Purchase Book

Purchases Book (also known as Invoice Journal/Bought Journal/Purchases Journal) is used for recording only the credit purchases of goods and merchandise in which the business is dealing in, i.e. goods purchased for resale purpose for earning revenue. It records neither the cash purchases of goods nor the purchase of any asset other than the goods or merchandise.

When we purchase goods on credit we receive a statement from the supplier giving the particulars of the goods supplied by him. The statement is known as an Invoice. The invoice states the quality, price and the value of goods supplied. It also states the discount allowable (trade and cash) and the condition under which payment is expected. The entries in the purchase book are made on the basis of invoices received from the supplies with the amounts net of trade discount/quantity discount. Trade discount is a reduction granted by the supplier from the list price of goods and services on business consideration such as quantity bought, trade practices other than for prompt payment. The object of allowing trade discount is to enable the retailer to sell the goods to the customer at list price and still leaving margin for meeting business expenses and his profit. Entries in the books of both supplier as well as retailer are made on the basis of net amount i.e. invoice price less trade discount.

Posting

After recording transactions in the Purchases Book, the posting in ledger accounts will be made. The posting from the Purchases Book is made as follows:

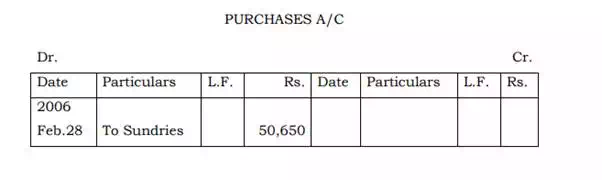

a) Debit the Purchases Account with the periodical totals of the Purchases Book. On the debit side of the Purchases Account, 121 write “To total as per Purchase Book” or “To Sundries” in the particulars column.

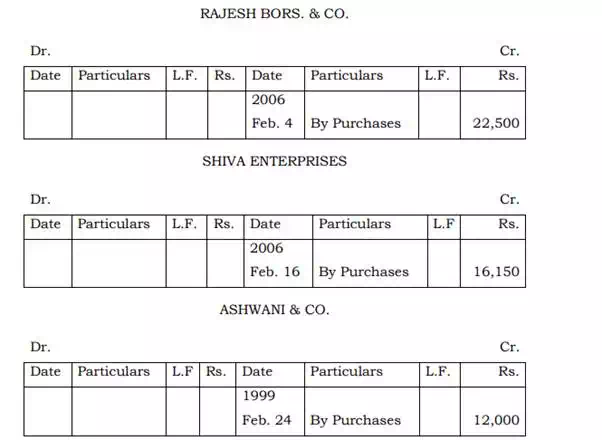

b) Personal accounts of each individual supplier is credited with the net amount of Inward Invoice recorded in Purchases Book by writing “By Purchases”.

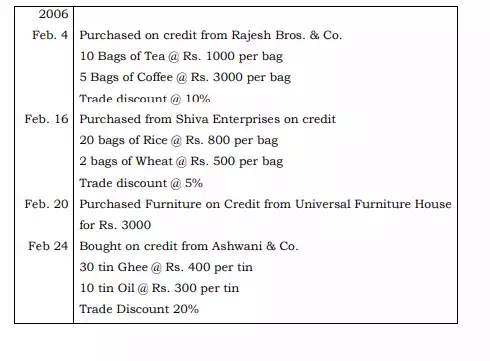

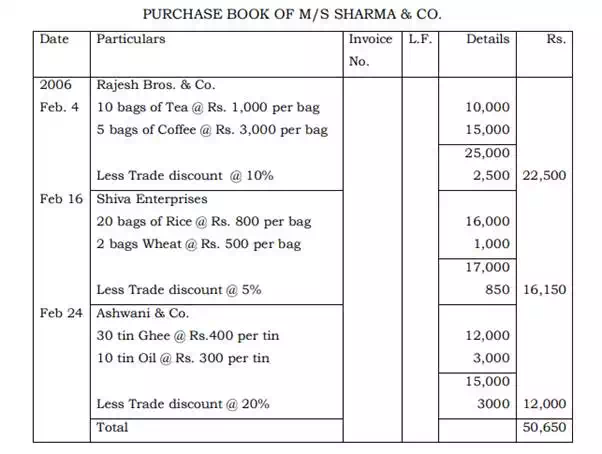

Illustration 5: Prepare the Purchases Book for the month of Feb 2006 from the following particulars of M/s Sharma & Co. and also post them into Ledger.

Solution

Note: Purchase of furniture being an asset is not to be recorded in purchase book, however, it will be recorded in Journal.