Non-cumulative sinking fund

A non-cumulative sinking fund differs from the cumulative type of sinking fund only in one respect: in non-cumulative sinking fund, interest received on sinking fund investment is not re-invested, nor is it transferred to sinking fund. Interest on sinking fund investment is treated as a simple profit and is kept in the business without earmarking its use and the amount is transferred to profit and loss account. Nevertheless, a careful study of the two types of funds will reveal that there is no difference between the two methods. In a non-cumulative type of fund, the appropriation from the profits is more but the excess burden on the profits is corrected by the transfer of interest on the investment to profit and loss account. While in the case of a cumulative type of sinking fund method, the appropriation from the profit is less, but that amount is made up by crediting to sinking fund the amount of interest earned on investment.

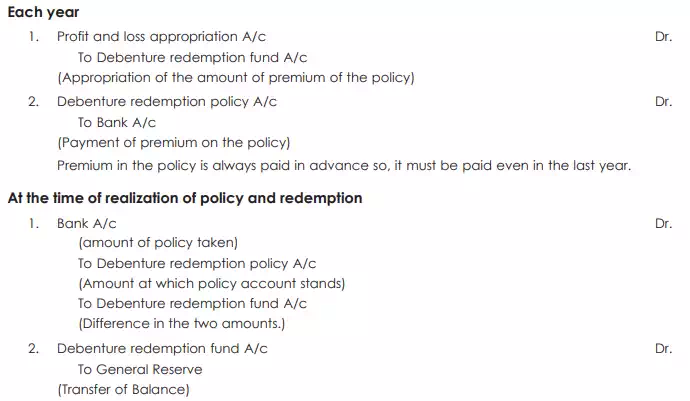

Insurance policy method

Under this method, an insurance policy for the required amount is to be taken for the redemption of debentures at the end of a fixed period. Under this system, the premium is paid regularly in installments and the insurance company, in its turn, returns the total accumulated money at the expiry of the period. Money so received is used for redeeming debentures. This method differs from the sinking fund method only in respect of interest on investment. Unlike sinking fund method, the insurance company does not give any interest on the installments received. Entries in respect of insurance policy are as follows: