Income And Expenditure Account

It is a nominal account of non-trading institutions equivalent to the Profit and Loss Account of the business concerns. It shows the classified summary of incomes, expenses and losses for current accounting period along with the excess of income over expenditure (i.e. surplus) or excess of expenditure over income (i.e. deficit) which is transferred to Capital Fund in the Balance Sheet. It is generally prepared from a given Receipts and Payments Account after making necessary adjustments. An Income and Expenditure Account being itself a nominal account includes only nominal accounts or revenue items. All items of revenue nature (nominal accounts) pertaining to relevant accounting period and, which appear, on the debit side of the Receipts and Payments Account are entered on the credit side (i.e. income side) of the Income and Expenditure Account with necessary adjustments for prepaid or outstanding figures. Similarly, all the revenue items (nominal accounts) appearing on the credit side of the Receipts and Payments Account will be entered on the debit side (i.e. expenditure side) of the Income and Expenditure Account with necessary adjustments as to prepaid or outstanding items. Thus, items of capital nature, such as purchase of machinery, building, furniture, etc. shall appear in the Balance Sheet. The end balance of the Income and Expenditure Account, which may be either excess of income over expenditure or excess of expenditure over income would be added to or deducted from, as the case may be, the Capital Fund on the liabilities side of the Balance Sheet. Its essential features can be put as follows:

(a) It is debited with the expenses and losses.

(b) It is credited with the incomes.

(c) It records only those incomes, expenses and losses which are of revenue nature.

(d) It records only those incomes, expenses and losses which relates to current

accounting year.

(e) It records non-cash items also (e. g. depreciation).

(f) Its balance at the end which represents either the net surplus (if credit side exceeds debit side) or net deficit (if debit side exceeds credit side) is transferred to the Capital Fund in the Balance Sheet.

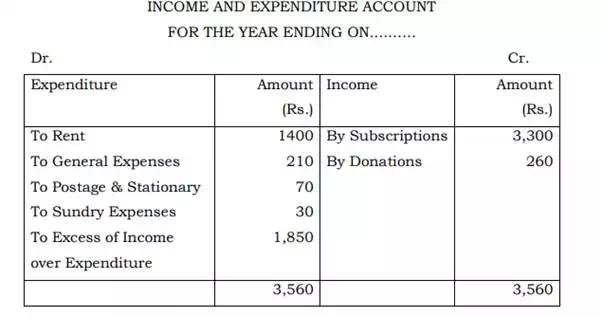

Illustration: From the information given in Illustration I, prepare an Income and Expenditure Account.

Solution

Distinction between Receipts and Payments Account and income and expenditure account

1. Receipts and Payments Account is a summarised statement of cash receipts and cash payments during a particular period, whereas Income and Expenditure Account is the substitute of Profit and Loss Account for non-trading concerns.

2. While Receipts and Payments Account, just like cash book, commences with opening cash balance/bank balance and closes with closing cash balance/bank balance, Income and Expenditure Account has nothing to do with opening or closing cash/bank balances.

3. Receipts and Payments Account concerns itself with actual cash received or paid during the period and ignores outstanding expenses as well as income accrued whereas Income and Expenditure Account includes all income even if not received and all expenses even if not paid.

4. Though Receipts and Payments Account includes both capital and revenue items, Income and Expenditure Account includes revenue items only.

5. While Receipts and Payments Account shows receipts on the debit side and payments on the credit side, Income and Expenditure Account shows income on the credit side and expenses on the debit side.

6. Receipts and Payments Account includes items relating to preceding as well as succeeding years. Income and Expenditure Account, on the other hand, concerns itself, only with income and expenditure of the period to which it relates.

7. In Receipts and Payments Account difference between two sides will represent closing cash/bank balance. In Income and Expenditure Account, the difference will mean either excess of income over expenditure or vice-versa.

8. Receipts and Payments Account is generally accompanied by statement of affairs, whereas Income and Expenditure Account is always accompanied by Balance Sheet.

9. Receipts and Payments Account belongs to the category of “real accounts”, but Income and Expenditure Account belongs to the family of “nominal accounts”.