Methods Of Calculating Depreciation

The following are various methods of depreciation in use:

1. Fixed instalment method or straight-line method.

2. Machine hour rate method.

3. Diministing Balance method.

4. Sum of years digits method

5. Annuity method

6. Depreciation Fund Method

7. Insurance Policy Method

8. Depletion Method.

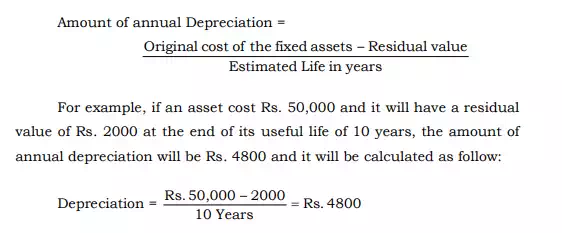

Straight Line Method

This is also known as fixed instalment method. Under this method the depreciation is charged on the uniform basis year after year. When the amount of depreciation charged yearly under this method is plotted on a graph paper, we shall get a straight line. Thus, the straight-line method assumes that depreciations is a function, of time rather than use in the sense that each accounting period received the same benefit from using the asset as every other period. The formula for calculating depreciation charge for each accounting period is:

This method has many shortcomings. First, it does not take into consideration the reasonal fluctuations, booms and depression. The amount of depreciation is the same in that year in which the machine is used day and night to that in another year in which it is used for some months. Second, it ignores the interest on the money spent on the acquisition of that asset. Third, the total charge for use of asset (i.e., depreciation and repairs) goes on increasing form year to year though the assets might have been use uniformly from year to year. For example, repairs cost together with depreciation charge in the beginning years is much less than what it is in the later year. Thus, each subsequent year is burdened with grater charge for the use of asset on account of increasing cost on repairs.

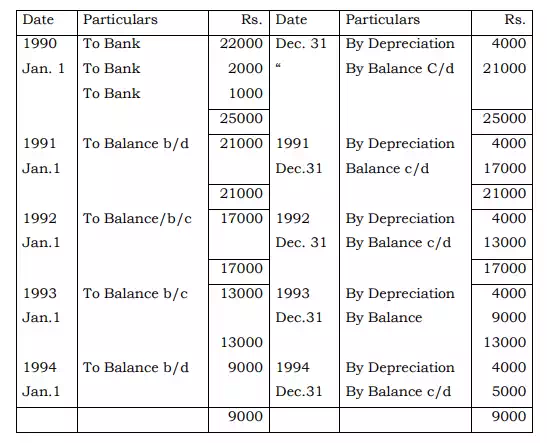

Illustration: H. Ltd. purchased a machinery on 1st January 1990 for Rs. 29000 and spent Rs. 2000 on its carriage and Rs. 1,000 on its erection. Machinery is estimated to have a scrap value of Rs. 5000 at the end of its useful life of 5 year. The accounts are closed every year on 31st December. Prepare the machinery account for five years charging depreciation according to straight line method.

Solution

MACHINERY ACCOUNT

This method is very suitable particularly in case of those assets which get depreciated more on account of expire of period e.g. lease hold properties, patents, etc.

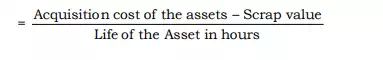

Machine Hour Rate Method

In case of this method, the running time of the asset is taken into account for the purpose of calculating the amount of depreciation. It is suitable for charging depreciation on plant and machinery, air-crafts, gliders, etc. The amount of depreciation is calculated as follows:

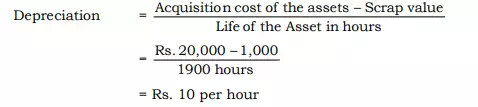

For example, if machinery has been purchased for Rs. 20000 and it will have a scrap value of Rs. 1000 at the end of its useful life of 1900 hours, the amount of depreciation per hour will be computed as follows:

If in a particular year, the machine runs for 490 hours, the amount of depreciation will be Rs. 4900 (i.e., Rs. 10x490). It is obvious from this example that under machine hour rate method the amount of depreciation is closely related with the frequency of use of an asset. The simplicity in calculations and understanding is the main advantage of this methods. However, it can be used only in case of those assets whose life can be measured in terms of working time.

Diministing Balance Method

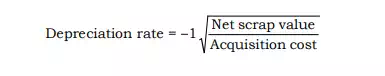

This is also known as Written down value method [WDV]. Under the diminishing balance method depreciation is charged at fixed rate on the reducing balance (i.e., cost less depreciation) every year. Thus, the amount of depreciation goes on decreasing every year. Under this method also the amount of depreciation is transferred to profit and loss account in each of the year and in the balance sheet the asset is shown at book value after reducing depreciation from it. For example, if an asset is purchased for Rs. 10,000 and depreciation is to be charged at 20% p.a. on reducing balance system then the depreciation for the first year will be Rs. 2000. In the second year, it will Rs. 1600 (i.e. 20% of 8000), in the third year Rs. 1280 (i.e. 20% of 6400) and so on. The rate of depreciation under this method can be computed by using the following formula:

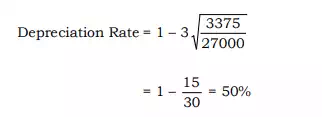

For example, if the cost of an asset is 27000, scrap value Rs. 3375, economic life 3 year, the rate of depreciation would be:

Merits of Diministing Balance Method

(i) It is very easy to understand and calculate the amount of depreciation despite the early variation in the book value after depreciation (ii) This method put an equal burden for use of the asset on each subsequent year since the amount of depreciation goes on decreasing for each subsequent year while the charge for repairs goes on increasing for each subsequent year. (iii) This method has also been approved by the income tax act applicable in India (iv) Asset is never reduced to zero because if the rate of depreciation is (say) 20%. Then even when asset is reduced to very small value, there must remain the 80% of that small value as on written off balance.

Demerit

(i) It ignores the interest on the capital committed to purchase that asset. (ii) It does not provide adequately for replacing the asset at the end of its life. (iii) The calculation of rate of depreciation is not so simple. (iv) The formula for calculating the rate of depreciation can be applied only when there is some residual of the asset.

Suitability

This method is suitable in those cases where the receipts are expected to decline as the asset gets older and, it is believed that the allocation of depreciation of depreciation ought to be related to the pattern of assets expected receipts.

Illustration 2:

A company purchases Machinery on 1st April 1990 for Rs. 20,000. Prepare the machinery account for three years charging depreciation @ 25% p.a. according to the written Down value Method.