Generally Accepted Accounting Principles (GAAP)

The goal of accounting is to ensure information provided to decision makers is useful. To be useful, information must be relevant and faithfully represent a business’s economic activities. This requires ethics, beliefs that help us differentiate right from wrong, in the application of underlying accounting concepts or principles. These underlying accounting concepts or principles are known as generally accepted accounting principles (GAAP).

GAAP in Canada, as well as in many other countries, is based on International Financial Reporting Standards (IFRS). IFRS are issued by the International Accounting Standards Board (IASB). The IASB’s mandate is to promote the adoption of a single set of global accounting standards through a process of open and transparent discussions among corporations, financial institutions, and accounting firms around the world.

GAAP are undergirded by qualitative characteristics and principles that inform how and when financial information is presented. Financial information that possesses the quality of:

Ř relevance has the ability to make a difference in the decision-making process.

Ř faithful representation is complete, neutral, and free from error.

Ř comparability tells users of the information that businesses utilize similar accounting practices.

Ř verifiability means that others are able to confirm that the information faithfully represents the economic activities of the business.

Ř timeliness is available to decision makers while it is still useful.

Ř understandability is clear and concise.

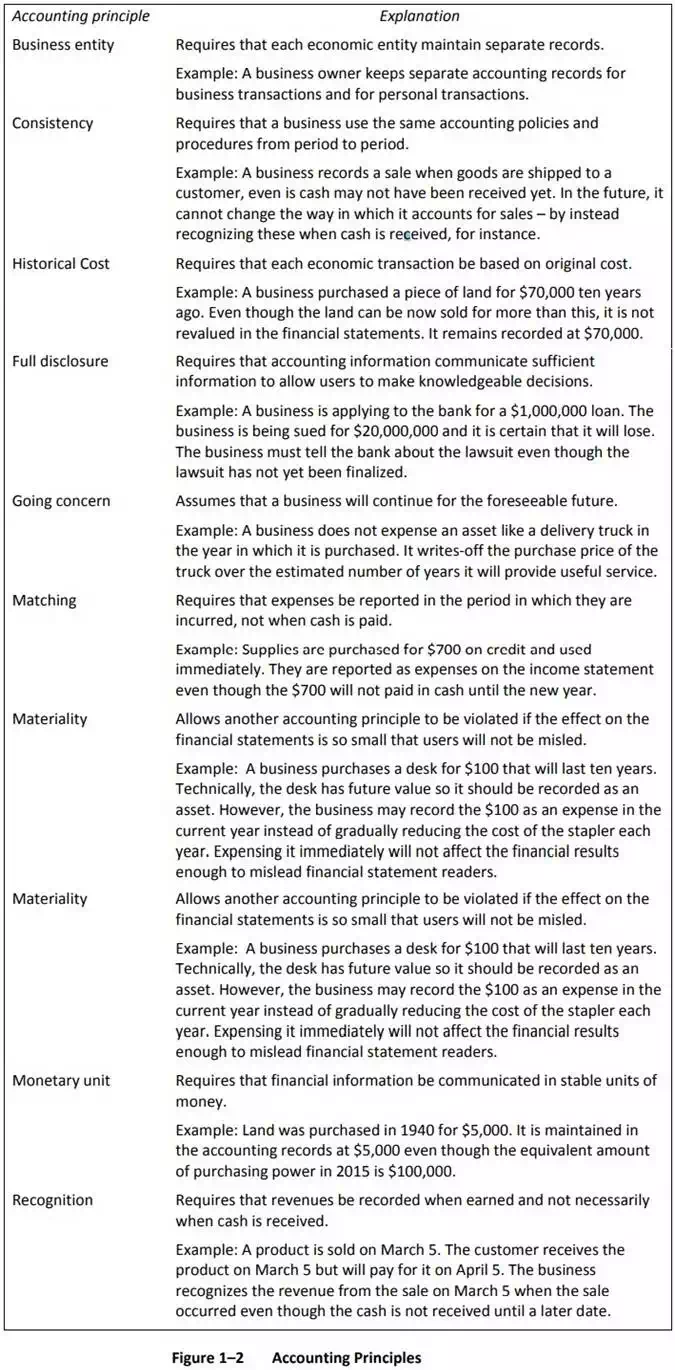

In addition, there are a number of accounting principles that guide development of GAAP. Figure 1–2 lists these.