Profit And Loss Account

Trading Account results in the gross profit/loss made by a businessman on purchasing and selling of goods. It does not take into consideration the other operating expenses incurred by him during the course of running the business. Besides this, a businessman may have other sources of income. In order to ascertain the true profit or loss which the business has made during a particular period, it is necessary that all such expenses and incomes should be considered. Profit and Loss Account considers all such expenses and incomes and gives the net profit made or net loss suffered by a business during a particular period. All the indirect revenue expenses and losses are shown on the debit side of the Profit and Loss Account, whereas all indirect revenue incomes are shown on the credit side of the Profit and Loss Account.

Profit and Loss Account measures net income by matching revenues and expenses according to the accounting principles. Net income is the difference between total revenues and total expenses. In this connection, we must remember that all the expenses, for the period are to be debited to this account - whether paid or not. If it is paid in advance or outstanding, proper adjustments are to be made (Discussed later). Likewise all revenues, whether received or not are to be credited. Revenue if received in advance or accrued but not received, proper adjustment is required.

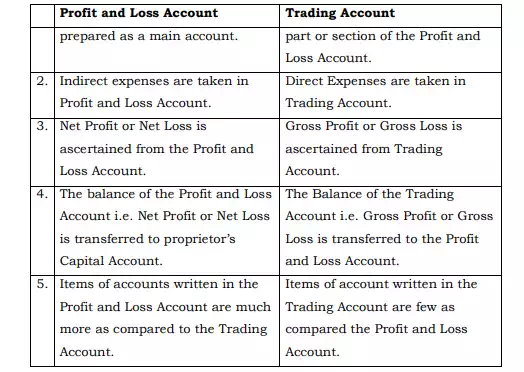

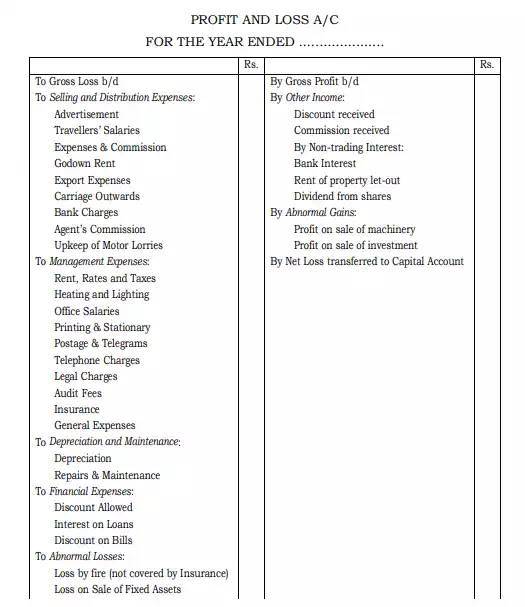

A proforma of the Profit and Loss Account showing probable items therein is as follows:

Important points in Profit and Loss account

1. Selling and Distribution Expenses

These expenses are incurred for promoting sales and distribution of sold goods. Example of such expenses are go down rent, carriage outwards, advertisement, cost of after sales service, selling agents commission, etc.

2. Management Expenses

These are the expenses incurred for carrying out the day-to-day administration of a business. Expenses, under this head, include office salaries, office rent and lighting, printing and stationery and telegrams, telephone charges, etc.

3. Maintenance Expenses

These expenses are incurred for maintaining the fixed assets of the administrative office in a good condition. They include repairs and renewals, etc.

4. Financial Expenses

These expenses are incurred for arranging finance necessary for running the business. These include interest on loans, discount on bills, etc.

5. Abnormal Losses

There are some abnormal losses that may occur during the accounting period. All types of abnormal losses are treated as extra ordinary expenses and debited to Profit and Loss Account. Examples are stock lost by fire and not covered by insurance, loss on sale of fixed assets, etc.

Following are the expenses not to appear in the Profit and Loss Account:

(i) Domestic and household expenses of proprietor or partners.

(ii) Drawings in the form of cash, goods by the proprietor or partners.

(iii) Personal income tax and life insurance premium paid by the firm on behalf of proprietor or partners.

6. Gross Profit

This is the balance of the Trading Account transferred to the Profit and Loss Account. If the Trading Account shows a gross loss, it will appear on the debit side.

7. Other Income

During the course of the business, other than income from the sale of goods, the business may have some other income of financial nature. The examples are discount or commission received.

8. Non-trading Income

Such incomes include interest on bank deposits, loans to employees and investment in debentures of companies. Similarly, dividend on investment in shares of companies and units of mutual funds are also known as non-trading incomes and shown in Profit and Loss Account

9. Abnormal Gains

There may be capital gains arising during the course of the year, e.g., profit arising out of sale of a fixed asset. Such profit is shown as a separate income on the credit side of the Profit and Loss Account.

Closing entries for Profit and Loss account

(i) For transfer of various expenses to Profit & Loss A/c

Profit and Loss A/c Dr.

To Various Expenses A/c

(Being various indirect expenses transferred to Profit and Loss Account)

(ii) For transfer of various incomes and gains to Profit & Loss

A/c

Various Incomes & Gains A/c Dr.

To Profit & Loss A/c

(Being various incomes & gains transferred to Profit and Loss Account)

(iii) (a) For Net Profit

Profit & Loss A/c Dr.

To Capital A/c

(Being Net Profit transferred to capital)

(b) For Net Loss

Capital A/c Dr

To Profit & Loss A/c

(Being Net Loss transferred to Capital Account)

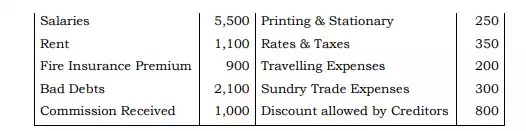

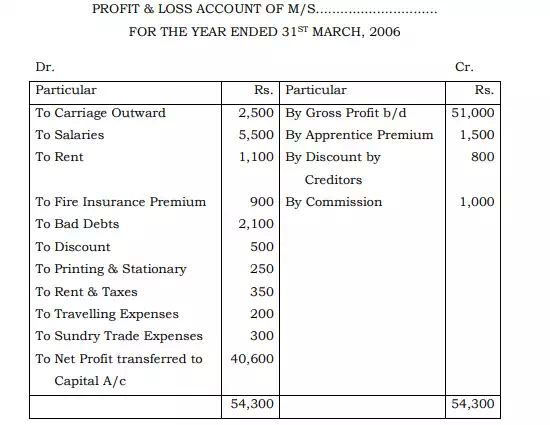

Illustration II: From the following balances extracted at the close of year ended 31 March 2006, prepare Profit and Loss Account as at that date:

Solution

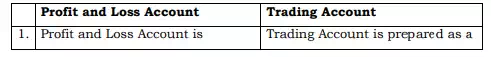

Distinction between trading account and Profit and Loss Account