Calculation Of Profit Or Loss

In case of a business maintaining accounts according to single entry system, profit (or loss) made during the year are calculated by any of the following two methods:

i) Increase in net worth method.

ii) Conversion method.

Increase in Net Worth Method

Under this method, profit can be calculated by comparing the net worth in the beginning of the year and at the end of the year. Any decrease in net worth is taken as loss, but any increase in net worth is taken as profit. However, this is true only in the absence of any other information. Thus, under a pure single-entry system profit cannot be calculated by preparing trading and profit and loss account. For this purpose, we need to calculate and compare capital (net worth) in the beginning and at the end of the year. For example, if net worth of the business on 1.4.1997 is Rs. 50,50,000 and it is Rs. 52,50,000 on 31st March 1998, it can be said that the business has made profit of Rs. 2,00,000 during the period.

In order to determine the capital in the beginning of the period and at the end, we prepare ‘statement of affairs’. A statement of affairs is a statement of all assets and liabilities. The excess of assets over liabilities is taken as net worth. For calculating profit by net worth method the following adjustments are required:

(i) Adjustment for drawings: The drawings made by proprietor from the business for his personal use are added to the capital at the end because drawings made during the year will reduce the capital at the end but not the profit for the year. In other words, accurate amount of profit (or loss) can be known only by making adjustments, in the capital at the end, for the drawings made.

(ii) Adjustment for capital introduced: The proprietor may introduce fresh capital in the business during the course of the financial year. This fresh capital is deducted from the capital at the end because the fresh capital will increase the capital of the proprietor at the end of the financial year, but not the profit. Thus the increase in the capital at the end due to introduction of capital during the year should not be misunderstood for increase in capital because of profits made during the year.

Steps for Preparing Statement of Affairs

The procedure for preparing the Statement of Affairs can be understood with the following steps:

a) Firstly, we are to prepare statement of affairs at the beginning for ascertaining net worth in the beginning.

b) Secondly, we shall prepare statement of affairs at the end for calculating net worth at the end.

c) Thirdly, make adjustments for drawings, and capital introduced during the year.

d) In the end, deduct net worth in the beginning from the net worth at the end. The excess of capital at the end over capital in the beginning will denote the profit.

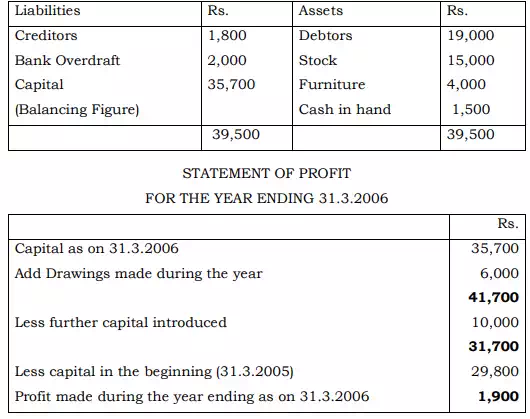

Illustration 1: J. Sikidar keeps her books on single entry system. From the following particulars, prepare a statement showing profit or loss made by her for the year ended March 31, 2006.

During the year Sikidar introduced Rs. 10,000 as further capital in the business and withdrew Rs. 6000

Solution

Sikidar’s Statement of Affairs as on 31st March 2005

Sikidar’s Statement of Affairs as on 31st March 2006

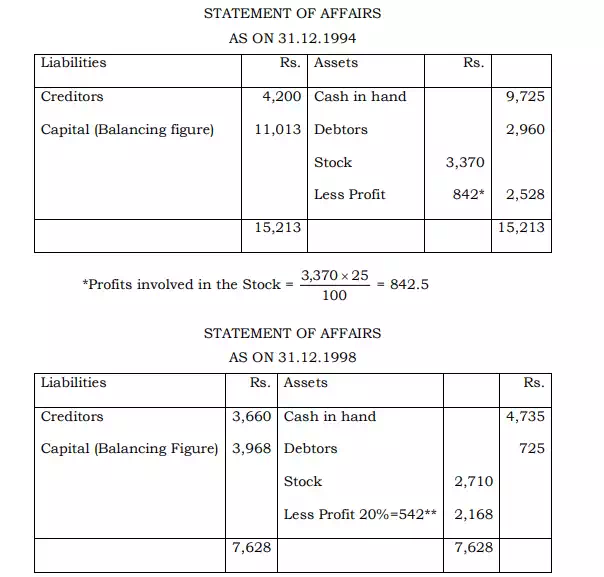

Illustration 2: M.R.P. Singh, who maintains his books by Single Entry System, has submitted returns to the Income Tax Authorities showing his income to be as follows:

But the Income Tax Authority is not satisfied as to the accuracy of the accounts submitted. You are asked to help in finding their accuracy. In this regard you are given with the following information:

i) Business assets and liabilities as on December 31, 1998 were: Debtors, Rs. 725; Cash at Bank, Rs. 4,735; Stock, Rs. 2,710 (at market price which is 25% above cost); Creditors, Rs. 3,660.

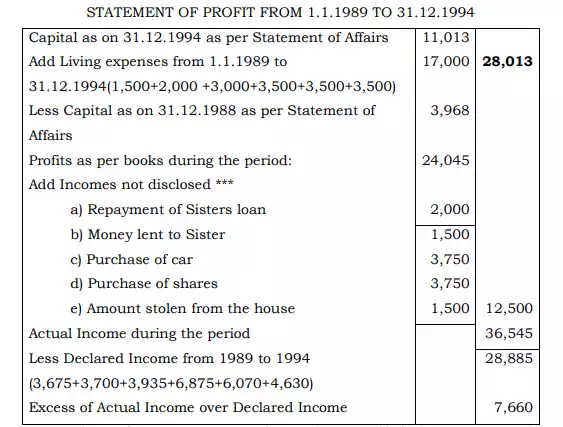

ii) M.R.P. Singh owed his sister, Rs. 2,000 on 31st December 1988. On 15th March 1991 he repaid this amount and on 1st April 1994, he lent his sister Rs. 1,500.

iii) M.R.P. Singh owns a house which he bought in 1984 for Rs. 10,000 and a car which he bought in 1990 for Rs. 3,750. In 1993, he bought Rs. 5,000 shares in X Ltd. for Rs. 3,750.

iv) In 1994, Rs. 1,500 were stolen from his house.

v) M.R.P. Singh stated that his living expenses have been: Rs. 1,500; Rs. 2,000; Rs. 3,000; Rs. 3,500; Rs. 3,500; Rs. 3,500 during the years 1989, 1990, 1991, 1992, 1993 and 1994 respectively. These expenses are exclusive of the amount stolen.

vi) On 31st December 1994, the business liabilities and assets were: Creditors Rs. 4,200; Debtors, Rs. 2,960; cash in hand, Rs. 9,725 and stock Rs. 3,370 (at market price which shows as gross profit of 25%).

From the information submitted, prepare a statement showing whether or not the income declared by M.R.P. Singh is accurate.

Solution

![]()

Purchase of property or money lent or loan repaid during 1.1.1989 and 31.12.1994 will be taken as additional income of assess, since these have not been considered so far. As the house was bought in 1984, therefore, it has been ignored.

Partnership Firms: For ascertaining the profit made by the business in case of a partnership firm, the balance in the capital accounts of all the partners will have to be considered. But, in case they (partners) have a fixed capital system, the balances in the current accounts should be considered while preparing statement of profit. Similar to the case of sole proprietorship, capital accounts of the partners should be adjusted for any amount withdrawn or fresh capital introduced by the partners before ascertaining the combined closing balance of the current accounts.