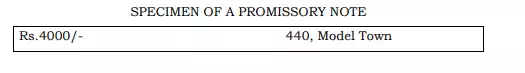

Promissory Note

Negotiable Instrument Act, 1881 defines a Promissory Note as “as instrument in writing (not being a bank note or a currency note) containing an unconditional undertaking by the maker to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument.” Thus, a promissory note is a written unconditional promise made by one person to another, to pay a specific sum of money either on demand or at a specified future date.

Essentials of a promissory note

The following are the essentials of a promissory note:

· It must be in writing.

· It must contain express promise to pay. Mere acknowledgment of debt is not sufficient to make a promissory note.

· The promise to pay must be unconditional. It should not depend upon contingencies which may or may not happen, because uncertainty affects the business.

· It should be signed by the maker. The person who promises to pay must sign the instrument even though it might have been written by the promissory himself.

· The maker of the promissory note must be certain. The promissory note itself must show clearly who is the person agreeing to undertake the liability to pay the amount. ·

· The payee must be certain. The instrument must point out with certainty the person to whom the promise has been made. The payee may be ascertained by name or by designation.

· The amount payable must be certain. There must be a certainty as to the amount promised to be paid as promissory note. In case the payment is not certain, the promissory note is not valid.

· The promise should be to pay money and money only. Money means legal tender money and not old and rare coins.

· A promissory note may be payable on demand or after a definite period of time.

· The other formalities regarding number, place, date, consideration are not essential to be incorporated in the promissory note, but it must be properly stamped according to India Stamp Act.

Difference between a bill of exchange and a promissory note

The following are the main points of differences between a bill of exchange and a promissory note:

(i) A bill of exchange is an unconditional order to pay whereas a promissory note is an unconditional promise to pay.

(ii) A bill of exchange is drawn by the creditor and he makes an order on the debtor to make the payment whereas a promissory note is written by the debtor wherein he promises to make the payment in future.

(iii) A bill of exchange has usually three parties namely, the drawer, the drawee and the payee whereas a promissory note has only two parties, i.e. the maker and the payee.

(iv) A bill of exchange is required to be accepted by the drawee (i.e., debtor) if it is to be a legal document, whereas a promissory note needs no acceptance because the debtor himself makes the promise to make the payment.

(v) Bills of exchange payable on demand do not require any stamp duty whereas promissory notes payable on demand require advalorem stamp duty.

(vi) The liability of the drawer of the bill of exchange is secondary because he is required to make the payment only when the drawee of the bill fails to make the payment. On the other hand, the liability of the maker of the promissory note is primary and absolute because a promissory note is written by him.

(vii) Foreign bills are usually drawn in a set of three whereas foreign promissory notes are drawn in one set only.

(viii) Foreign bills must be noted and protested on their being dishonoured but foreign promissory notes do not need any noting and protesting on their dishonour.

Advantages of bills of exchange and promissory notes

The following are the advantages of bills of exchange and promissory notes:

1. These are helpful in increasing the size of the business because they facilitate credit transactions.

2. A bill of exchange or a promissory note is a conclusive proof of the indebtedness of the purchaser of goods or services on credit.

3. A bill or a promissory note is a legal document and can be enforced in a court for its payment if its payment is refused by dishonour.

4. A bill or a promissory note fixes date of payment, so it provides a great facility to the creditor to know exactly when to expect payment and the debtor to know when to make the payment.

5. If the creditor cannot wait for the payment till the date of the maturity of the bill or the promissory note, he can get the bill discounted with the bank and get the payment before the maturity of the document.

6. Foreign trade is facilitated with the help of foreign bills of exchange.

7. A bill or a promissory note is a negotiable instrument and can be easily transferred from one person to another person in settlement of debts.