Accounting Concepts And Conventions

Introduction

Accounting is often called the language of business because the purpose of accounting is to communicate or report the results of business operations and its various aspects to various users of accounting information. In fact, today, accounting statements or reports are needed by various groups such as shareholders, creditors, potential investors, columnist of financial newspapers, proprietors and others. In view of the utility of accounting reports to various interested parties, it becomes imperative to make this language capable of commonly understood by all. Accounting could become an intelligible and commonly understood language if it is based on generally accepted accounting principles. Hence, you must be familiar with the accounting principles behind financial statements to understand and use them properly.

Meaning And Features Of Accounting Principles

For searching the goals of the accounting profession and for expanding knowledge in this field, a logical and useful set of principles and procedures are to be developed. We know that while driving our vehicles, follow a standard traffic rules. Without adhering traffic rules, there would be much chaos on the road. Similarly, some principles apply to accounting. Thus, the accounting profession cannot reach its goals in the absence of a set rules to guide the efforts of accountants and auditors. The rules and principles of accounting are commonly referred to as the conceptual framework of accounting.

Accounting principles have been defined by the Canadian Institute of Chartered Accountants as “The body of doctrines commonly associated with the theory and procedure of accounting serving as an explanation of current practices and as a guide for the selection of conventions or procedures where alternatives exists. Rules governing the formation of accounting axioms and the principles derived from them have arisen from common experience, historical precedent statements by individuals and professional bodies and regulations of Governmental agencies”. According to Hendriksen (1997), Accounting theory may be defined as logical reasoning in the form of a set of broad principles that (i) provide a general frame of reference by which accounting practice can be evaluated, and (ii) guide the development of new practices and procedures. Theory may also be used to explain existing practices to obtain a better understanding of them. But the most important goal of accounting theory should be to provide a coherent set of logical principles that form the general frame of reference for the evaluation and development of sound accounting practices.

The American Institute of Certified Public Accountants (AICPA) has advocated the use of the word “Principle” in the sense in which it means “rule of action”. It discuss the generally accepted accounting principles as follows:

Financial statements are the product of a process in which a large volume of data about aspects of the economic activities of an enterprise are accumulated, analysed and reported. This process should be carried out in conformity with generally accepted accounting principles. These principles represent the most current consensus about how accounting information should be recorded, what information should be disclosed, how it should be disclosed, and which financial statement should be prepared. Thus, generally accepted principles and standards provide a common financial language to enable informed users to read and interpret financial statements.

Generally accepted accounting principles encompass the conventions, rules and procedures necessary to define accepted accounting practice at a particular time....... generally accepted accounting principles include not only broad guidelines of general application, but also detailed practices and procedures (Source: AICPA Statement of the Accounting Principles Board No. 4, “Basic Concepts and Accounting Principles underlying Financial Statements of Business Enterprises “, October, 1970, pp 54-55)

According to ‘Dictionary of Accounting’ prepared by Prof. P.N. Abroal, “Accounting standards refer to accounting rules and procedures which are relating to measurement, valuation and disclosure prepared by such bodies as the Accounting Standards Committee (ASC) of a particular country”. Thus, we may define Accounting Principles as those rules of action or conduct which are adopted by the accountants universally while recording accounting transactions. Accounting principles are man-made. They are accepted because they are believed to be useful. The general acceptance of an accounting principle usually depends on how well it meets the following three basic norms: (a) Usefulness; (b) Objectiveness; and (c) Feasibility.

A principle is useful to the extent that it results in meaningful or relevant information to those who need to know about a certain business. In other words, an accounting rule, which does not increase the utility of the records to its readers, is not accepted as an accounting principle. A principle is objective to the extent that the information is not influenced by the personal bias or Judgement of those who furnished it. Accounting principle is said to be objective when it is solidly supported by facts. Objectivity means reliability which also means that the accuracy of the information reported can be verified. Accounting principles should be such as are practicable. A principle is feasible when it can be implemented without undue difficulty or cost. Although these three features are generally found in accounting principles, an optimum balance of three is struck in some cases for adopting a particular rule as an accounting principle. For example, the principle of making the provision for doubtful debts is found on feasibility and usefulness though it is less objective. This is because of the fact that such provisions are not supported by any outside evidence.

Kinds Of Accounting Principles

In dealing with the framework of accounting theory, we are confronted with a serious problem arising from differences in terminology. A number of words and terms have been used by different authors to express and explain the same idea or notion. The various terms used for describing the basic ideas are: concepts, postulates, propositions, assumptions, underlying principles, fundamentals, conventions, doctrines, rules, axioms, etc. Each of these terms is capable of precise definition. But, the accounting profession has served to give them lose and overlapping meanings. One author may describe the same idea or notion as a concept and another as a convention and still another as postulate. For example, the separate business entity idea has been described by one author as a concept and by another as a convention. It is better for us not to waste our time to discuss the precise meaning of generic terms as the wide diversity in these terms can only serve to confuse the learner.

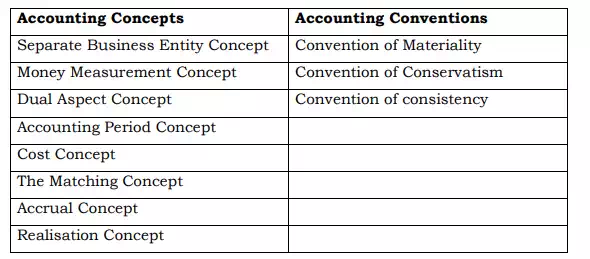

We do feel, however, that some of these terms/ideas have a better claim to be called ‘concepts’ while the rest should be called ‘conventions’. The term ‘Concept’ is used to connote the accounting postulates, i.e., necessary assumptions and ideas which are fundamental to accounting practice. In other words, fundamental accounting concepts are broad general assumptions which underline the periodic financial statements of business enterprises. The reason why some of these terms should be called concepts is that they are basic assumptions and have a direct bearing on the quality of financial accounting information. The term ‘convention’ is used to signify customs or tradition as a guide to the preparation of accounting statements. The following are the important accounting concepts and conventions: