What Is Shareholders’ Equity?

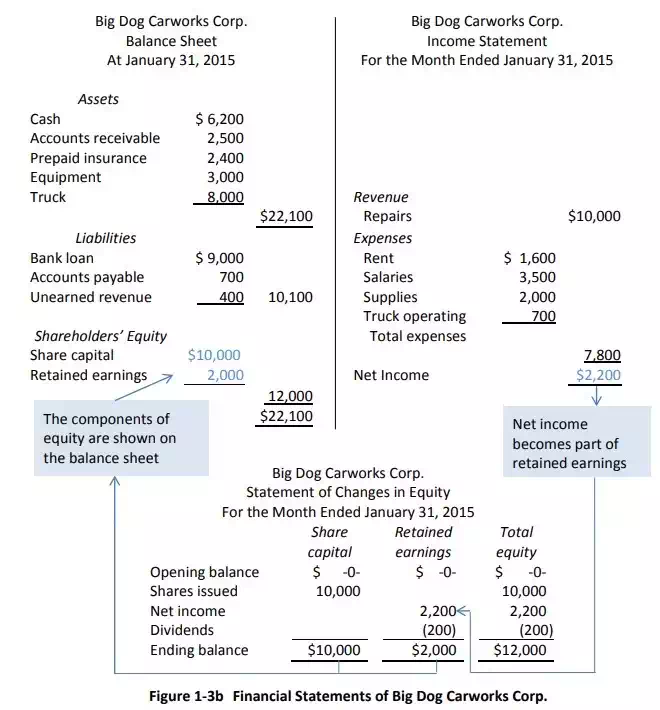

Shareholders’ equity represents the net assets owned by the owners (the shareholders). Net assets are assets minus liabilities. For example, in Big Dog’s January 31 balance sheet, net assets are $12,000, calculated as total assets of $22,100 minus total liabilities of $10,100. This means that although there are $22,100 of assets, only $12,000 are owned by the shareholders and the balance, $10,100, are financed by debt. Notice that net assets and total shareholders’ equity are the same value; both are $12,000. Shareholders’ equity consists of share capital and retained earnings. Share capital represents how much the shareholders have invested in the business. Retained earnings are the sum of all net incomes earned by a corporation over its life, less any dividends distributed to shareholders. Shareholders have a right to these accumulated earnings because they own the corporation.

In summary, the balance sheet is represented by the equation:

Assets = Liabilities + Shareholders’ equity

Transaction Analysis and Double-entry Accounting

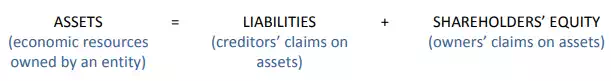

The accounting equation is foundational to accounting. It shows that the total assets of a business must always equal the total claims against those assets by creditors and owners. The equation is expressed as:

When financial transactions are recorded, combined effects on assets, liabilities, and shareholders’ equity are always exactly offsetting. This is the reason that the balance sheet always balances.

Each economic exchange is referred to as a financial transaction—for example, when an organization exchanges cash for land and buildings. Incurring a liability in return for an asset is also a financial transaction. Instead of paying cash for land and buildings, an organization may borrow money from a financial institution. The company must repay this with cash payments in the future. The accounting equation provides a system for processing and summarizing these sorts of transactions.

Accountants view financial transactions as economic events that change components within the accounting equation. These changes are usually triggered by information contained in source documents (such as sales invoices and bills from creditors) that can be verified for accuracy.

The accounting equation can be expanded to include all the items listed on the Balance Sheet of Big Dog at January 31, 2015, as follows:

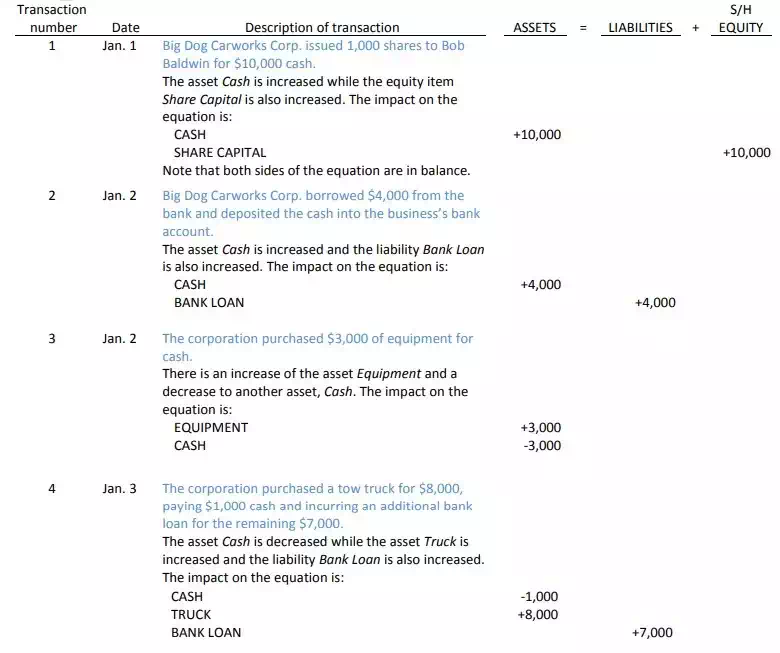

If one item within the accounting equation is changed, then another item must also be changed to balance it. In this way, the equality of the equation is maintained. For example, if there is an increase in an asset account, then there must be a decrease in another asset or a corresponding increase in a liability or shareholders’ equity account. This equality is the essence of double-entry accounting. The equation itself always remains in balance after each transaction. The operation of double-entry accounting is illustrated in the following section, which shows 10 transactions of Big Dog Carworks Corp. for January 2015.

These various transactions can be recorded in the expanded accounting equation as shown below:

Transactions summary:

1. Issued share capital for $10,000 cash.

2. Assumed a bank loan for $4,000.

3. Purchased equipment for $3,000 cash.

4. Purchased a truck for $8,000; paid $1,000 cash and incurred a bank loan for $7,000.

5. Paid $2,400 for a comprehensive one-year insurance policy effective January 1.

6. Paid $2,000 cash to reduce the bank loan.

7. Received $400 as an advance payment for repair services to be provided over the next two months as follows: $300 for February, $100 for March.

8. Performed repairs for $7,500 cash and $2,500 to be paid by customers at a later date.

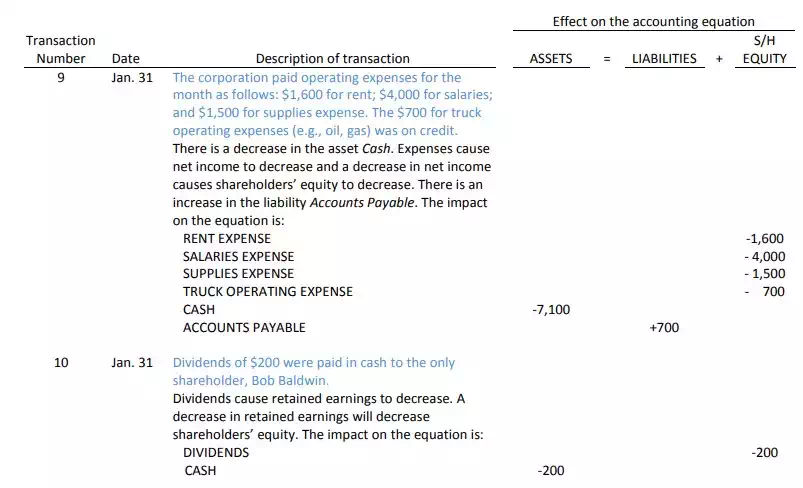

9. Paid a total of $7,100 for operating expenses incurred during the month; also incurred an expense on account for $700.

10. Dividends of $200 were paid in cash to the only shareholder, Bob Baldwin.