Depreciation Fund Method

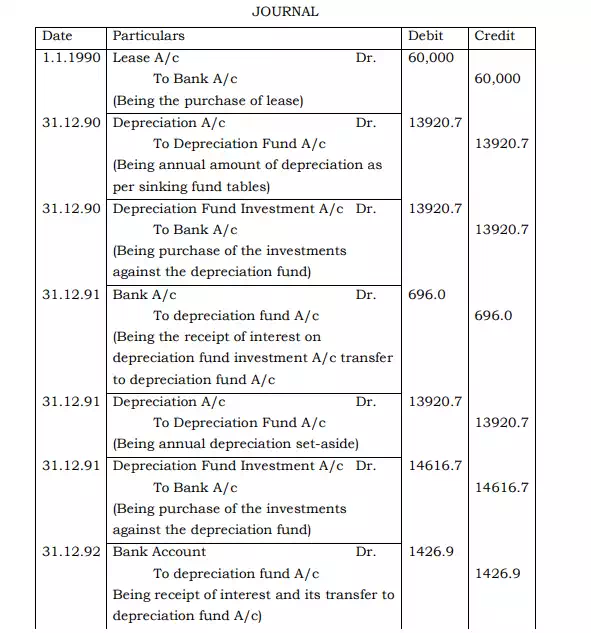

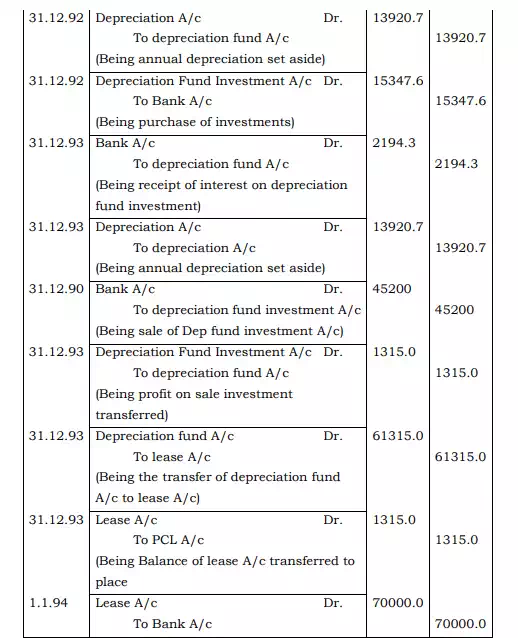

Business assets become useless at the expiry of their life and therefore, need replacement. However, all the methods of depreciation discussed above do not help in accumulating the amount which can be readily available for the replacement of the asset its useful life comes to an end Depreciation fund method takes care of such a contingency as it incorporates the benefits of depreciating the asset as well as accumulating the necessary amount for its replacement. Under this method, the amount of depreciation charged from the profit and loss account is invested in certain securities carrying a particular rate of interest. The interest received on the investment in such securities is also invested every year together with the amount of annual depreciation. In the last of the life of asset the depreciation amount is set aside interest is received as usual. But the amount is not invested because the amount is immediately needed for the purchase of new asset. Rather all the investments so far accumulated are sold away. Cash realised on the sale of investments is utilised for the purchase of new asset. The following accounting entries are generally made in order to work out this system of depreciation.

1. At the end of the first year

(i) for setting aside the amount of depreciation: The amount to be charge by way of depreciation is determined on the basis of sinking Fund Table given as an Appendix at the end of every book of accountancy.

Depreciation Account Dr.

To Depreciation Fund Account (or Sinking Fund A/c)

(ii) For investing the amount charged by way of depreciation:

Depreciation Fund Investment A/c

Dr. To Bank A/c

2. In the second and subsequent years

(i) For receiving interest. The interest on the balance of Depreciation Fund Investment outstanding in the beginning of each year will be received by the end of the year. This entry is:

Bank Account Dr.

To Depreciation Fund Account

(ii) For setting aside the amount of depreciation

Profit and Loss A/c Dr.

To Depreciation Fund A/c

(iii) For investing the amount

Depreciation Fund Investment A/c Dr.

To Bank A/c

(Annual instalment of depreciation and interest received invested)

3. In the last year

(i) For receiving interest:

Bank A/c Dr.

To Depreciation Fund A/c

(ii) For setting aside the amount of depreciation

Profit and loss A/c Dr.

To depreciation Fund A/c

Note: In the last year no investment will be made, because the amount is immediately required for the purchase of new asset.

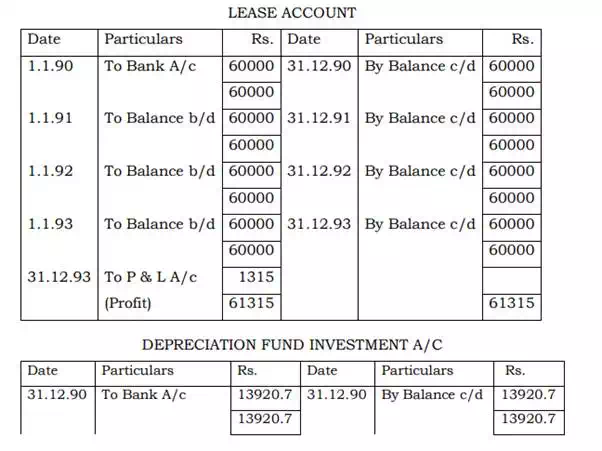

(iii) For the sale of investment:

Bank A/c Dr.

To Depreciation Fund Investment A/c

(iv) For the transfer of profit or loss on sale on investments: The profit or loss on the sale of these investments is transferred to the Depreciation Fund Account.

The entry for loss:

Depreciation Fund A/c Dr.

To Depreciation Fund Investment A/c

The entry for profit

Depreciation Fund Investment A/c

To Depreciation Fund A/c

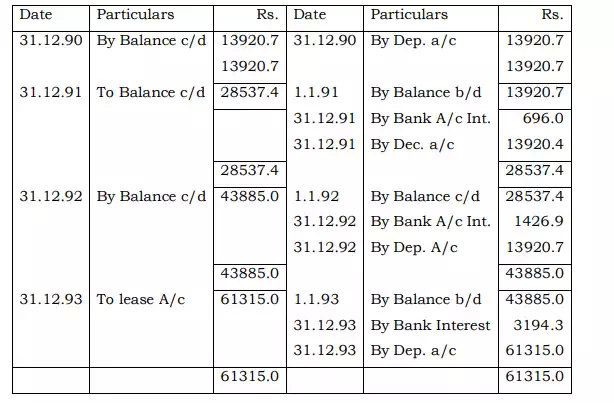

(v) For the sale of old asset:

Bank A/c Dr.

To asset A/c

(vi) The depreciation fund is transferred to asset account and any balance left in the asset account is transferred to profit and loss account. The entry is:

Depreciation Fund A/c. Dr.

To asset A/c

(vii) The balance in Asset Account represents profit or loss. Therefore it will be transferred to the profit and loss account.

(viii) The cash realised on the sale of investments and the old asset is utilised for the purchase of new asset.

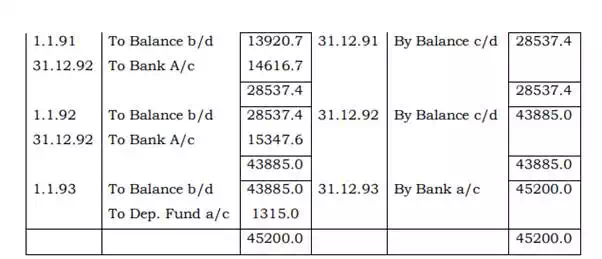

Illustration: Amitabh Company Ltd. purchased 4-year lease on January 1990 for Rs. 60,000. The company decided to charge depreciation according to depreciation fund method. It is expected that investments will earn interest @5% p.a. Sinking Fund Table shows that Rs. 0.232012 invested each year will produce Rs. 1 at the end of 4 years at 5% p.a. At the expiry of lease , the Depreciation Fund Investments were sold for Rs. 45200. A new lease is purchased for Rs. ................ on 1.1.1994. Show the journal entries and prepare the necessary accounts in the book the company.