Double Column Cash Book

This Cash Book has two amount columns one for cash and another for discount on each side. It is customary in business to allow discount when payment is received from a customer promptly and before due date. It is equally so when payment is made to a creditor before due date. All cash receipts and discount allowed are recorded on the debit side and all cash payments and discount received are recorded on the credit side of Cash Book.

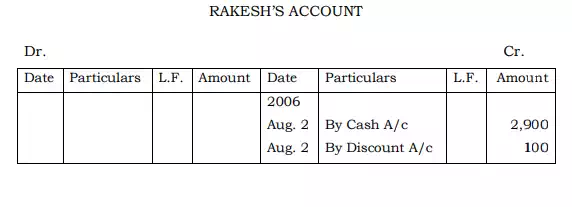

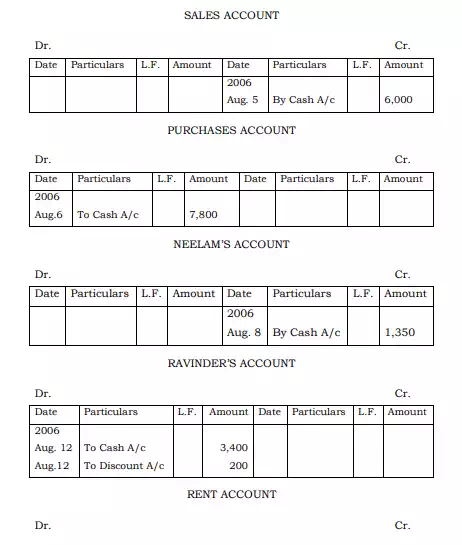

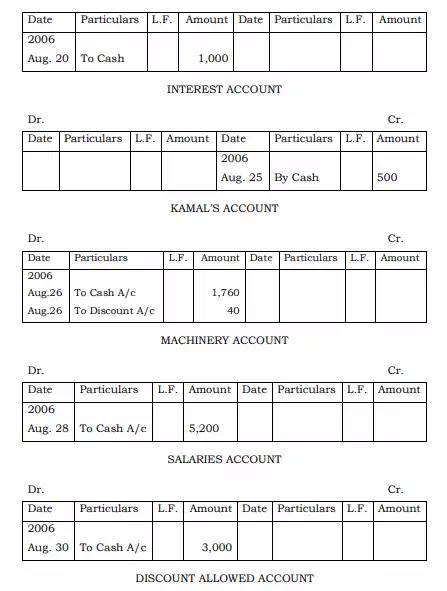

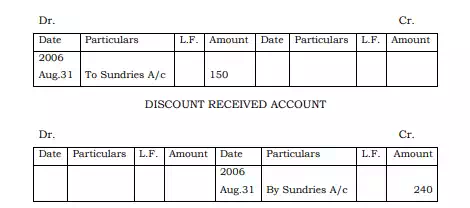

The posting from the cash columns is done in the same manner as it is done in Single Column Cash Book. Entries from discount column of the debit side of the Cash Book are posted on the credit side of every individual debtor’s account to whom the business has allowed the discount. The total of the debit side of the discount column is shown on the debit side of the “Discount Allowed Account” by writing “To Sundries” in the particulars column. Entries from the discount column of the credit side of the Cash Book are posted on the debit side of every individual creditor’s account by whom the discount is allowed to the business. The total of the credit side of the discount column is shown on the credit side of the “Discount Received Account” by writing “By Sundries” in the particulars column.

The cash column of the Double Column Cash Book is balanced exactly in the same manner as in case of the Single Column Cash Book. But, the discount columns are not balanced but merely totalled. These totals are posted to the respective Discount Allowed Account and Discount Received Account.

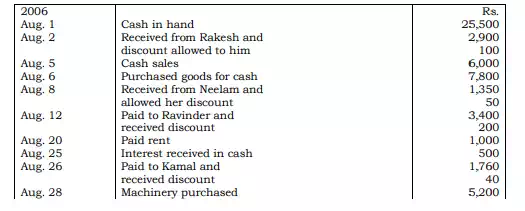

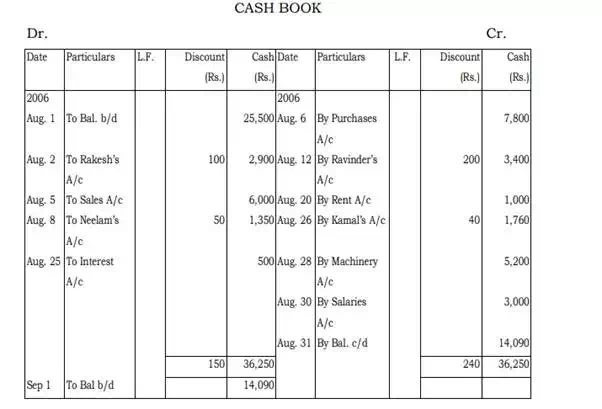

Illustration 2: From the following transactions, prepare the Two Column Cash Book and also post them in the Ledger.

Solution

Note: The discount columns are not balanced but these are totalled in respective column and posted in the ledger.

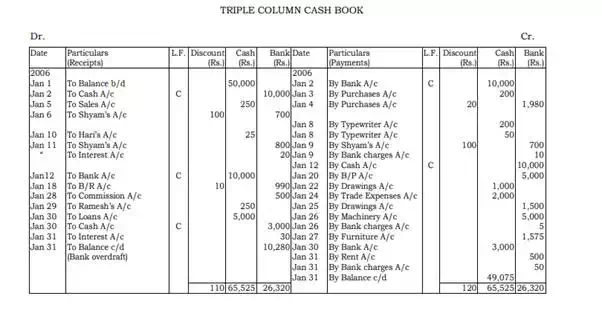

Triple Column Cash Book

This type of Cash Book is an improvement over the Double Column Cash Book. In modern times, it is virtually impossible to imagine any business without having dealings with a bank. Most of the transactions relating to receipts and payments of money are made through cheques. So transactions through bank are also recorded in the cash book by adding one more column i.e. bank column on both sides of the cash book. Therefore there are three columns on both sides of the cash book i.e. cash, bank and discount columns. That is why this type of cash book is known as Triple Column Cash Book.

Receipt side (Dr side) of the Triple Column Cash Book is used to record all receipts both in cash and by cheques as also to record the discount allowed to our debtors while receiving the payment. Cash receipts are entered in the cash column whereas amounts received by cheques are entered in the bank column and discount allowed in the discount column. Posting from the debit side of the cash book is made to the credit side of each account in the ledger– in case of personal accounts credit is to be given for cash or cheques received plus discount allowed.

Payment side (Cr. side) of the Cash Book is used to record all payments both in cash and through cheques as also to record the discount received or availed by us from over creditors while making payment to them. Cash payments are recorded in the cash column, payments through cheques are entered in the bank column and discount received in the discount column. Posting from the credit side of the cash book is made on the debit side of respective accounts– in case of personal accounts debit is to be given for the total of the payments made and discount received.

After recording all the relevant transactions in the Cash Book, all the columns of the Cash Book are totalled. The difference in the cash columns is put on the credit side of Cash Book in the column by writing “By Balance c/d”. The bank balance may have a debit balance or a credit balance. If the total of the debit side of the bank column is more than the total of the credit side of the bank column, it has a debit balance and if the total of the credit side is more than that of the debit side, then it has a credit balance (overdraft). However, the difference is put on the lesser side. There is no need to balance the discount columns. The discount columns of both the sides are totalled.

In the Triple Column Cash Book there will be some cross or contra entries i.e., transfer of money from cash to bank (amount deposited) and vice-versa (amount withdrawn from bank for office use). In all such cases both entries occur in the cash book and no ledger entry is required. This is indicated by a contra sign (C) in the folio column indicating thereby that the double entry aspect of this transaction is complete and it requires no posting to the ledger.

Illustration 3: Prepare a Triple Column Cash Book from the following particulars: 2006

Jan.

1. Cash in hand Rs. 50,000.

2. Paid into bank Rs. 10,000.

3. Bought goods from Hari for Rs. 200 for cash.

4. Bought goods for Rs. 2,000 paid cheque for them, discount allowed 1%

5. Sold goods to Mohan for cash Rs. 250.

6. Received a cheque from Shyam to whom goods were sold for Rs. 800. Discount allowed 12.5%

8. Purchased an old typewriter for Rs. 200. Spent Rs. 50 on its repairs.

9. Bank notified that Shyam’s cheque has been returned dishonoured and debited to the account in respect of charges Rs. 10.

10. Received a money order for Rs. 25 from Hari.

11. Shyam settled his account by means of a cheque for Rs. 820, Rs. 20 being for interest charged.

12. Withdrew from bank Rs. 10,000.

18. Discounted a bill of exchange for Rs.1,000 at 1% through bank.

20. Honoured our own acceptance by cheque Rs. 5,000.

22. Withdrew for personal use Rs. 1,000.

24. Paid trade expenses Rs. 2,000.

25. Withdrew from bank for private expenses Rs. 1,500.

26. Purchased machinery from Rajiv for Rs. 5,000 and paid him by means of a bank draft purchased for Rs. 5,005.

27. Issued cheque to Ram Saran for cash purchase of furniture Rs. 1,575.

28. Received a cheque for commission Rs. 500 from R. & Co. and deposited into bank.

29. Ramesh who owned us Rs. 500 became bankrupt and paid us 50 paisa in a rupee.

30. Received payment of a loan of Rs. 5,000 and deposited Rs. 3,000 out of it into bank.

31. Paid rent to landlord ‘Mohan’ by a cheque of Rs. 500. 31. Interest allowed by bank Rs. 30. 31. Half-yearly bank charges Rs. 50.

Solution