Conversion Method

We have seen under the net worth method in the preceding explanation that the method does not give details of the gross profit and net profit. Also, it does not provide a clear picture of the operational results of a business. Resultantly, it becomes just impossible to make a objective analysis of the financial statements. But the effective steps needed to strengthen the financial position of the business cannot be devised without making a meaningful analysis of financial position. Hence, it is quite essential to ascertain the missing information from the books of accounts, and other sources. The missing information can be ascertained by preparing Total Debtors Account, Receipts and Payments Account, Total Creditors Account, Memorandum Trading Account, etc. After ascertaining the required information, it will be possible to prepare a trial balance. Now, one can prepare final accounts in the usual manner since full information as under double entry system is available. Hence, under conversion method net profit is ascertained by conversion of single entry system into double entry system.

Under conversion method, firstly statement of affairs in the beginning is prepared to ascertain capital in the beginning. For preparing this statement, the students should ascertain the information’s on debtors in the beginning or creditors or cash in khand or cash at bank or any other items, if these are missing. This is done by preparing a cash book, total debtors account, total creditors account, bills receivable account, bills payable account, etc. These various accounts will help in revealing a missing figure of cash, bank, credit sales, cash sales, creditors or debtors balance either in the beginning or at the end or any other information. After preparing these accounts the students should calculate total sales by adding credit sales and cash sales; total purchases by adding cash purchases and credit purchases. Information relating to nominal accounts can be ascertained from the cash book. Real accounts and amounts outstanding will be available by way of information. Now, it will be possible to prepare a trial balance. However, in practice trial balance is skipped and only such information is collected which is required for preparing the Trading and Profit and Loss Account, and Balance Sheet of the business.

In order to prepare trading and profit and loss account and balance sheet, the students’ needs the following information:

1. Opening stock and closing stock

2. Purchases

3. Direct expenses

4. Sales

5. Indirect expenses and other incomes

6. All assets and all liabilities

7. Capital in the beginning

8. Profit made during the year

The following illustrations would enable you to calculate the amount of the various items given above.

Opening Stock and Closing Stock:

The amount of Opening and Closing Stock can be ascertained by preparing a Memorandum Trading Account.

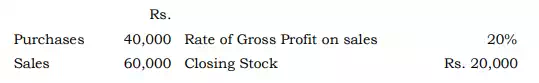

Illustration 4: From the following particulars, find out the amount of Opening Stock:

Solution

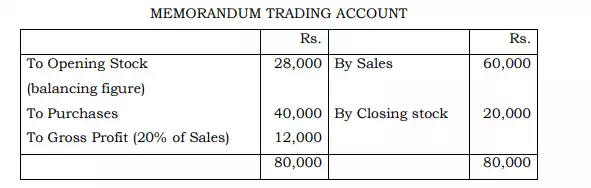

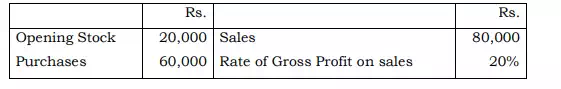

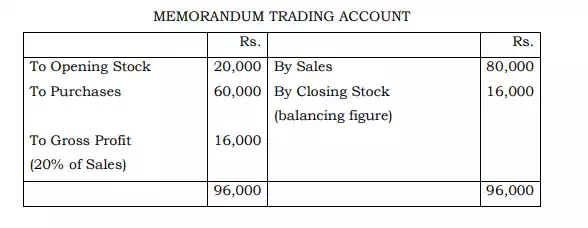

Illustration 5: From the following figures, find out the amount of Closing Stock.

Solution

2. Purchases:

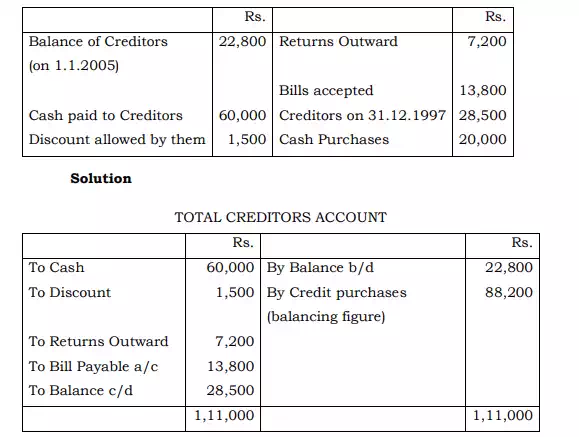

Purchases are calculated by adding cash purchases and credit purchases. Cash book reveals the amount of cash purchases. The amount of credit purchases can be ascertained by preparing (i) total creditors account, and (ii) bills payable account.

Illustration 6: From the following information, ascertain the amount of Credit Purchases for the year 2005.

If we are required to find total purchases, it will be found out simply by adding cash purchases and credit purchases i.e. total purchases = 20,000 + 88,200 = 1,08,200