Petty Cash Book

In every business organisation, there are a number of payments which involve small amounts e.g. payments for postage, telegrams, carriage, cartage etc. If all these transactions are recorded in the Cash Book, it will increase the head cashier’s work manifold and it will make the Cash Book unnecessarily bulky and uneasy. Normally, one person is handed over a small amount to meet the petty expenses of a given period (say, week, fortnight or month) and is authorised to make such payments and to record them in a separate Cash Book. Such person, amount and Cash Books are called as “Petty Cashier”, ‘Imprest’ and ‘Petty Cash Book’ respectively. The Petty Cash Book may or may not be maintained on ‘Imprest System’. Under both the systems (i.e. Imprest and Non-imprest), the petty cashier submits the Petty Cash Book to the Head Cashier who examines the Petty Cash Book. Under the Imprest system, the Head Cashier makes the reimbursement of the amount spent by the Petty Cashier but under Non-imprest system, the Head Cashier may handover the Cash to the Petty Cashier equal to/more than/less than the amount spent. Usually, the Petty Cash Book is maintained on the basis of imprest system.

Advantage of the Imprest System:

The system of petty cash payments along with the imprest system offers the following advantages:

(1) The money in the hands of the petty cashier is limited to the imprest amount.

(2) As the periodical reimbursements are the actual expenses paid and not mere advances on account only, they are as such brought prominently to the notice of Chief Cashier.

(3) The Chief Cashier, by handing over a fixed sum, is relieved of the cumbersome work of petty disbursements.

(4) The main cash book is not unnecessarily clogged with the large number of small items. Even in the ledger, only the totals are posted.

(5) At all time, the amount of cash in hand plus expenses not reimbursed must equal the imprest amount, thus, facilitating a simple check.

(6) The maximum liability of the petty cashier can never exceed the imprest amount.

(7) The regular check of the petty cash book creates a sense of responsibility in the petty cashier.

All the heads of expenses are totalled periodically and such periodic totals are individually posted to the debit side of the concerned ledger accounts in the ledger by writing ‘To Petty Cash A/c’ in the particulars column. The Petty Cash Account in the ledger is credited with the total expenditure incurred during the period by writing ‘By Sundries as per Petty Cash Book’ in the particulars column. The ledger folio number is written under every total amount of expense to indicate that the entry has been posted in the ledger. In the folio column of the ledger account, the page number of the petty cash book is written.

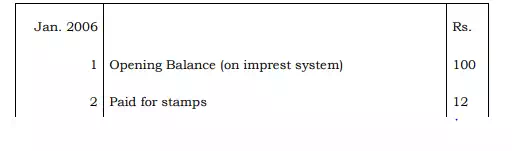

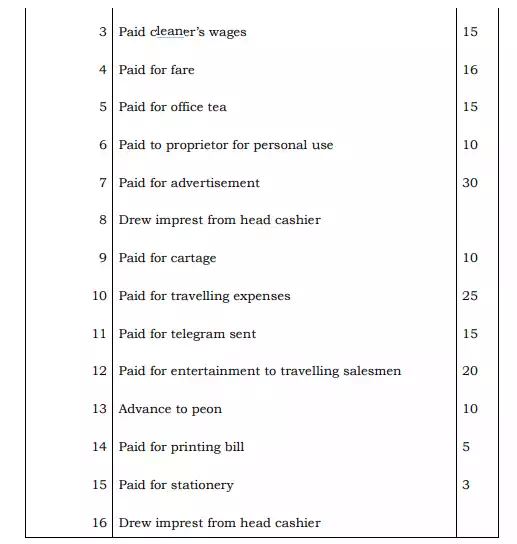

Illustration 4: From the following particulars, prepare Petty Cash Book on imprest system of K.P. Singh & Co. for the month of January 2006

Solution