Preparation Of Profit And Loss Account And Balance Sheet

Introduction

The transactions of a business enterprise for the accounting period are first recorded in the books of original entry, then posted therefrom into the ledger and lastly tested as to their arithmetical accuracy with the help of trial balance. After the preparation of the trial balance, every businessman is interested in knowing about two more facts. They are: (i) Whether he has earned a profit or suffered a loss during the period covered by the trial balance, and (ii) Where does he stand now? In other words, what is his financial position?

For the above said purposes, the businessman prepares financial statements for his business i.e. he prepares the Trading and Profit and Loss Account and Balance Sheet at the end of the accounting period. These financial statements are popularly known as final accounts. The preparation of financial statements depends upon whether the business concern is a trading concern or manufacturing concern. If the business concern is a trading concern, it has to prepare the following accounts along with the Balance Sheet: (i) Trading Account; and (ii) Profit and Loss Account.

But, if the business concern is a manufacturing concern, it has to prepare the following accounts along with the Balance Sheet: (i) Manufacturing Account; (ii) Trading Account; and (iii) Profit and Loss Account.

Trading Account is prepared to know the Gross Profit or Gross Loss. Profit and Loss Account discloses net profit or net loss of the business. Balance sheet shows the financial position of the business on a given date. For preparing final accounts, certain accounts representing incomes or expenses are closed either by transferring to Trading Account or Profit and Loss Account. Any Account which cannot find a place in any of these two accounts goes to the Balance Sheet.

Trading Account

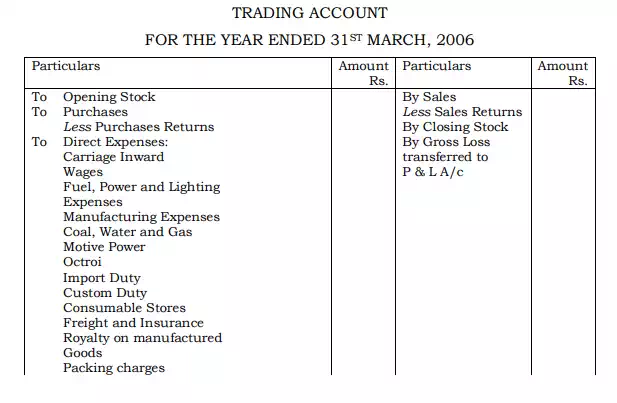

After the preparation of trial balance, the next step is to prepare Trading Account. Trading Account is one of the financial statements which shows the result of buying and selling of goods and/or services during an accounting period. The main objective of preparing the Trading Account is to ascertain gross profit or gross loss during the accounting period. Gross Profit is said to have made when the sale proceeds exceed the cost of goods sold. Conversely, when sale proceeds are less than the cost of goods sold, gross loss is incurred. For the purpose of calculating cost of goods sold, we have take into consideration opening stock, purchases, direct expenses on purchasing or manufacturing the goods and closing stock. The balance of this account i.e. gross profit or gross loss is transferred to the Profit and Loss Account. The specimen of a Trading Account is given below:

Important points regarding trading account

1. Stock

The term ‘stock’ includes goods lying unsold on a particular date. The stock may be of two types:

(a) Opening stock

(b) Closing stock

Opening stock refers to the closing stock of unsold goods at the end of previous accounting period which has been brought forward in the current accounting period. This is shown on the debit side of the Trading Account.

Closing stock refers to the stock of unsold goods at the end of the current accounting period. Closing stock is valued either at cost price or at market price whichever is less. Such valuation of stock is based on the principle of conservatism which lays down that the expected profit should not be taken into account but all possible losses should be duly provided for.

Closing stock is an item which is not generally available in the trial balance. If it is given in Trial Balance, it is not to be shown on the credit side of Trading Account but appears only in the Balance Sheet as an asset. But if it is given outside the trial balance, it is to be shown on the credit side of the Trading Account as well as on the asset side of the Balance Sheet.

2. Purchases

Purchases refer to those goods which have been bought for resale. It includes both cash and credit purchases of goods. The following items are shown by way of deduction from the amount of purchases:

(a) Purchases Returns or Return Outwards.

(b) Goods withdrawn by proprietor for his personal use.

(c) Goods received on consignment basis or on approval basis or on hire purchase.

(d) Goods distributed by way of free samples.

(e) Goods given as charity.

3. Direct Expenses

Direct expenses are those expenses which are directly attributable to the purchase of goods or to bring the goods in saleable condition. Some examples of direct expenses are as under:

(a) Carriage Inward: Carriage paid for bringing the goods to the go down is treated as carriage inward and it is debited to Trading Account.

(b) Freight and insurance: Freight and insurance paid for acquiring goods or making them saleable is debited to Trading Account. If it is paid for the sale of goods, then it is to be charged (debited) to Profit and Loss Account.

(c) Wages: Wages incurred in a business is direct, when it is incurred on manufacturing or merchandise or on making it saleable. Other wages are indirect wages. Only direct wages are debited to the Trading Account. Other wages are debited to the Profit and Loss Account. If it is not mentioned whether wages are direct or indirect, it should be assumed as direct and should appear in the Trading Account.

(d) Fuel, Power and Lighting Expenses: Fuel and power expenses are incurred for running the machines. Being directly related to production, these are considered as direct expenses and debited to Trading Account. Lighting expenses of factory is also charged to Trading Account, but lighting expenses of administrative office or sales office are charged to Profit and Loss Account.

(e) Octroi: When goods are purchased within municipality limits, generally octroi duty has to be paid on it. It is debited to Trading Account.

(f) Packing Charges: There are certain types of goods which cannot be sold without a container or proper packing. These form a part of the finished product. One example is ink, which cannot be sold without a bottle. These type of packing charges are debited to Trading Account. But if the goods are packed for their safe despatch to customers, i.e. packing meant for transportation or fancy packing meant for advertisement will appear in the Profit and Loss Account.

(g) Manufacturing Expenses: All expenses incurred in manufacturing the goods in the factory such in factory rent, factory insurance etc. are debited to Trading Account.

(h) Royalties: These are the payments made to a patentee, author or landlord for the right to use his patent, copyright or land. If royalty is paid on the basis of production, it is debited to Trading Account and if it is paid on the basis of sales, it is debited to Profit and Loss Account.

4. Sales

Sales include both cash and credit sales of those goods which were purchased for resale purposes. Some customers might return the goods sold to them (called sales return) which are deducted from the sales in the inner column and net amount is shown in the outer column. While ascertaining the amount of sales, the following points need attention:

(a) If a fixed asset such as furniture, machinery etc. is sold, it should not be included in sales.

(b) Goods sold on consignment or on hire purchase or on sale or return basis should be recorded separately.

(c) If goods have been sold but not yet despatched, these should not be shown under sales but are to be included in closing stock.

(d) Sales of goods on behalf of others and forward sales should also be excluded from sales.