Accounting Of Negotiable Instruments

Introduction

Business transactions are either cash transactions or credit transactions. In cash transactions, goods are sold and transferred to the purchaser by the seller for immediate cash payment. In other words, the claim of the seller of goods is settled then and there. But in case of credit transactions, the seller’s claim is settled on a later date. Credit is a very powerful instrument in the development of modern structure of business. Without credit facilities, it is not possible to expand a business. Therefore, with the help of credit transactions, a trader is in a position to enter many more transactions than his actual capital. But on the other side, credit transaction bring a lot of risks to the trader. In a credit transaction, goods are sold and transferred in return of a promise to pay the price of the goods at some future date or on demand. This promise can be either be by word of mouth or in writing. It is possible that the oral promise of making the payment in future may not be fulfilled by the purchaser causing a loss to the seller of goods. Therefore, in order to avoid a such a situation, it is always better to take an undertaking in writing for the payment of the price of goods. This written undertaking may be in the form of “Bills of Exchange” or “Promissory Note” or “Cheques” or “Hundi”. These are the undertakings in writing by the debtors to pay an amount of money on a definite or determinable date. These documents are known as “Negotiable Instruments.”

Negotiable Instrument Act, 1881 defines the Negotiable Instrument as “A negotiable instrument means promissory note, bill of exchange or cheque payable either on order or to bearer”. The word “Negotiable” means transfer by delivery and the word “Instrument” mean a written document by which a right is created in favour of some person.

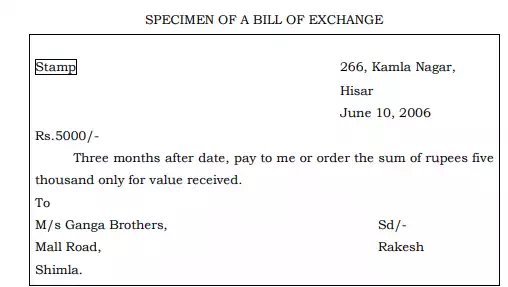

Bill Of Exchange

Section 5 of the Negotiable Instrument Act, 1881 defines a Bill of Exchange as “an instrument in writing containing an unconditional order, signed by the maker, directing a certain person, to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument”. It means that if an order is made in writing by one person on another directing him to pay a certain sum of money unconditionally to a certain person or according to his instructions or to the bearer, and if that order is accepted by the person on whom the order was make, the document is a bill of exchange.

Essentials of a bill of exchange: Following are the essentials of a bill of exchange:

1. It should be in writing.

2. It should contain an order by the seller to the purchaser to make the payment in future. A mere request by the seller to the purchaser to make the payment in future does not amount to a bill of exchange.

3. The order contained in the bill should be unconditional. A bill of exchange with a conditional order cannot be made payable.

4. The maker of the bill or the seller is known as “drawer” and the bill must be signed by him, otherwise it will be invalid.

5. The purchaser upon whom the bill is drawn is known as “drawee” and he must be a certain person.

6. Amount ordered to be paid by the drawer in a bill must be certain and it should be in money alone and not in goods.

7. The person to whom payment of the bill is to be made is known as “payee” and he must be a certain person or the bearer of the bill.

Classification of Bill of Exchange

Classification of the bill of exchange can be made on the following basis–

1) On the basis of place.

2) On the basis of purpose

3) On the basis of time.

1. Classification on the basis of place

On the basis of place, bills are of two types

a) Inland Bills

A bill is termed as Inland bill if

i) it is drawn in India on a person residing in India whether payable in or outside India or

ii) it is drawn in India on a person residing outside India but payable in India.

b) Foreign Bills Foreign bill are those bills of exchange that are drawn outside India and made payable in India. In other words, a bill which is not an Inland Bill is a Foreign Bill.

2. Classification on the basis of purpose

On the basis of purpose of writing of the bill, the bills can again be classified as:

a) Trade Bills Where a bill of exchange has been drawn and accepted for a genuine trade transaction, it is termed as a trade bill. For example, X has sold goods to Y for Rs.1000 on credit and X has drawn a bill on Y for the said amount, which Y accepts, then this bill is a trade bill.

b) Accommodation Bills Where a bill of exchange is drawn and accepted for providing funds to a friend in need, it is termed as accommodation bill. In this bill, the drawer and drawee are not the creditor and the debtor respectively. These are drawn for the mutual benefit of the drawer and the acceptor and are not backed by business transactions.

3. On the basis of time

On the basis of time, a bill of exchange may be time bill or demand bill.

a) Time Bill

When payment of a bill of exchange is to be made after a particular period of time, the bill is termed as a “Time Bill”. In such a case, date of maturity is always calculated by adding three days of grace. Such bills require “acceptance” of the drawee. It is generally given by writing across the face of the instrument.

b) Demand Bill

Demand bill is a bill which is payable at any time on demand. Neither the acceptance of the drawee is necessary nor any days of grace are allowed in this case.