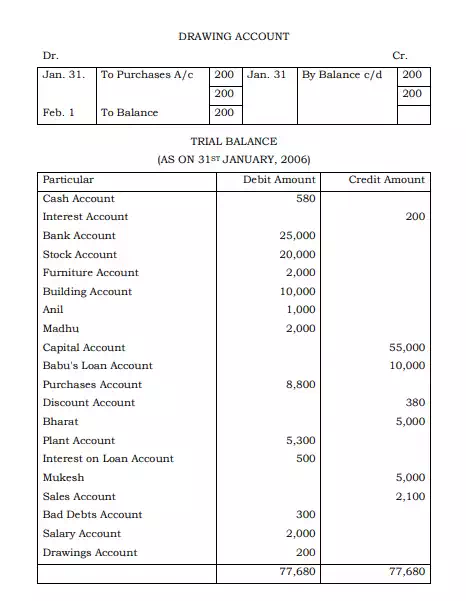

Trial Balance

In case, the various debit balances and the credit balances of the different accounts are taken down in a statement, the statement so prepared is termed as a ‘Trial Balance’. In other words, Trial Balance is a statement containing the various ledger balances on a particular date. For example, with the balances of the ledger accounts prepared in Illustration 1. The Trial Balance can be prepared as follows:

Thus, the two sides of the Trial Balance tally. It means the books of accounts are arithmetically accurate.

Objectives of Preparing a Trial Balance

(i) Checking of the arithmetical accuracy of the accounting entries

As indicated above, Trial Balance helps in knowing the arithmetical accuracy of the accounting entries. This is because according to the dual aspect concept for every debit, there must be an equivalent credit. Trial Balance represents a summary of all ledger balances and, therefore, if the two sides of the Trial Balance tally, it is an indication of this fact that the books of accounts are arithmetically accurate. Of course, there may be certain errors in the books of accounts in spite of an agreed Trial Balance. For example, if a transaction has been completely omitted, from the books of accounts, the two sides of the Trial Balance will tally, in spite of the books of accounts being wrong.

(ii) Basis for financial statements

Trial Balance forms the basis for preparing financial statements such as the Income Statement and the Balance Sheet. The Trial Balance represents all transactions relating to different accounts in a summarised form for a particular period. In case, the Trial Balance is not prepared, it will be almost impossible to prepare the financial statements as stated above to know the profit or loss made by the business during a particular period or its financial position on a particular date.

(iii) Summarised ledger

It has already been stated that a Trial Balance contains the ledger balances on a particular date. Thus, the entire ledger is summarised in the form of a Trial Balance. The position of a particular account can be judged simply by looking at the Trial Balance. The Ledger may be seen only when details regarding the accounts are required.

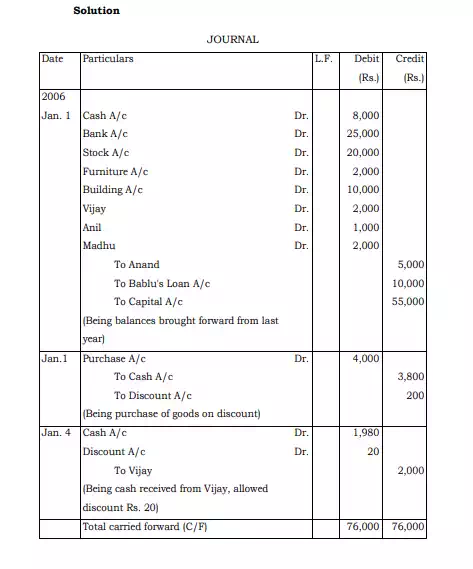

Illustration 2: Journalise the following transactions in the books of trade. Also make their Ledger Postings and prepare a Trial Balance.

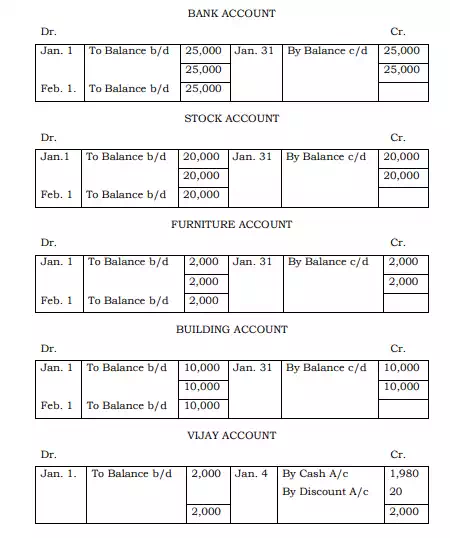

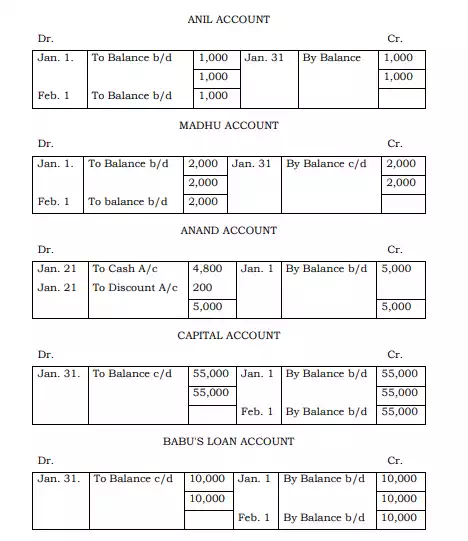

Debit Balances as on Jan. 1, 2006: Cash in hand Rs. 8,000; Cash at Bank Rs. 25,000; Stock of goods Rs. 20,000; Furniture Rs. 2,000; Building Rs. 10,000; Sundry Debtors-Vijay Rs. 2,000, Anil Rs. 1,000 and Madhu Rs. 2,000.

Credit Balances on Jan. 1, 2006: Sundry Creditors- Anand Rs. 5,000; Loan from Bablu Rs. 10,000.

The following were further transactions in the month of Jan 2006:

Jan. 1: Purchased goods worth Rs. 5,000 for cash less 20% trade discount and 5% cash discount.

Jan. 4: Received Rs. 1,980 from Vijay and allowed him Rs. 20 as discount.

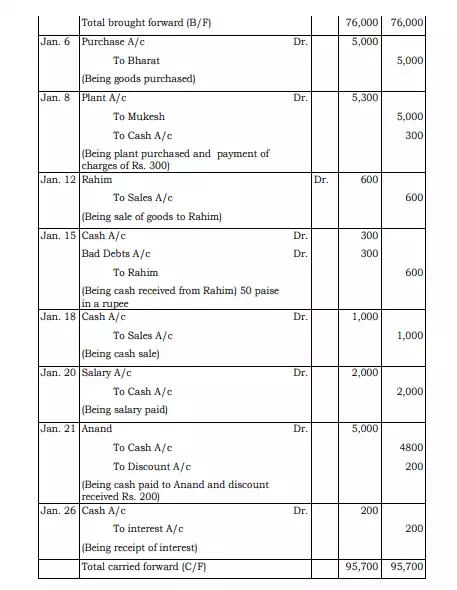

Jan. 6: Purchased goods from Bharat Rs. 5,000.

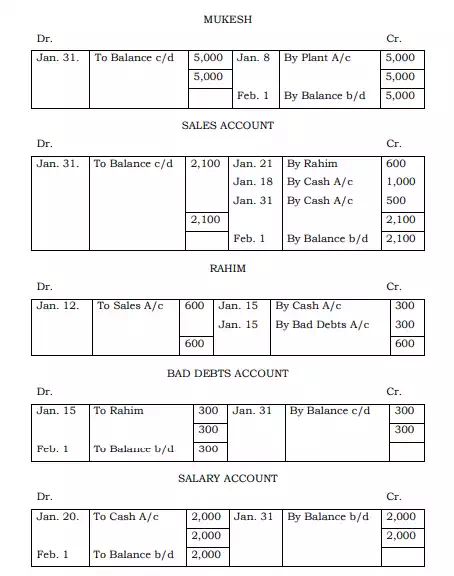

Jan. 8: Purchased plant from Mukesh for Rs. 5,000 and paid Rs. 100 as cartage for bringing the plant to the factory and another Rs. 200 as installation charges.

Jan. 12: Sold goods to Rahim on credit Rs. 600.

Jan. 15: Rahim became insolvent and could pay only 50 paise in a rupee.

Jan. 18: Sold goods to Ram for cash Rs. 1,000

Jan. 20: Paid salary to Ratan Rs. 2,000

Jan. 21: Paid Anand Rs. 4,800 in full settlement.

Jan. 26: Interest received from Madhu Rs. 200

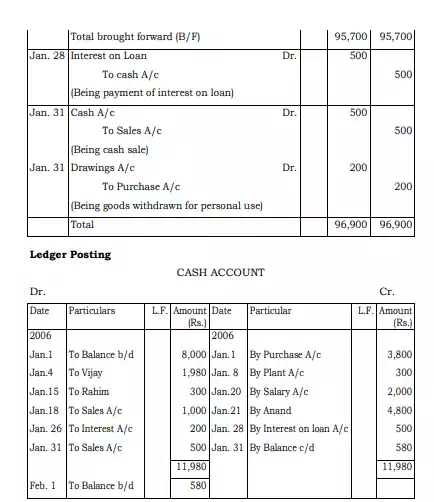

Jan. 28: Paid to Bablu interest on Loan Rs. 500

Jan. 31: Sold goods for cash Rs. 500

Jan. 31: Withdraw goods from business for personal use Rs. 200

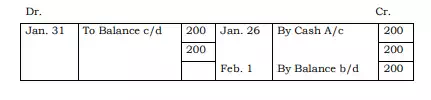

INTEREST ACCOUNT