Annuity Method

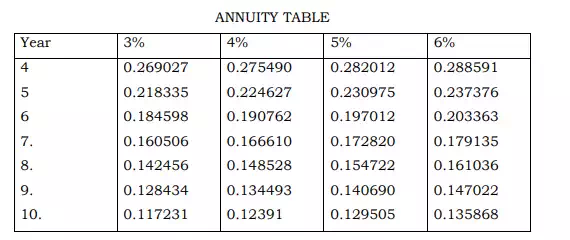

Sofar we have described such methods of charging depreciation which ignore the interest factor. Also, sometimes it becomes inconvenient for a company to follow any of the methods discussed earlier. Under such circumstances the company may use some special depreciation systems. Annuity method is one of these special systems of depreciation. Under this system, the depreciation is charged on the basis that besides losing the acquisition cost of the asset the business also loses interest on the amount used for purchasing the asset. Here, interest refers to that income which the business would have earned otherwise if the money used in buying the asset would have been committed in some other profitable investment. Therefore, under the annuity method the amount of total depreciation is determined by adding the cost and interest thereon at an expected rate. The annuity table is used to help in the determination of the amount of depreciation. A specimen of Annuity Table is as follows:

In case depreciation is charged according to this method, the following accounting entries are passed:

(i) Purchase of an asset

Asset Account Dr. To Bank

(ii) For Charging interest

Asset Account Dr. To Interest Account

(iii) For Charging depreciation:

Depreciation Account Dr.

To Asset Account

Evaluation of Annuity Method

Merits

(i) This method keep into account interest on money spent on the purchase of the asset.

(ii) The value of the asset become zero at the end of life.

Demerits

(i) This method is comparatively more difficult than the methods discussed so far.

(ii) It makes no arrangement of money to replace the old asset with the new one at the expiry of its life.

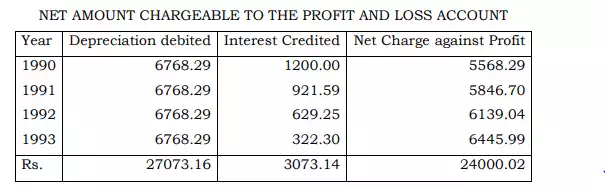

(iii) Under this method the burden on the profit and loss account is no similar in each year because the depreciation remains constant year after year but the interest goes on decreasing.

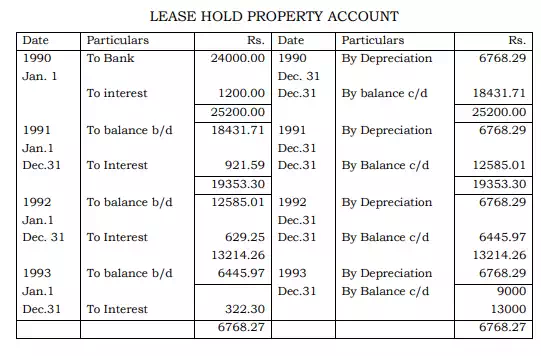

Illustration: On 1st January 1990 a firm purchased a leasehold property for 4 year at a cost of Rs. 24000. It decides to depreciate the lease by Annuity Method by charging interest at 5% per annum. The Annuity Table shows that the annual necessary to write off Rs. 1 at 5% Rs. 0.282012. You are required to prepare the lease Hold Property Account for four years and show the net amount to be charged to the profit and loss account for these four years.