Preparation Of Receipts And Payments Account From Income And Expenditure Account

The practical steps involved in the preparation of a Receipts and Payments Account from an Income and Expenditure Account are:

Step I Put the ‘opening balances’ of cash/bank as the first item on the ‘Receipts side’ and ‘closing balances’ of cash/bank as the last item on the ‘Payments side’ of the Receipts and Payments Account. If one of the two balances are given, the other balance will have to be ascertained.

Step II Ascertain ‘Revenue Receipts’ received during the current accounting period as under and show it on the receipts side of Receipts and Payments Account:

Revenue Income (account-wise) for the current year as per Income and Expenditure Account.

Add Income received in advance at the end of current year.

Add Income outstanding in the beginning of current year.

Less Income outstanding at the end of current year. Less Income received in advance in the beginning of the current year.

Step III Ascertain ‘Revenue Payments’ made during the current accounting period as under and show it on the payments side of Receipts and Payments Account:

Revenue expenses (account-wise) for the current year as per Income and Expenditure Account

Add Expenses outstanding in the beginning of current year.

Add Expenses prepaid at the end of current year.

Less Expenses outstanding at the end of current year.

Less Expenses prepaid in the beginning of current year.

Step IV Ascertain all capital receipts and capital payments from the additional information or Balance Sheets or by preparing the accounts of capital items and show the capital receipts on the ‘Receipts side’ and the capital payments on the ‘Payments side’ of the Receipts and Payments Account.

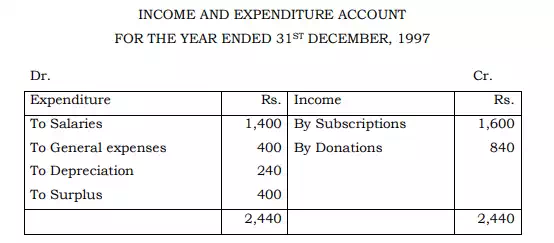

Illustration: The Income and Expenditure Account of Star Club is as follows:

The Secretary of the Club informs you that the above account was prepared after making the following adjustments:

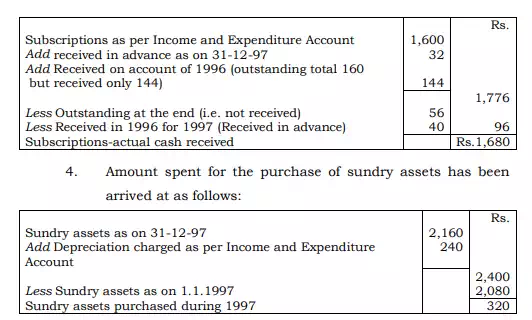

(i) Subscriptions were outstanding on 1st January 1997 (for 1996) Rs. 160 out of which Rs. 144 were received in 1997.

(ii) As on 1st January 1997 subscriptions received in advance amounted to Rs. 40, whereas on 31st December 1997 subscriptions received in advance Rs. 32. Also Rs. 56 worth subscriptions (for 1997) were outstanding as on Dec. 31, 1997.

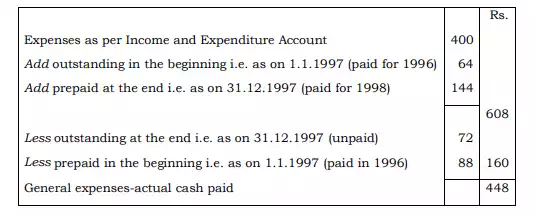

(iii) General Expenses were outstanding on 1st January 1997 Rs. 64 and on 31st December 1997 Rs. 72. Prepaid expenses amounted to Rs. 88 in the beginning and at close Rs. 144.

(iv) Sundry assets as on 1st January 1997 Rs. 2,080 and after providing depreciation for the year 1997 the value of sundry assets was Rs. 2,160.

(v) Cash in hand on 31st December 1997 was Rs. 480.

You are required to prepare Receipts and Payments Account

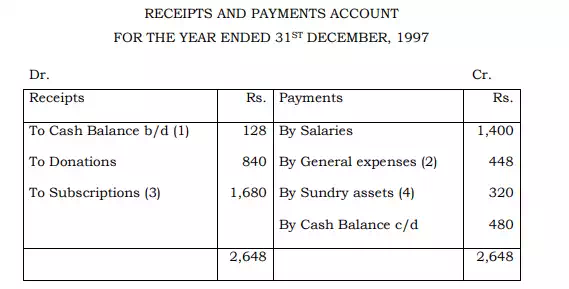

Solution

Working Notes

1. Opening cash balance is the balancing figure of the Receipts and Payments Account.

2. Actual amount paid in respect of general expenses has been arrived at as follows:

3. Actual amount received in respect of subscriptions has been arrived at as follows: