Preparation Of Income And Expenditure Account

The practical steps involved in the preparation of an Income and Expenditure Account from the Receipts and Payments Account are as under:

Step I Ignore opening and closing cash/bank balances appearing in the Receipts and Payments Account.

Step II Eliminate all items of capital receipts and payments.

Step III Ascertain the revenue income of the relevant period by excluding from the total receipts, the income received on account of previous and future years. Then add income accrued in the year but not received.

Step IV Make adjustments as per additional information such as depreciation, bad debts, etc., if any,

Step V Calculate the difference between the total of debit side and the total of credit side. If the total of credit side exceeds the total of debit side, show the excess of income over expenditure (surplus) on the debit side. If the total of debit side exceeds the total of credit side, the excess of expenditure over income (deficit) on the credit side of Income and Expenditure Account.

If surplus add it to the Capital Fund and if deficit deduct from Capital Fund in the Balance Sheet.

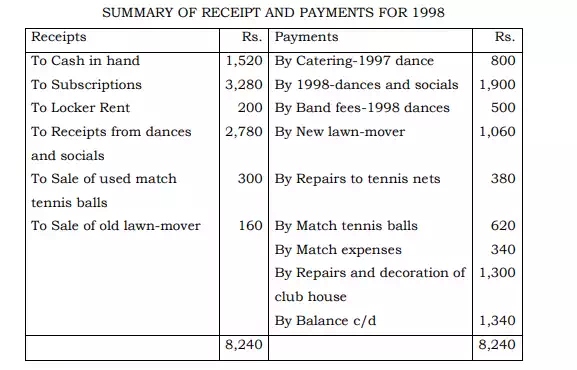

Illustration: From the following details and notes attached relating to the Haryana Tennis Club, prepare the final accounts of the year ended 31st December 1998.

On January 1998 the club’s assets are:

Freehold Club house Rs. 20,000; Equipment Rs. 1,400; club subscription in arrear Rs. 160; The club owed Rs. 800 to a firm for Christmas 1997 dance catering.

Notes

(i) The book value on 1 January 1998 of the old lawn mover sold during the year was Rs. 60.

(ii) The club has 40 members and the subscription is Rs.80 each per annum. The subscriptions received in 1998 included those in arrear for 1997.

(iii) On 31 December 1998 Rs. 220 was owed to Play fair Ltd. for tennis balls supplied.

(iv) Equipment as at 31 December 1998 to be depreciated by 15% p. a.

v) Tennis balls are regarded as revenue expenditure

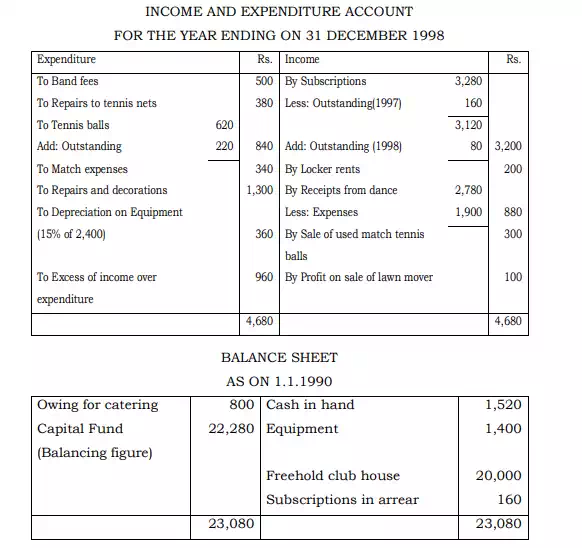

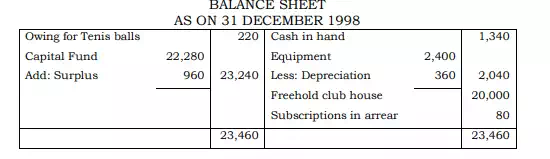

Solution

Notes

(i) Equipment includes lawn mover.

(ii) Since there are 40 members each paying Rs. 80 as yearly subscription, the club ought to have received Rs. 3,200 as total subscriptions. Hence, Rs. 80 are outstanding for subscription.