Balance Sheet

Balance Sheet of a non-trading concern is prepared in the usual way and contains particulars of all assets on right-hand side and liabilities on left-hand side of the concern on the date on which it is prepared. The excess of total assets over total outside liabilities is known as Capital Fund. While preparing the Balance Sheet, the excess of income over expenditure is added to the opening Capital Fund and the excess of expenditure over the income is deducted from the opening Capital Fund. Sometimes, two balance sheets may have to be prepared (i) Balance Sheet in the beginning of the accounting year to ascertain the amount of Capital Fund in the beginning of the accounting year, and (ii) Balance Sheet at the end of the accounting year to show the financial position of the concern as on that date.

Items Peculiar to Non-profit making organisations

The technique of preparing the final accounts of a non-trading concern is similar to that of preparing final accounts of a trading concern. However, there are certain peculiar items in case of non-trading institutions. The accounting treatment of these items and their presentation in the final accounts is as follows:

1. Legacy

Legacy refers to the amount which one gets on account of a will. The amount received on account of a legacy appears on the receipts side of Receipts and Payments Account. It should not be treated as an income because it is not of recurring in nature but should be treated as capital receipt, i.e., credited to Capital Fund Account.

2. Donations This is very common receipt for non-trading institutions. It is a sort of gift in cash or property from some person, firm or a company. It appears on the receipts side of the Receipts and Payments Account, if received in cash. Donations can be for specific purposes or for general purposes. The accounting treatment for these is as follows:

(a) Specific donation: In case a donation has been received for a specific purpose, the donation is termed as a specific donation. For example, an institution may receive donation for construction of building or for giving prizes to best artist. The amount of such donation cannot, therefore, be used for general purpose. It should be taken to the Balance Sheet on the liabilities side and be used only for the purpose which it is meant, irrespective of the amount.

(b) General donation: A donation not received for a specific purpose is termed as general donation. In case, the general donation is of a big or large amount, it can fairly taken for granted that such donation is of a non-recurring nature and, therefore, should be taken to the Balance Sheet on the liabilities side. However, if the donation is of a small amount and not meant for a specific purpose, it can be taken to credit side of the Income and Expenditure Account. Whether the donation is of big amount or small amount would depend on the facts of each case. For example, in case of an educational institution, a sum of Rs. 11,000 can be taken as a small donation, but for a cricket club, a sum of Rs. 11,000 is quite substantial and, therefore, it will be proper to take the amount of such donation received to the Balance Sheet.

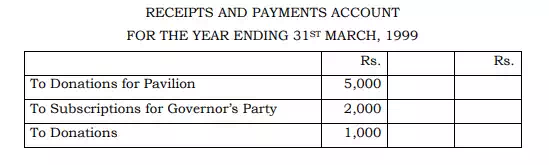

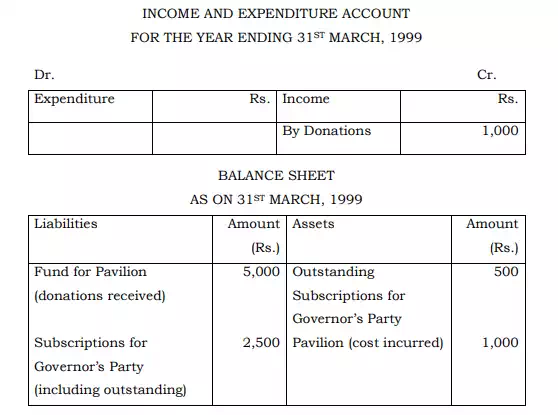

Illustration: Following are the extracts from the Receipts and Payments Account of a sports club. You are required to show the different items in the Income and Expenditure Account and Balance Sheet of the club after taking into account the additional information given

Additional Information

(i) Amount spent on Pavilion Rs. 1,000. (ii) Outstanding subscriptions for Governorís Party Rs. 500.

Solution

3. Subscriptions

This is the major source of revenue income of a non-trading institution. Subscriptions are the amounts paid by the members of such entity to maintain their membership. Subscriptions may be paid periodically (usually on yearly basis) or as a lump sum for life membership. Periodical subscriptions are treated as revenue receipts, whereas life membership subscriptions are usually treated as capital receipts and, thus, are transferred to the Capital Fund. The Receipts and Payments Account records the amount of actual subscriptions received while the Income and Expenditure Account records only the subscriptions which relate to the accounting period, whether received or not. Adjustments may, therefore, be required to be made to find out the actual amount of income from subscription. The following illustration is being given to clarify this point:

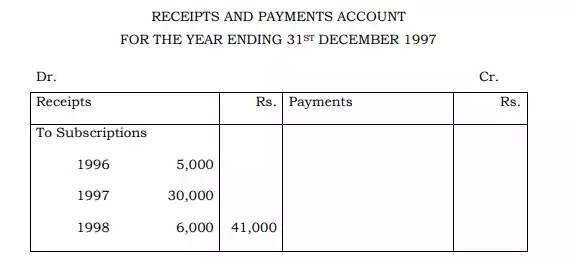

Illustration:

From the following extracts of Receipts and Payments Account and the additional information, you are required to calculate the Income from Subscriptions for the year ending 31 December 1997 and show them in the Income and Expenditure Account, and the Balance Sheet of a Club.

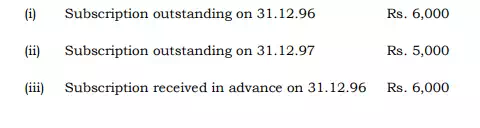

Additional Information

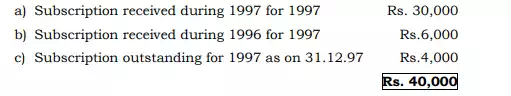

Solution

Working Note: Calculation of Subscription Income for 1997-

4. Entrance fee or admission fee

This is the amount of fee usually charged by a club or a society or an educational institution from the new entrants. It is usually taken as an item of income. There are arguments that since it is paid only once for all and of non-recurring nature and, therefore, should be capitalised and taken to the liabilities side of the Balance Sheet. But another argument is that though it is paid by each member only once, the club or institution receives it regularly because of frequent changes in its membership for one reason or the other. Accordingly, it should be treated as revenue income and credited to Income and Expenditure Account. In the absence of any specific instructions about entrance fee in the question, any one of the above treatment may be followed but students should append a note justifying their treatment.

5. Sale of old newspapers and periodicals

The sale proceeds of old newspapers and periodicals is of a recurring nature and should, therefore, be taken as income in the Income and Expenditure Account.

6. Sale of old fixed assets

The sale proceeds of old fixed assets are treated as capital receipts and, thus, are credited to the respective fixed assets account. However, the profit or loss on sale of fixed assets is shown in the Income and Expenditure Account.

7. Sale of sports material

Sale of sports material is a regular feature of clubs and the amount received is treated as an ordinary or revenue income. It is, therefore, shown in the credit side of the Income and Expenditure Account.

8. Endowment Fund

It is a fund arising from a bequest or gift, the income of which is devoted for a specific purpose. Thus, endowment fund is a capital receipt and is shown in the liabilities side of the Balance Sheet.

9. Payment of Honorarium

This is the payment to a person for his specific services rendered by him not as a regular employee. For example, the payment made to a Professor to deliver lecture on a topic or to a Television artist for his/her specific performance, is termed as honorarium. This is an item of expense and is shown in the debit side of the Income and Expenditure Account.

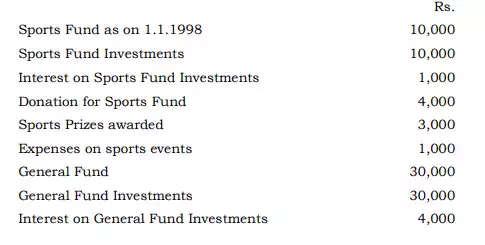

10. Special Funds

An institution may keep special funds for some special purposes. For example, a sports club may keep a special fund for meeting sports expenses or for awarding of sports prizes. In case such special funds, all incomes relating to such funds should be added to these funds in the Balance Sheet on the liabilities side. Similarly, all expenses on account of these funds should be deduced from these funds. In case of a deficit, the amount should be met out from the Income and Expenditure Account. In case of surplus, it will be better on account of convention of conservatism, to keep it in the Balance Sheet or merge it with the Capital Fund.

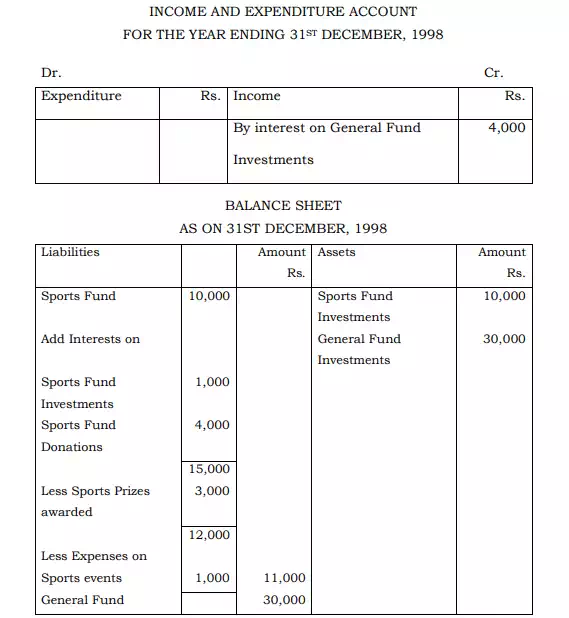

Illustration: Following is the information given in respect of certain items of a sports club. You are required to show them in the Income and Expenditure Account and prepare the Balance Sheet of the club.

Solution