Forfeiture of Shares

Forfeiture of Shares

When a shareholder fails to pay calls, the company, if empowered by its articles, may forfeit the shares. If a shareholder has not paid any call on the day fixed for payment thereof and fails to pay it even after his attention is drawn to it by the secretary by registered notice, the Board of Directors pass a resolution to the effect that such shares be forfeited. Shares once forfeited become the property of the company and may be sold on such terms as directors think fit. Upon forfeiture, the original shareholder ceases to be a member and his name must be removed from the register of members.

Surrender of Shares

After the allotment of shares, sometimes a shareholder is not able to pay the further calls and returns his shares to the company for cancellation. Such voluntary return of shares to the company by the shareholder himself is called surrender of shares. Surrender of shares has no separate accounting treatment but it will be like that of forfeiture of shares. The same entries (as are passed in case of forfeiture of shares) will be passed in case of surrender of shares.

Reissue of Forfeited Shares

Forfeited shares may be reissued by the company directors for any amount but if such shares are issued at a discount then the amount of discount should not exceed the actual amount received on forfeited shares. The purchaser of forfeited reissued shares is liable for payment of all future calls duly made by the Company.

When all Forfeited Shares are not Issued

When all forfeited shares are not issued, i.e., only a part of such shares is issued, it is desirable to spread the amount of shares forfeited account on all such forfeited shares and of the amount relating to that part of forfeited shares which has been reissued, discount on reissue of shares should be deducted from such amount and the balance is transferred to capital reserve being capital profit. The amount relating to that part of shares forfeited account which has not been reissued should be shown on the liabilities side of Balance Sheet as Shares Forfeited Account.

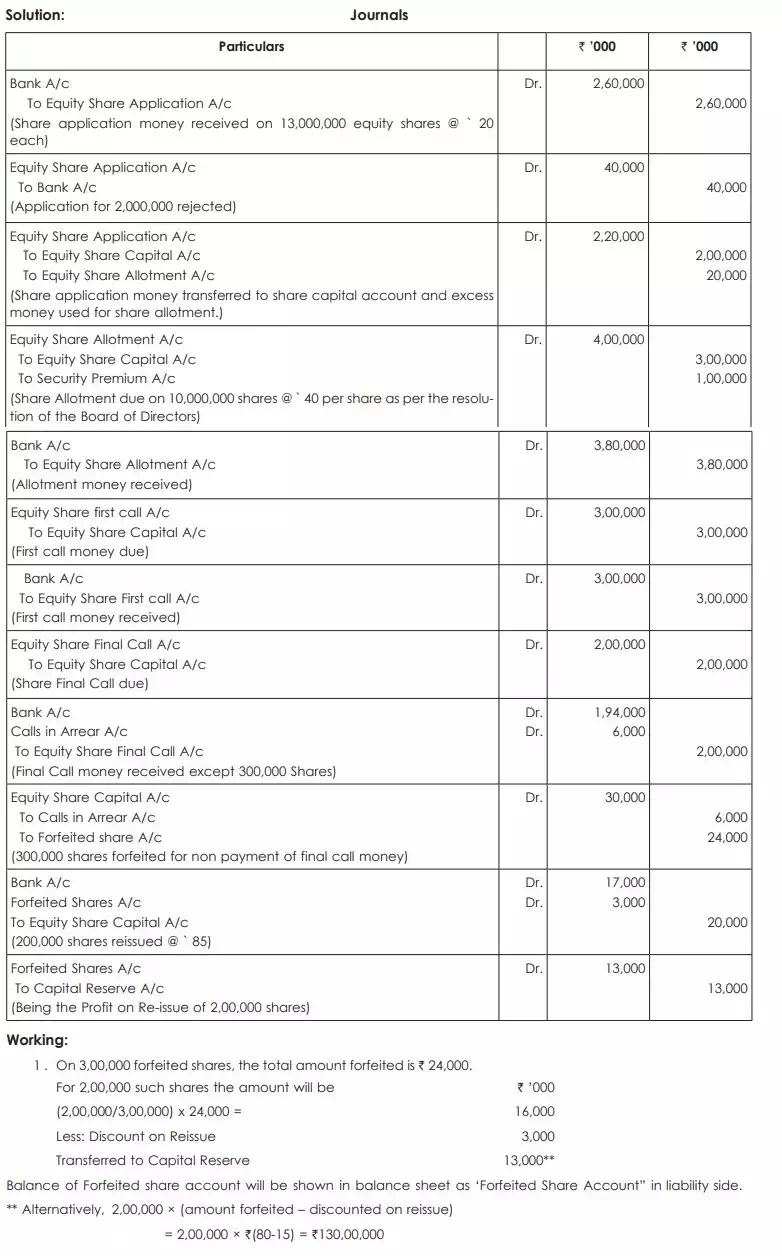

A Company invited the public to subscribe for 100,00,000 Equity Shares of ` 100 each at a premium of ` 10 per share payable on allotment. Payments were to be made as follows: On application ` 20; on allotment ` 40; on first call ` 30 and on final call ` 20.

Applications were received for 130,00,000 shares; applications for 20,00,000 shares were rejected and allotment was made proportionately to the remaining applicants. Both the calls were made and all the moneys were received except the final call on 3,00,000 shares which are forfeited after due notice. Later 2,00,000 of the forfeited shares were re-issued as fully paid at ` 85 per share. Pass Journal entries.