Insurance Policy Method

Under this method, instead of investing the money in securities an insurance policy for the required amount is taken. The amount of the policy is such that it is adequate to replace the asset when it is worn out. A fixed sum equal to the amount do depreciation is paid as premium every y

ear. Company receiving premium allows a small rate of interest on compound basis. At the maturity of the policy, the insurance company pays the agreed amount with which the new asset can be purchased. Accounting entries will be made as follows.

1. First and every subsequent years

(a) Depreciation Insurance policy A/c Dr.

To Bank (Entry in the beginning of the year for payment of insurance premium)

(b) Profit and loss Account Dr.

To Depreciation fund A/c

(Entry at the end of the year for providing depreciation )

2. Last year

(a) Bank A/c Dr

To Depreciation Policy A/c

(Entry for the amount of policy received)

(b) For transfer of profit on insurance policy:

Depreciation Insurance Policy A/c Dr.

To Depreciation Fund A/c

(c) For transfer of accumulated depreciation to the asset account:

Depreciation Fund A/c Dr.

To Asset A/c

(d) On purchase of new asset:

On purchase of new asset:

New Asset A/c Dr.

To Bank

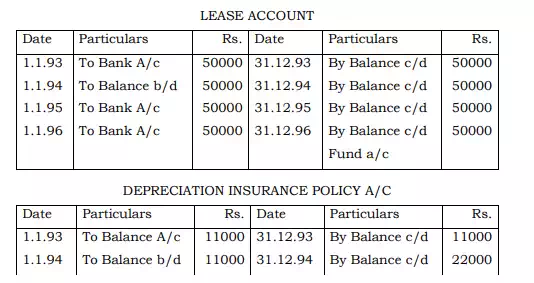

Illustration: On 1.1.1993, a firm purchased a lease for four years for Rs. 50,000. It decided to provide for its replacement by means of an insurance policy for Rs. 50,000. The annual premium is Rs. 11,000. On 1.1.1997, the lease is renewed for a further period of 4 years for the same amount. Show the necessary ledger accounts.

Depletion Method

This is also known as productive output method. In this method it is essential to make an estimate of the units of output the asset will produce in its life time. This method is suitable in case of mines, queries, etc., where it is possible to make an estimate of the total output likely to be available. Depreciation is calculated per unit of output. Formula for calculating the depreciation rate is as under:

![]()

Example: If a mine is purchased for 50,000 and it is estimated that the total quantity of mineral in the mine is 1,00,000 tonnes, the rate of depreciation would be:

![]()

Hence, the rate of depreciation is 50 paise per tonne. In case output in a year is 20,000 tonnes, the amount of depreciation to be charged to the profit and loss account would be Rs. 10,000 (i.e., 20,000 tonnes × Rs. 0.50).

This method is useful where the output can be measured effectively, and the utility of the asset is directly related to its production use. Thus, the method provides the benefit of correlating the amount of depreciation with the productive use of asset.