Subsidiary Books Of Accounts

Introduction

All business transactions, at the first stage, are recorded in the book of original entry i.e. Journal and then posted into the ledger under the double entry system of book-keeping. This procedure is easy and practicable in small business houses where the number of business transactions are less and when a single person can handle the business transactions. But it is practically very difficult, rather impossible, to record all the business transactions of a day in the Journal of a large business house where the number of business transactions are varied and enormous because of the following reasons:

(a) The system of recording all transactions in a journal requires (i) writing down of the name of the account involved as many times as the transactions occur; and (ii) an individual posting of each account debited and credited and hence, involves the repetitive journalising and posting labour.

(b) Such a system does not provide the information on a prompt basis.

(c) The journal becomes bulky and voluminous.

(d) Such a system does not facilitate the installation of an internal check system since the journal can be handled by only one person.

Therefore, to overcome the shortcomings of the use of the journal as the only book of original entry, the journal is subdivided into special journals. It is divided in such a way that a separate book is used for each category of business transactions which are repetitive in nature, similar and are sufficiently large in number. Special journals refer to the journals meant for recording specific business transactions of similar nature. These special journals are also known as “Subsidiary Books” or “Day Books”. The main types of special journals are as follows:

(i) Cash Book: It records all those transactions which are in cash or by cheques.

(ii) Purchases Book: It records all transactions relating to goods purchased on credit.

(iii) Sales Book: It records all transactions relating to goods sold on credit.

(iv) Purchases Return Book: It records return of goods to suppliers.

(v) Sales Return Book: It records return of goods by the customers.

(vi) Bills Receivable Book: It records entries regarding bills receivables. The details of bills are given in this book.

(vi) Bills Payable Book: All bills which are accepted and payable by a business house are recorded in this book.

(viii) Journal Proper: Those transactions which are not recorded in any of the above-mentioned books are recorded in the Journal Proper.

Before recording transactions in these day books, it is necessary to explain the special meaning given in business to the words ‘Goods’, ‘Purchases’ and ‘Sales’.

Goods: It refers to items forming part of the stock-in-trade of a business house which are purchased and are to be resold at a profit. A business house may purchase fixed assets or stationery for use in business, but they are not purchases of goods.

Purchases: It refers to the purchase of goods for resale, and not the purchase of assets or stationery. The Purchases Account, therefore, only contains purchases of goods for resale.

Sales: It refers to the sale of goods which form part of the stock-intrade of the business.

Advantages

The advantages of using Special Journals are as under:

(a) Facilitates division of work: The accounting work can be divided among many persons.

(b) Time and labour saving in journalising and posting: For instance, when a Sales Book is kept, the name of the Sales Account will not be required to be written down in the Journal as many times as the sales transactions occur and at the same time, Sales Account will not be required to be posted again and again since, only a periodic total of Sales Book is posted to the Sales Account.

(c) Permits the use of specialised skill: The accounting work requiring specialised skill may be assigned to a person possessing the required skill. With the use of a specialised skill, prompt, economical and more accurate supply of accounting information may be obtained.

(d) Permits the installation of internal check system: The accounting work can be divided in such a manner that the work of one person is automatically checked by another person. With the use of internal check, the possibility of occurrence of error/fraud may be avoided.

Cash Book

A Cash Book is a special journal which is used for recording all cash receipts and cash payments. If a cash book is maintained, there is no need for preparing a cash account in the ledger. However, the other aspects of the transactions will be recorded in the ledger. Cash Book serves dual role of journal as well ledger. Cash Book is the book of original entry (Journal) since transactions are recorded for the first time from the source documents. It is a ledger in the sense that it is designed in the form of Cash Account and records cash receipts on the debit side and cash payments on the credit side.

Features

· Only cash transactions are recorded in the Cash Book.

· It performs the functions of both journal and the ledger at the same time.

· All cash receipts are recorded on the debit side and all cash payments are recorded on the credit side.

· The Cash Book, recording only cash transactions can never show a credit balance.

Kinds of Cash Book

Cash Book can be of several kinds:

· Single Column Cash Book- For recording cash transactions only.

· Double (Two) Column Cash Book- For recording cash transactions involving gain or loss on account of discount.

· Triple (Three) Column Cash Book- For recording cash and bank transactions involving gain or loss on account of discount.

· Petty Cash Book- For recording petty expenses.

Single Column Cash Book

The Single Column Cash Book has one column of amount on each side. All cash receipts are recorded on the debit (left-hand) side and all cash payments are recorded on credit (right-hand) side. In fact, it is nothing but a Cash Account. Hence, there is no need to open Cash Account in the ledger. Posting from the debit (receipt) side of the Cash Book is done to the credit side of concerned accounts and from the credit (payment) side of the Cash Book to the debit side of concerned accounts.

Balancing the Cash Book: The Cash Book is balanced in the same manner as a ledger account. To verify the accuracy of the entries made and to confirm the authenticity of cash balance, it should be balanced daily. The balance as per Cash Book must tally with the actual cash in hand. In the Cash Book, the total of amount column of the debit side always exceeds the total of credit side. As such, the Cash Book always shows a debit balance, since we cannot pay more than we have with us. At the end of the period, the balance of the Cash Book is placed on the credit side by writing “By Balance c/d” and then the totals are shown on both side in one straight line. The total of each side should be the same.

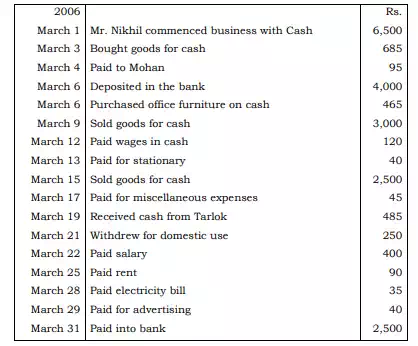

Illustration I. Enter the following transactions in the Cash Book of Mr. Nikhil.

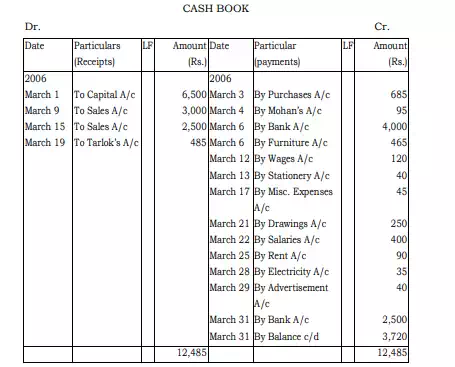

Solution