Location Of Errors

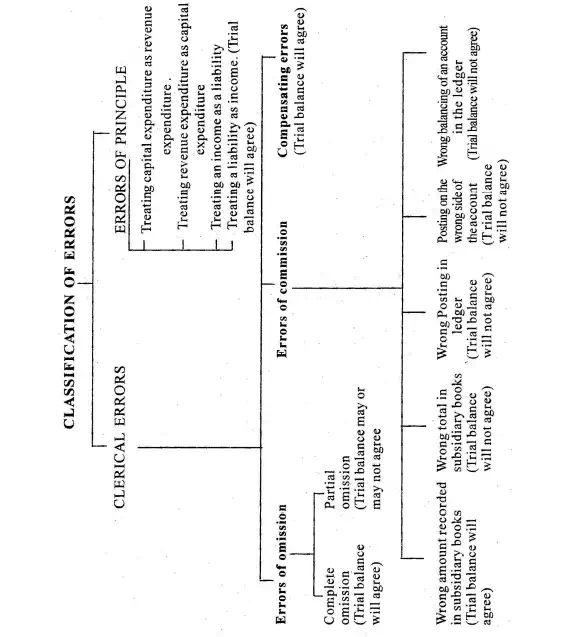

The location of errors of omissions, compensations and principles are slightly difficult because of the fact that such errors do not affect the agreement of trial balance. However, the locations of some errors of commission are comparatively easier because they affect the agreement of the trial balance. Thus, the errors can be classified into two categories from the point of view of locating them:

Errors which do not affect the agreement of Trial Balance

As stated, errors of omission, errors of compensating nature and errors of principle do not affect the agreement of the trial balance. Their location is, therefore, a difficult task. These are usually found out when the statements of accounts are sent to the customers or received by the business or during the course of audit and sometimes by chance. For example, if a credit sale of Rs. 2000 to Suresh has not been recorded in the books of accounts, the error will not affect the agreement of the trial balance and therefore, at the time of finalizing the accounts it may not be traced out. However, this will be found out when a statement of account is received from Suresh showing the money payable by him or when a statement of account is sent to Suresh showing the money due from him.

Errors which affect the agreement of Trial balance

The errors which cause a mismatch in the trial balance totals are frequently referred to as errors disclosed by a trial balance. However, the mismatch does not automatically point out the actual errors. It is only the diligence and ingenuity of the person preparing the accounts which would help in the location of errors. The procedure to be followed for location of such errors can be put as follows:

I. The totals of the trial balance itself should be thoroughly rechecked in order to find out exact or correct difference.

II. Make sure that the balances of cash and bank are included.

III. The difference of the two sides of the trial balance should be found and be divided by two and then find out whether a figure equal to the same (i.e. half the difference) appears in the trial balance. This procedure would enable to locate the amount placed on the wrong side.

IV. If the error remains undetected, divide the exact difference by 9. If it is divisible by 9, this will mean that there may be transposition error or slide error. A transposition error is committed when the digit of an amount is misplaced. For example, machinery account has a balance of Rs. 5689, but it has been written as Rs. 5869 in the trial balance. The resulting error is Rs. 180, which is divisible by 9. A slide error is committed when the decimal point is placed incorrectly. For example, Rs. 3670 is copied as Rs. 36.70. The resulting error is Rs. 3633.30 which is also divisible by 9.

V. See that there is no mistake in balancing of the various accounts.

VI. The schedules of debtors and creditors should be scrutinised so as to find out that all the debtors and creditors have been included in these schedules; their totals are correct.

VII. If the difference is of a substantial amount, compare the figures of trial balance of the current year with the trial balance of the preceding year and see whether there is any abnormal difference between the balances of important accounts of the two trial balances.

VIII. The total of subsidiary books should be checked and it should be seen whether posting has been done from these books correctly to respective accounts in the ledger or not.

IX. It should be checked that opening balances have been correctly brought forward in the current year’s books.

X. If the difference is still not traced, check thoroughly the books of original entry and their posting into the ledger and finally the balancing of various accounts.

XI. If the error still remains undetected, repeat the above steps with the help of other members of the staff, who are not involved in maintaining the books of accounts.