Restrictions on Dividends

Ø In the case of new company, distribution of dividends shall require the approval of trustees to the issue of debentures and lead institution, if any.

Ø In the case of existing companies prior permission-of the lead institution for declaring dividend exceeding 20% or as per the loan covenants is necessary if the company does not comply with institutional condition regarding interest and debt coverage ratio.

Ø Dividends may be distributed out of profits of particular year only after transfer of requisite amount in DRR. If residual profits are inadequate to distribute reasonable dividends, company may distribute dividend out of general reserve.

As mentioned already the two modes of provisioning are (1) the sinking fund method, and (2) the insurance policy method.

It is always prudent for a company to save money for redeeming debentures on the due date. In the absence of such a provision it becomes difficult for the company to find lumpsum amount to repay the debt. This can be done by adopting any of the two methods explained below:

Sinking fund method

Under this method the amount is invested in first class securities with secured and fixed return. Accumulation of interest becomes compounded resulting to produce the amount required to redeem the debentures on the due date. This method of providing for funds is also called debenture redemption fund method. The sinking fund method for redeeming a loan is different from sinking fund method for replacing an asset in the following ways:

· Sinking fund created for replacing an asset is in the nature of accumulated depreciation, while sinking fund created for repaying loan is in the nature of accumulated profits. It is for this reason that sinking fund’s balance (after the redemption of loan) is transferred to general reserve, while that for an asset is transferred to asset account.

· Annual installment set aside for the replacement of an asset is a charge and is debited to profit and loss account, while that for the redemption of a loan is an appropriation and is debited to profit and loss appropriation account.

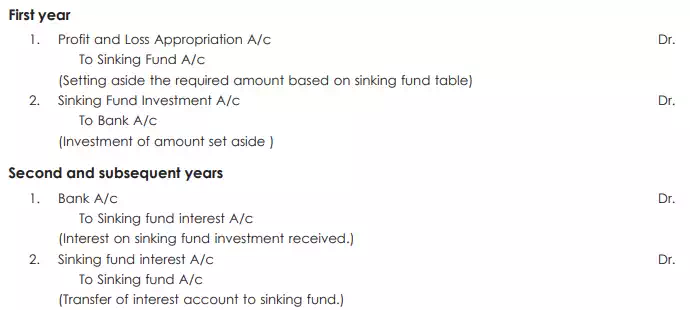

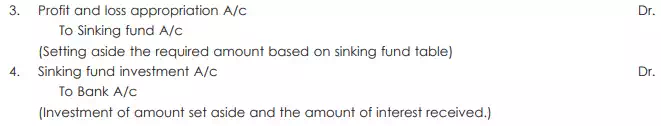

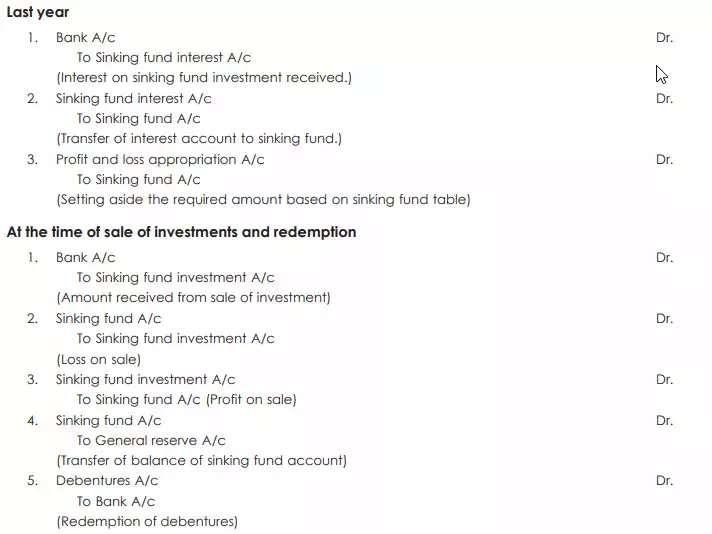

Accounting entries for making the provision for the redemption of debentures are as follows:

It may be noted that in the final year the amount appropriated from the profits of the company and the amount received as interest on sinking fund investment are not invested, as the amount would be needed on the following day for the redemption of debenture.