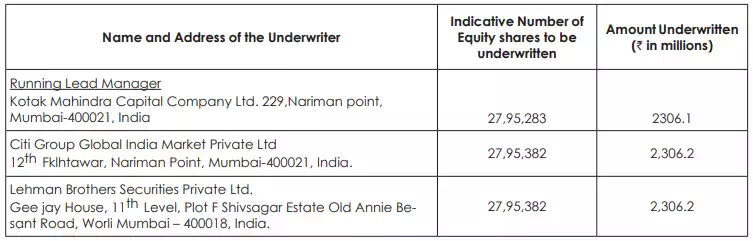

The Underwriters have indicated their intention to underwrite the following number of Equity Shares: (This portion has been intentionally left blank and will be filled in before filing of the Prospectus with RoC)

Sub-Underwriters

In order to spread the risk of under-subscription , the principal underwriters may enter into subsidiary agreements with sub-underwriters. Such agreements are made between the underwriters alone, with the company not being a party thereto. As per agreement, the company pays commission at a prescribed rate to the principal underwriters, who in turn, disburse commission to the sub- underwriters. Sometimes an additional commission is paid to the principal underwriters to encourage sub-underwriting. This is known as over-riding commission. The payment of an over-riding commission enables the company to deal with one or two underwriters instead of a number of them.

Underwriting Commission

It may be paid in cash or in fully paid-up shares or debentures or a combination of all these. It is paid on the issue price of the shares or debentures so underwritten. As per the provision of Section 40 of the Companies Act, 2013, commission is payable if the following conditions are satisfied:

v The payment of the commission is authorized by the articles;

v (ii) The commission paid or agreed to be paid does not exceed in the case of shares, five per cent of the price at which the shares are issued or the amount or rate authorized by the articles, whichever is less, and in the case of debentures, two and a half per cent of the price at which the debentures are issued or the amount or rate authorized by the articles, whichever is less;

v The amount or rate per cent of the commission paid or agreed to be paid is - in the case of shares or debentures offered to the public for subscription, disclosed in the prospectus, and in the case of shares or debentures not offered to the public for subscription, disclosed in the statement in lieu of prospectus, or in a statement in the prescribed form signed in like manner as a statement in lieu of prospectus and filled in before the payment of the commission with the Registrar and, where a circular or notices not being a prospectus inviting subscription for the shares or debentures, is issued, also disclosed in that circular or notice:

v The number of shares or debentures which persons have agreed for a commission to subscribe absolutely or conditionally is disclosed in the manner aforesaid; and

v A copy ‘If the contract for the payment of the commission is delivered to the Registrar at the time of delivery of the prospectus or the statement in lieu of prospectus for registration.

In this regard, the following points are to be noted:

ü No underwriting commission is payable on the shares taken up by the promoters, employees, directors, business associates, etc.

ü Commission is payable on the whole issue underwritten irrespective of the fact that whole of the issue may be taken over by the public.

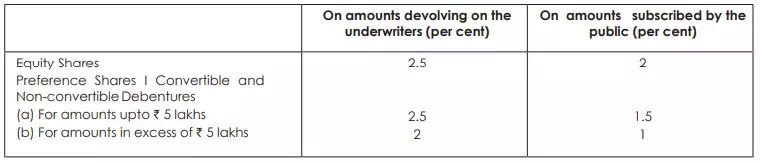

However, as per Guidelines issued by the Stock Exchange division of the Department of Economic Affairs, Ministry of Finance vides their reference No. F-14/1/SE/85, dated 7th May, 1985, the following rates for payment of underwriting commission are in force.

Ø The rates of underwriting of commission mentioned above are maximum ceiling rates, within which any company will be free to negotiate the same with the underwriters.

Ø (ii) Underwriting commission will not be payable on amounts taken up by the promoters group, employees, directors, their friends and business associates.

The company while fixing the underwriting commission should ensure that the commission is within the limits specified by the Central Government as stated in the above table.

Underwriting Agreement

There are two types of underwriting agreement: (a) conditional; and (b) firm. Conditional underwriting: Under this type of agreement, the underwriter agrees to take up agreed proportion of shares, not taken up by the public. If the shares are fully subscribed by the public, the underwriter does not take up any share. Firm underwriting: Under this type of agreement, the underwriter agrees to take up a specified number of shares irrespective of the number of shares subscribed for by the public. Unless it has otherwise agreed, the Underwriters’ liability is determined without considering the number of shares taken up ‘firm’ by him.