Right Issue

Where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares shall be offered to persons who, at the date of the offer, are holders of equity shares of the company in proportion, as nearly as circumstances admit, to the paid-up share capital on those shares by sending a letter of offer subject to the following conditions, namely:

a. the offer shall be made by notice specifying the number of shares offered and limiting a time not being less than fifteen days and not exceeding thirty days from the date of the offer within which the offer, if not accepted, shall be deemed to have been declined;

b. unless the articles of the company otherwise provide, the offer aforesaid shall be deemed to include a right exercisable by the person concerned to renounce the shares offered to him or any of them in favour of any other person; and the notice referred to in clause (i) shall contain a statement of this right;

c. after the expiry of the time specified in the notice aforesaid, or on receipt of earlier intimation from the person to whom such notice is given that he declines to accept the shares offered, the Board of Directors may dispose of them in such manner which is not dis-advantageous to the shareholders and the company.

Valuation of Rights

Usually a company offers rights issue at a price which is lower than the market price of the shares so that existing (i.e., old) shareholders may get the monetary benefit of being associated with the company for a long time. Existing shareholders who have been offered right shares and do not want to purchase these offered shares may renounce their right shares in favour of some other persons within the specified period as mentioned earlier. In such a case, the existing shareholders can make a profit by selling his right to such other person. This right can be valued in terms of money as below:

a. Calculate the market value of shares which an existing shareholder is required to have in order to get fresh shares.

b. Add to the above price paid for the fresh shares.

c. Find out the average price of existing shares and fresh shares.

d. The average price of the share should be deducted from the market price and the difference thus ascertained is value of right.

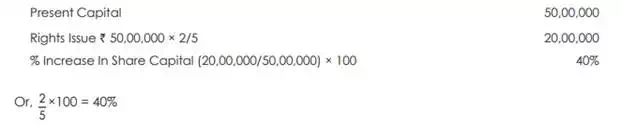

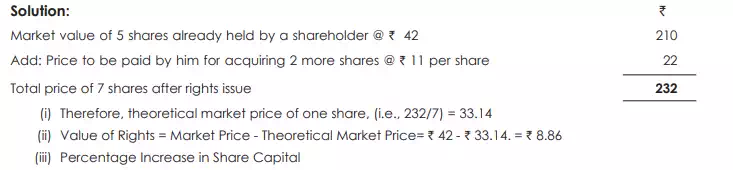

A Company is planning to raise funds by making rights issue of equity shares to finance its expansion. The existing equity share capital of the company is ` 50,00,000. The market value of its share is ` 42. The company offers to its shareholders the right to buy 2 shares at ` 11 each for every 5 shares held. You are required to calculate:

(i) Theoretical market price after rights issue;

(ii) The value of rights; and

(iii) Percentage increase in share capital.

COMPANY ACCOUNTS AND AUDIT