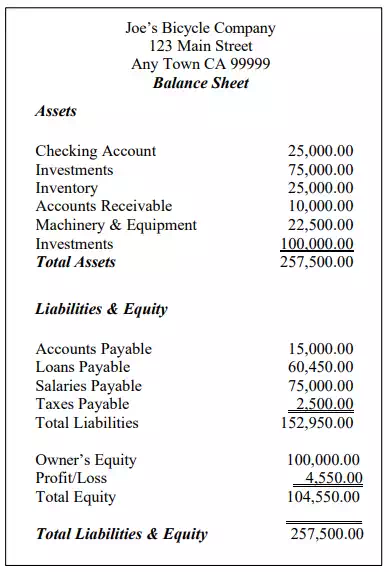

Balance Sheet

A Balance sheet is like a “snapshot” that gives you the overall picture of the financial health of a company at one moment in time. This report lists the assets, liabilities, and owner’s equity in the business. Unlike the income statement, this report is always created to show the financial status as of a certain date. Two common ending periods to create a balance sheet are the end of a month and the end of the year.

The Balance Sheet has two sections. The first section lists all the Asset accounts and their balances. At the end of the list, the totals of all assets are listed. In the second section, the Liability and Owner’s Equity accounts are listed. There are two sub-totals for the Liability and the Equity accounts. At the end, there is a combined total of the Liabilities and Owner’s Equity. As discussed earlier in the accounting equation, the Assets equal the sum of the Liabilities and the Equities. You will also notice that the Profit from the income statement is listed in the Equity section of the balance sheet. Some of the important accounts in the balance sheet are:

Current Assets: Current assets are always listed first and include cash and other items that can be converted into cash within the following year. This includes funds in checking and savings accounts.

Accounts Receivable: Accounts Receivable represents money owed to the business. These usually result from the sale of merchandise or performance of services for a client on account. The phrase On Account indicates that on the date the goods were sold to the client, or the service performed for him, the business did not receive full payment. However, it did obtain an asset – the right to collect payment for merchandise sold or Services performed. The claim a business has against a credit client is referred to as an Account Receivable. It is an asset because it represents a legal claim to cash.

Inventory: Inventories may represent merchandise purchased for resale as well as the raw materials acquired by a manufacturing firm to put into the product. In the case of a manufacturer, the term inventories also includes manufacturing supplies, purchased parts, the work that is in process, and finished goods. Inventory is also an asset account.

Accounts Payable: When you purchase goods or services on account, you are usually required to pay within a fixed period of time. These amounts you owe for the goods or services purchased are called accounts payable. The payment of these purchases is usually due within a relatively short period of time. Usually this period is one year or less. Typical periods are thirty to sixty days. The payment for these short-term liabilities requires the use of existing resources like the Cash or The Checking Account.

A very simple form of a balance sheet displays in the following example:

This program automatically creates the Balance Sheet and the Income Statements for you. All the accounts are automatically updated when you create invoices, checks, and transactions in the system. To create a Balance Sheet or an Income Statement all you have to do is to select the report from the menu and print it.