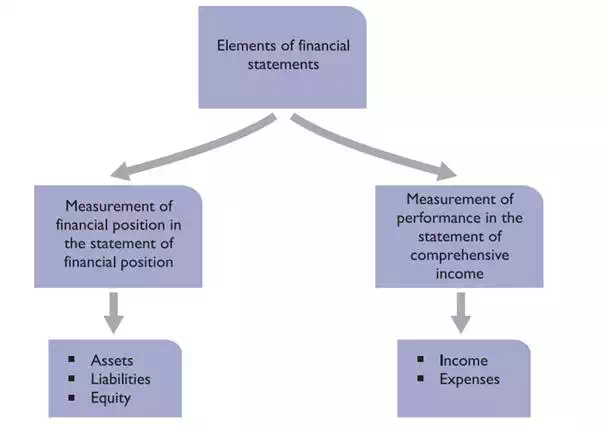

The elements of financial statements

Transactions and other

events are grouped together in broad classes and in this way their financial

effects are shown in the financial statements. These broad classes are the

elements of financial statements.

A process of sub-classification then takes place for presentation in the financial statements, e.g. assets are classified by their nature or function in the business to show information in the best way for users to make economic decisions.

1 . Financial position

We need to define the three terms listed under this heading above.

Definitions

Asset. A resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity.

Liability. A present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits.

Equity. The residual interest in the assets of the entity after deducting all its liabilities.

These definitions are important, but they do not cover the criteria for recognition of any of these items, which are discussed in the next section of this chapter. This means that the definitions may include items which would not actually be recognised in the statement of financial position because they fail to satisfy recognition criteria particularly, as we will see below, the probable flow of any economic benefit to or from the business.

Whether an item satisfies any of the definitions above will depend on the substance and economic reality of the transaction, not merely its legal form

2.Assets

We can look in more detail at the components of the definitions given above.

Definition

Future economic benefit. The potential to contribute, directly or indirectly, to the flow of cash and cash equivalents to the entity. The potential may be a productive one that is part of the operating activities of the entity. It may also take the form of convertibility into cash or cash equivalents or a capability to reduce cash outflows, such as when an alternative manufacturing process lowers the cost of production.

Assets are usually employed to produce goods or services for customers; customers will then pay for these. Cash itself renders a service to the entity due to its command over other resources. The existence of an asset, particularly in terms of control, is not reliant on:

(a) physical form (hence patents and copyrights are assets); nor

(b) legal rights (hence leases can give rise to assets).

Transactions or events in the past give rise to assets; those expected to occur in the future do not in themselves give rise to assets. For example, an intention to purchase a non-current asset does not, in itself, meet the definition of an asset.

3.Liabilities

Again we can look more closely at some aspects of the definition. An essential characteristic of a liability is that the entity has a present obligation.

Definition

Obligation. A duty or responsibility to act or perform in a certain way. Obligations may be legally enforceable as a consequence of a binding contract or statutory requirement. Obligations also arise, however, from normal business practice, custom and a desire to maintain good business relations or act in an equitable manner.

It is important to distinguish between a present obligation and a future commitment. A management decision to purchase assets in the future does not, in itself, give rise to a present obligation. An obligation is something that cannot be avoided.

Settlement of a present obligation will involve the entity giving up resources embodying economic benefits in order to satisfy the claim of the other party. This may be done in various ways, not just by payment of cash.

Liabilities must arise from past transactions or events. In the case of, say, recognition of future rebates to customers based on annual purchases, the sale of goods in the past is the transaction that gives rise to the liability.

4. Provisions

Is a provision a liability?

Definition

Provision. A present obligation which satisfies the rest of the definition of a liability, even if the amount of the obligation has to be estimated.

5. Equity

Equity is defined above as a residual, but it may be sub-classified in the statement of financial position into different reserves. This will indicate legal or other restrictions on the ability of the entity to distribute or otherwise apply its equity. Some reserves are required by statute or other law, e.g. for the future protection of creditors. The amount shown for equity depends on the measurement of assets and liabilities. It has nothing to do with the market value of the entity's shares.

6. Performance

Profit is used as a measure of performance, or as a basis for other measures (e.g. earnings per share). It depends directly on the measurement of income and expenses, which in turn depend (in part) on the concepts of capital and capital maintenance adopted. The elements of income and expenses are therefore defined.

Definitions

Income. Increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants.

Expenses. Decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurring of liabilities that result in decreases in equity, other than those relating to distributions to equity participants

Income and expenses can be presented in different ways in the statement of comprehensive income, to provide information relevant for economic decision-making. For example, a distinction is made between income and expenses which relate to continuing operations and those which do not.

7. Income

Both revenue and gains are included in the definition of income. Revenue arises in the course of ordinary activities of an entity.

Definition

Gains. Increases in economic benefits. As such they are no different in nature from revenue.

Gains include those arising on the disposal of non-current assets. The definition of income also includes unrealised gains, e.g. on revaluation of marketable securities. 1.8

8. Expenses

As with income, the definition of expenses includes losses as well as those expenses that arise in the course of ordinary activities of an entity.

Definition

Losses. Decreases in economic benefits. As such they are no different in nature from other expenses.

Losses will include those arising on the disposal of non-current assets. The definition of expenses will also include unrealised losses, e.g. exchange rate effects on borrowings or the downward revaluation of property.

9 . Capital maintenance adjustments

A revaluation results in an increase or decrease in equity.

Definition

Restatement of assets' and liabilities' carrying amounts.

These increases and decreases meet the definitions of income and expenses. They are not included in an entity’s profit or loss for the year under certain concepts of capital maintenance, however, but rather in equity. However, they will be shown in the statement of comprehensive income under the heading of 'other comprehensive income'.