Revenue

Revenue, also called sales (or turnover, in the UK), refers to the value of the products and services a company sells.

Net revenue usually refers to a company's sales net of discounts and returns.

How It Works (Example):

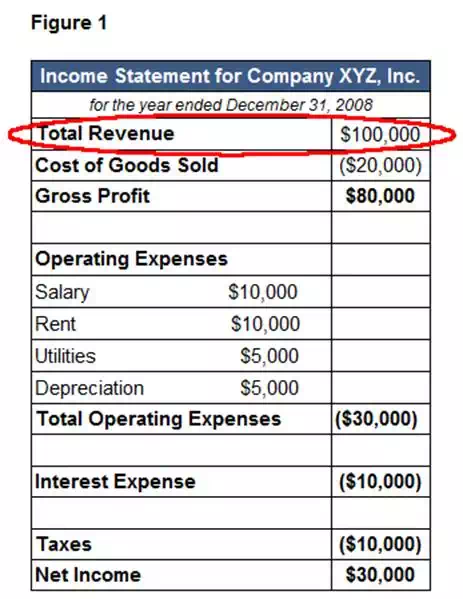

Let's assume grocery store XYZ sold $100,000 worth of food for the year. It would record these sales as revenue on the very top of its income statement (as shown below).

Why It Matters:

Revenue is a measure of how much raw income a company is bringing in from sales of its products and services. A company that sees its revenue rise every year signals that a company is selling more of its products and services which can help it grow. Falling revenues each year signal that a company is faltering or shrinking.

Generally, the more revenue a company brings in the more money a company has to work with to pay expenses and make a profit.

Generally accepted accounting principles (GAAP) and industry standards often determine when a company can record revenue. For example, if a wholesaler sells a product for $10,000, does it record the sale when it receives the order, when it ships the product a week later, or when it receives payment from the buyer a month after that? Revenue recognition standards answer these questions, which vary by industry and type of sale. You can usually learn what a company’s revenue recognition policies are in the notes to its financial statements.