Methods Of Valuation Of Inventories

The basic methods of valuation of inventories are as follows:

(a) Historical cost-based method

(b) Sale price-based method

(c) Lower of cost or sale price

Methods based on Historical cost

According to AS-2 historical cost is the aggregate of costs of purchases, costs of conversion and other costs incurred in the normal course of business in bringing the inventories to their present locations and condition. Cost of purchase comprises purchase price, duties and taxes, freight inwards and other expenditure directly attributable to acquisitions. However, selling expenses such as advertisement expenses or storage cost should not be included.

The valuation of inventory at cost price will be in consonance with the realisation concept. According to this concept, revenue is not realised until the sale is complete and the inventory is converted into either cash or accounts receivable. There can thus be no recognition of revenue accretion except at the point of sale.

This is a method with very high objectivity since the inventory valuer has to base it on a transaction which is completely verifiable. The main limitation of this method is its inability to distinguish operational gains from holding gains during period of inflation. (Note: Holding gain refers to profits which arises as a result of holding inventories during inflation). They may be attributed to the fact that this method matches the past inventories against revenues which have current relations. Thus, this system will result in the inclusion of “inventory profits” (i.e. holding gain) in the income statements during periods of rising prices.

Now, we shall describe the various methods for assigning historical costs to inventory and goods sold.

1. First In First Out Method (FIFO)

This method is based on the assumption that the materials which are purchased first are issued first. Issues of inventory are priced in order of their purchases. Inventory issues/sales are priced on the same basis until the first lot of material of goods purchased is exhausted. Thus, units issued are priced at the oldest cost price listed on the stock ledger sheets. Under this system it is not necessary that the material which were longest in stock are exhausted first. But the use of FIFO necessarily mean that the oldest costs are first used for accounting purposes. In practice, an endeavour is made by most business houses to sell of oldest merchandise or materials first. Hence when this system is followed the closing stock does not consist of most recently purchased goods.

Advantages: The following are the advantages of this method:

(i) This method is easy to operate, provided the prices of materials do not fluctuate frequently.

(ii) It gives such a value of closing stock which is very near to current market prices since closing inventory is made of most recently purchased goods.

(iii) It is a realistic method because it takes into account the normal procedure of issuing goods/inventory, i.e. the materials are issued to production in the order of their receipts.

(iv) As it is based on historical cost, no unrealised profit enters into the financial statements for the period.

Disadvantages: This method suffers from the following limitations:

(i) Because of violent changes in prices of materials, it involves somewhat complicated calculations and, therefore, it involves somewhat complicated calculations and, therefore, increase the changes of clerical errors.

(ii) The prices of issues of materials may not reflect current market prices and, therefore, during the period of inflation, the charge to production is unreasonably low.

(iii) Comparison between different jobs executed by the firm becomes sometimes difficult. A job commenced a few minutes before another job might have consumes the supply of lower priced stock. This is particularly because of that the fact the first job might have completely exhausted the supply of materials of a particular lot.

Suitability

FIFO method is considered more suitable during the periods of falling prices. The reason is that the higher price at which the purchase of materials was made earlier stands recovered in cost. This method is suitable when the size of purchases is large but not much frequent. The moderate fluctuations in the prices of materials, and easy comparison between different jobs are also the important conditions for the use of this method.

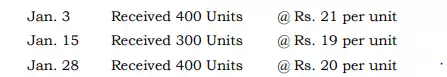

Illustration: The following is the record of receipts of certain materials during the month of January 2006:

![]()

The physical inventory taken on 31st January 2006 shows that there are 600 units in hand. Compute the inventory value on 31st January 2006 by FIFO method.

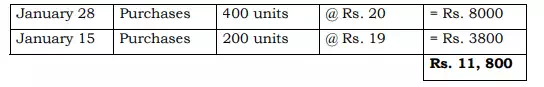

Solution: Under FIFO method, closing inventory includes recent purchases at most recent prices. Hence, the value of the inventory on 31st January will be as follows:

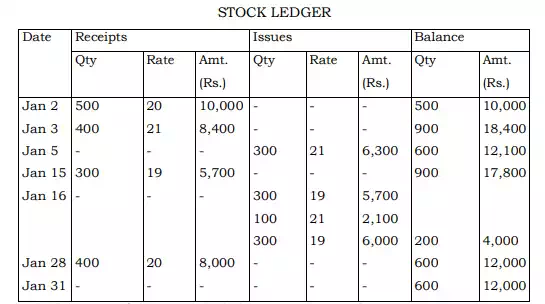

Here, the value of inventory as on 31st January 2006 has been arrived as on the presupposition that the firm uses periodic inventory system, the value of inventory would remain the same even if the perpetual inventory system is in use. To take an example, if out of 1000 units issued, 300 units were issued on January 5, while 700 units were issued on January 16, the valuation of inventory using perpetual inventory system will be done as follows:

From the above stock ledger it is obvious that the value of ending inventory under FIFO method is same in case of both periodic and perpetual inventory systems.

2. Last in First Out Method (LIFO)

Under this method, it is assumed that the material/goods purchased in the last are issued first for production and those received first issued/sold last. In case a new delivery is received before the first lot is fully used, price become the ‘last-in’ price and is used for pricing issued until either the lot is exhausted or a new delivery is received.

As stated above, materials are issued to production at cost which may be very near to current market price. However, inventories at the end will be valued at old prices which may be out of tune with the current maked price.

Advantages:

(i) This method takes into account the current market circumstances while valuing materials issued to various jobs or ascertaining the cost of goods sold.

(ii) No unrealised profit or loss is usually made in case this method is followed.

Disadvantages:

(i) The stock in hand is valued at a price which have become out-of-date when compared with the current inventory prices.

(ii) This method may not be acceptable for taxation purposes since the value of closing inventory may be quite different from the current market value.

(iii) Comparison among similar jobs is very difficult because they may bear different issue prices for materials consumed.

Suitability: This method is most suitable for materials which are of a bulky and non-perishable type.

Illustration: With the information given in illustration (1), compute the inventory value on 31st Jan. 1998 by LIFO method. Also prepare a store ledger account showing how the receipts and issues on 5th Jan and 700 units issued on 16th January 2006.

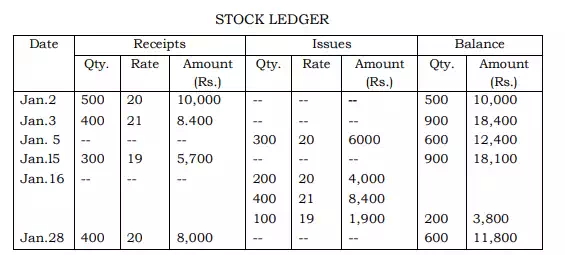

Solution: Under LIFO method, closing inventory includes most old purchases remaining unissued till last date. Hence, valuation of inventory under periodic inventory system would be as follows:

Hence, the value of the inventory on 31st January will be as follows:

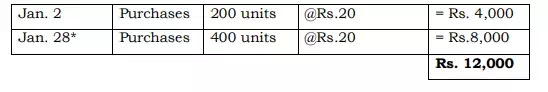

Valuation of Inventory under perpetual inventory system

*Closing entry of 600 units includes 200 units purchased on 2nd January but remained unissued and 400 units purchased on 28th January remaining unissued upto 31st January.

Implications of FIFO and LIFO method in case of rising and falling prices:

Both these methods value the products manufactured at true costs because both are based on actual cost. But in period of rising and falling prices both have conflicting result.

In periods of rising prices the cost of production will be lower in case of FIFO method. This is simply because of the lowest material cost. Contrary to this, LIFO method will result in charging products at highest materials cost. Thus in case of rising price the application of FIFO method will result in higher profitability, and higher income tax liability, whereas the application of LIFO method result in lower profitability, which in turn will reduce income tax liability.

In periods of falling market, the cost of product will tend to be low with reference to the overall cost of inventory in case material cost is to be charged according to LIFO method. Hence, this method will be resulting in inflating of profits and increasing the tax liability. The reverse will be the case if FIFO method is followed. Production will be relatively overcharged. This will deflate the profits and reduce the income tax liability.

In periods of falling prices the ending inventory will be valued in FIFO method at a price lower than in case of LIFO method. The reverse will be the case when the prices are rising. Interestingly, on the basis of above discussion, it may be concluded that in periods of falling prices, LIFO method tends to give a more meaningful balance sheet but less realistic income statement, whereas FIFO method gives a more meaningful income statement but a less realistic balance sheet. The reverse will be the situation in periods of rising prices.

Now the question arises about the superiority of the LIFO and FIFO methods. Based on forgoing discussion about implications of these methods in case of both rising and falling markets, it may be concluded that each method has its own merits and demerits depending upon the circumstances prevailing at a particular moment of time. Thus, no generalisation can be made regarding superiority of LIFO over FIFO or vice-versa.

3. Highest-in-First-our (HIFO)

According to this method, the highest priced materials are treated as being issued first irrespective of the date of purchase. In fact, the inventory of materials or goods are kept at the lowest possible price. In periods of rising prices the closing inventory is undervalued and thus secret reserves are created. However, the highest cost of materials is recovered first. Consequently, the closing inventory amount remains at the minimum value. Hence, this method is very appropriate when the prices are frequently fluctuating. As this method involves calculation more than that of LIFO and FIFO methods, it has not been adopted widely.