Ledger Posting And Trial Balance

Introduction

It has already been discussed in earlier lesson that accounting involves recording, classifying and summarising the financial transactions. Recording is made in Journal, which has been explained in the preceding lesson. Classification of the recorded transactions is made in the ledger. This is being discussed in the present lesson.

Ledger is a book which contains various accounts. In simple words, ledger is a set of accounts. It includes all accounts of the business enterprise whether Real, Nominal or Personal. Ledger may be kept in any of the following two forms:

· Bound Ledger; and

· Loose Leaf Ledger.

It is common to keep the ledger in the form of loose-leaf cards these days instead of keeping them in bounded form. This helps in posting transactions particularly when mechanised system of accounting is used. Interestingly, nowadays, mechanised system of accounting is preferred over the manual system of accounting.

Posting

The term ‘Posting’ means transferring the debit and credit items from the Journal to their respective accounts in the ledger. It is important to note that the exact names of accounts used in the Journal should be carried to the ledger. For example:

If in the Journal, Salary Account has been debited, it would not be correct to debit the Outstanding Salary Account in the Ledger. Therefore, the correct course would be to use the same account in both the Journal and Ledger.

Ledger posting may be done at any time. However, it must be completed before the annual financial statements are prepared. It is advisable to keep the more active accounts posted up to date. The examples of such accounts are the cash account, personal accounts of various parties, etc.

The Ledger posting may be made by the book-keeper from the Journal to the Ledger by any of the following methods:

· He may take a particular side first. For example, he may take the debits first and make the complete postings of all debits from Journal to the Ledger.

· He may take a particular account first and post all debits and credits relating to that account appearing on one particular page of Journal. He may then take some other account and follow the same procedure.

· He may complete posting of each journal entry before proceeding to the next entry.

It is advisable to follow the last method. Further, one should post each debit and credit item as it appears in the Journal.

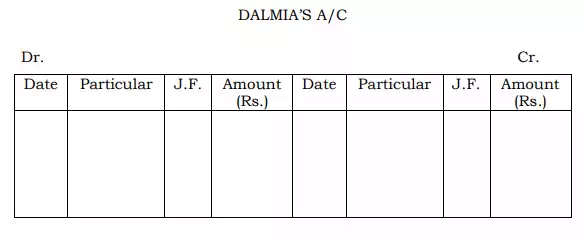

The Ledger Folio (L.F.) column in the Journal is used at the time when debits and credits are posted to the Ledger. The page number of the Ledger on which the posting has been done is mentioned in the L.F. Column of the Journal. Similarly a folio column in the Ledger can also be kept where the page from which posting has been made from the Journal. Thus, these are cross references in both the Journal and the Ledger. A proper index must be maintained in the Ledger giving the names of the accounts and the page number. A specimen of Ledger is given below:

All entries relating to Dalmia’s A/c shall be posted in this specimen a/c and finally the balance either debit or credit may be drawn. All rules regarding the posting must strictly be followed.

Rules Regarding Posting

The following rules must be observed while posting transactions in the Ledger from the Journal:

i. Separate accounts should be opened in the Ledger for posting transactions relating to different accounts recorded in the Journal. For example, separate accounts may be opened for sales, purchases, sales returns, purchases returns, salaries, rent, cash, etc.

ii. The concerned account which has been debited in the Journal should also be debited in the Ledger. However, a reference should be made of the other account which has been credited in the Journal. For example, for salaries paid, the salaries account should be debited in the Ledger, but reference should be given of the Cash Account which has been credited in the Journal.

iii. The concerned account, which has been credited in the Journal; should also be credited in the Ledger, but reference should be given of the account, which has been debited in the Journal. For example, for salaries paid, Cash Account has been credited in the Journal. It will be credited in the Ledger also, but reference will be given of the Salaries Account in the Ledger.

Thus, it may be concluded that while making posting in the Ledger, the concerned account which has been debited or credited in the Journal should also be debited or credited in the Ledger, but reference has to be given of the other account which has been credited or debited in the Journal, as the case may be. This will be clear with the following example:

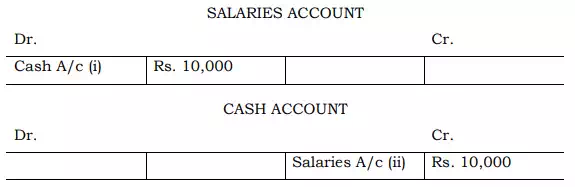

Suppose salaries of Rs. 10,000 have been paid in cash, the following entry will be passed in the Journal:

Salaries Account Dr. 10,000

To Cash Account 10,000

In the Ledger two accounts will be opened (i) Salaries Account, and (ii) Cash Account. Since Salaries Account has been debited in the Journal, it will also be debited in the Ledger. Similarly Cash Account has been credited in the Journal and, therefore, it will also be credited in the Ledger, but reference will be given of the other account involved. Thus, the accounts will appear as follows in the Ledger:

Use of the words “To” and “By”:

It is customary to use words ‘To’ and ‘By’ while making posting in the Ledger. The word ‘To’ is used with the accounts which appear on the debit side of a Ledger Account. For example in the Salaries Account, instead of writing only “Cash” as shown above, the words “To Cash” will appear on the debit side of the account. Similarly, the word “By” is used with accounts which appear on the credit side of a Ledger Account. For example in the above case, the words “By Salaries A/c” will appear on the credit side of the Cash Account instead of only “Salaries A/c”. The words ‘To’ and ‘By’ do not have any specific meanings. Modern accountants are, therefore, ignoring the use of these words.

Balancing of an Account

In business, there may be several transactions relating to one particular account. In Journal, these transactions appear on different pages in a chronological order while they appear in a classified form under that particular account in the Ledger. At the end of a period (say a month, a quarter or a year), the businessman will be interested in knowing the position of a particular account. This means, he should total the debits and credits of his account separately and find out the net balance. This technique of finding out the net balance of an account, after considering the totals of both debits and credits appearing in the account is known as ‘Balancing the Account’. The balance is put on the side of the account which is smaller and a reference is given that it has been carried forward or carried down (c/f or c/d) to the next period. On the other hand, in the next period a reference is given that the opening balance has been brought forward or brought down (b/f or b/d) from the previous period. This will be clear with the help of the following illustration.

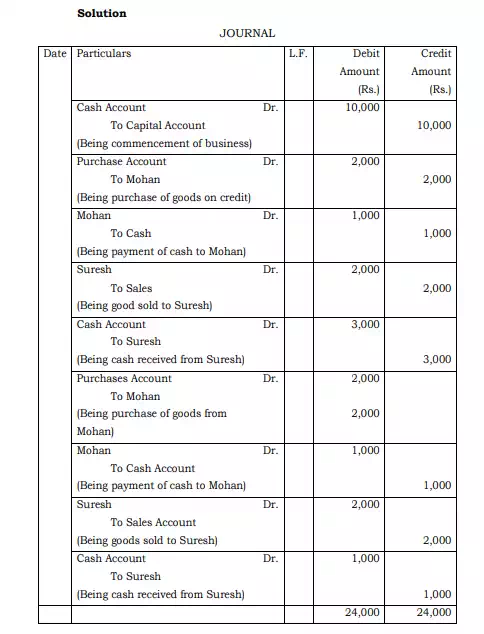

Illustration 1: Journalise the following transactions, post them in the Ledger and balance the accounts as on 31st March, 2006.

1. Ram started business with a capital of Rs. 10,000.

2. He purchased goods from Mohan on credit Rs. 2,000.

3. He paid cash to Mohan Rs. 1,000.

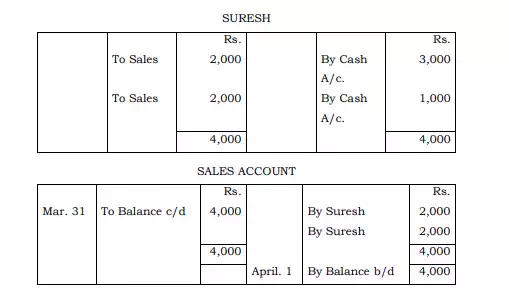

4. He sold goods to Suresh Rs. 2,000.

5. He received cash from Suresh Rs. 3,000.

6. He further purchased goods from Mohan Rs. 2,000.

7. He paid cash to Mohan Rs. 1,000.

8. He further sold goods to Suresh Rs. 2,000.

9. He received cash from Suresh Rs. 1,000

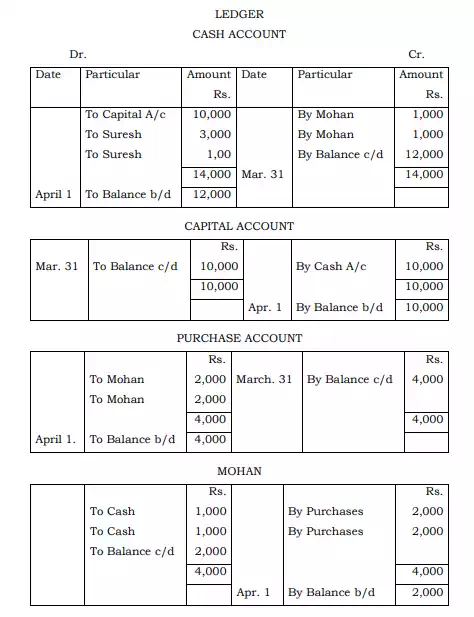

It is to be noted that the balance of an account is always known by the side which is greater. For example, in the above illustration, the debit side of the Cash Account is greater than the credit side by Rs. 12,000. It will be therefore said that Cash Account is showing a debit balance of Rs. 12,000. Similarly, the credit side of the Capital Account is greater than debit side by Rs. 10,000. It will be, therefore, said that the Capital Account is showing a credit balance of Rs. 10,000.