Valuation Of Inventory For Balance Sheet Purpose

In certain cases, it is not possible for the business to take inventory on the date of balance sheet. It might have been taken on a date earlier or later than the date of balance sheet. In such a case, when student are required to calculate the value of stock on the date of preparation of final accounts, then they should take into consideration information about additional transactions which occur during the period. For example, if value of stock on 28th March is given, then in order to find the value of stock on 31st March all purchases between these dates will be added. Likewise, if value of stock on 4th April is given and value of stock on the proceeding 31st March is required then purchases during the period will be deducted and issues/sales (at acquisition price) during this period will be added. Both of the above-mentioned cases could be understood and elaborated as under:

(i) When the Position of stock is given on a date prior to the balance sheet date

In this case, the following adjustments will generally be required:

(a) Add purchases made during the period.

(b) Deduct purchases returns during the said period.

(c) Deduct inventory issued/sold between the two dates.

(d) Add sales returns between the two dates.

(ii) When the position of stock is given on a date after the balance sheet date

For example, if the balance sheet is to be prepared as on 31st March 2005 and the stock position has been given as on 15th April 2005 the following adjustments will be required:

(a) Less purchases made between 1st April 2005 to 15th April 2005.

(b) Add purchases returns between 1st April 2005 to 15th April 2005.

(c) Add sales (at cost price) between 1st April 2005 to 15th April, 2005.

(d) Less sales returns between 1st April 2005 to 15th April 2005.

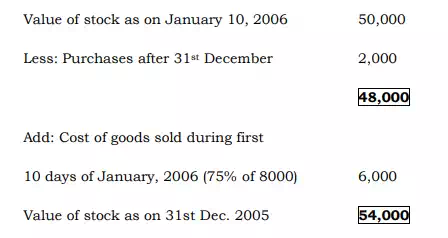

Illustration: The financial year of Sultan S. & Co. ends on 31st December 2005. Stock taking continues up to 10th January 2006. You are required to determine, the value of costing stock (at cost) as on 31st December 2005 from the following information:

(i) The closing stock (valued at cost) came to Rs. 50,000 on 10th January 2006.

(ii) Purchases made in the first 10 days of January 2006 amounted to Rs. 2000.

(iii) Sales made from 1st January to 10th January in 2006 amounted to Rs. 8000. The firm makes a gross profit of 25% on sales.

Solution: Valuation of closing stock

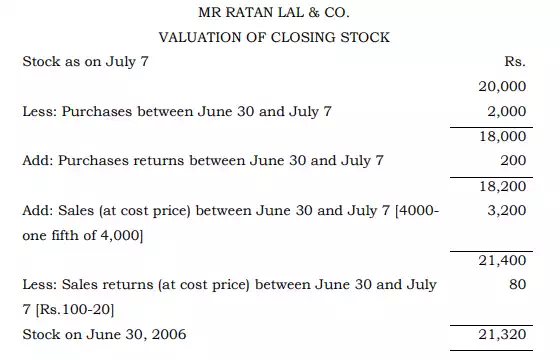

Illustration: The financial year of Mr. Ratan Lal & Co. ends on 30th June 2006, but the actual stock is physically only on 7th July 2006, when it is estimated at Rs. 20,000.

Additional information:

1. Purchases between 30th June and July are Rs. 2000.

2. Purchases returns between 30th June and 7th July are Rs. 200.

3. Sales between 30th June and 7th July are Rs. 4000.

4. Sales returns between 30th June and 7th July are Rs. 100.

5. The firm makes a gross profit at 25% on cost. Calculate the value of stock on 30th June 2006.

Solution

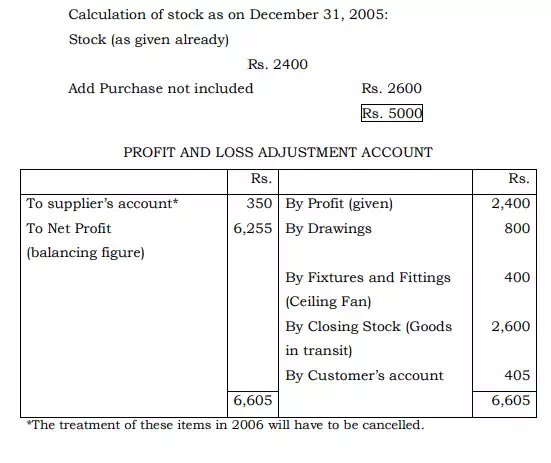

Illustration: The Profit and Loss Account of Cardamom for the year ended 31st December 2005 showed a net profit of Rs. 2,400 after taking into account the closing stock of Rs. 2,400. On a scrutiny of the books the following information could be obtained:

(1) Cardamom has taken goods valued Rs. 800 for his personal use without making entry in the books.

(2) Purchases of the year included Rs. 400 spent on acquisition of a ceiling fan for his shop.

(3) Invoices for goods amounting to Rs.2600 have been entered on 29th December, but such goods were not included in stock.

(4) Rs. 350 have been included in closing stock in respect of goods purchased and invoiced on 28th December 2005 but included in purchases for January 2006.

(5) Sale of goods amounting to Rs. 405 sold and delivered in December 2005 had been entered in January 2006 sales.

You are required to ascertain the correct amount of closing stock as on 31st December 2005 and the adjusted net profit for the year ended on that date.

Solution