Debits and Credits Explained in Detail

If the words "debits" and "credits" sound like a foreign language to you, you are more perceptive than you realize—"debits" and "credits" are words that have been traced back five hundred years to a document describing today's double-entry accounting system.

Under the double-entry system every business transaction is recorded in at least two accounts. One account will receive a "debit" entry, meaning the amount will be entered on the left side of that account. Another account will receive a "credit" entry, meaning the amount will be entered on the right side of that account. The initial challenge with double-entry is to know which account should be debited and which account should be credited.

Before we explain and illustrate the debits and credits in accounting and bookkeeping, we will discuss the accounts in which the debits and credits will be entered or posted.

What is an Account ?

To keep a company's financial data organized, accountants developed a system that sorts transactions into records called accounts. When a company's accounting system is set up, the accounts most likely to be affected by the company's transactions are identified and listed out. This list is referred to as the company's chart of accounts. Depending on the size of a company and the complexity of its business operations, the chart of accounts may list as few as thirty accounts or as many as thousands. A company has the flexibility of tailoring its chart of accounts to best meet its needs.

Within the chart of accounts, the balance sheet accounts are listed first, followed by the income statement accounts. In other words, the accounts are organized in the chart of accounts as follows:

· Assets

· Liabilities

· Owner's (Stockholders') Equity

· Revenues or Income

· Expenses

· Gains

· Losses

Because every business transaction affects at least two accounts, our accounting system is known as an entry system. (You can refer to the company's chart of accounts to select the proper accounts. Accounts may be added to the chart of accounts when an appropriate account cannot be found.)

For example, when a company borrows $1,000 from a bank, the transaction will affect the company's Cash account and the company's Notes Payable account. When the company repays the bank loan, the Cash account and the Notes Payable account are also involved.

If a company buys supplies for cash, its Supplies account and its Cash account will be affected. If the company buys supplies on credit, the accounts involved are Supplies and Accounts Payable.

If a company pays the rent for the current month, Rent Expense and Cash are the two accounts involved. If a company provides a service and gives the client 30 days in which to pay, the company's Service Revenues account and Accounts Receivable are affected.

Although the system is referred to as double-entry, a transaction may involve more than two accounts. An example of a transaction that involves three accounts is a company's loan payment to its bank of $300. This transaction will involve the following accounts: Cash, Notes Payable, and Interest Expense.

(If you use accounting software you may not actually see that two or more accounts are being affected due to the user-friendly nature of the software. For example, let's say that you write a company check by means of your accounting software. Your software automatically reduces your Cash account and prompts you only for the otheraccounts affected.)

After you have identified the two or more accounts involved in a business transaction, you must debit at least one account and credit at least one account.

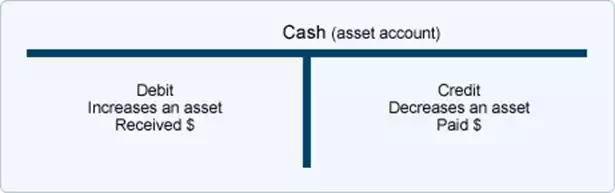

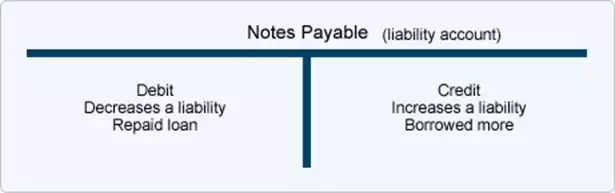

To debit an account means to enter an amount on the left side of the account. To credit an account means to enter an amount on the right side of an account.

· Debit means left

· Credit means right

Generally, these types of accounts are increased with a debit:

· Dividends (Draws)

· Expenses

· Assets

· Losses

You might think of D - E - A - L when recalling the accounts that are increased with a debit.

Generally, the following types of accounts are increased with a credit:

· Gains

· Income

· Revenues

· Liabilities

· Stockholders' (Owner's) Equity

You might think of G - I - R - L - S when recalling the accounts that are increased with a credit.

To decrease an account, you do the opposite of what was done to increase the account. For example, an asset account is increased with a debit. Therefore, it is decreased with a credit.

The abbreviation for debit is dr. and the abbreviation for credit is cr.

T-accounts

Accountants and bookkeepers often use T-accounts as a visual aid for seeing the effect of the debit and credit on the two (or more) accounts. (Learn more about accountants and bookkeepers in our Accounting Career Center.)

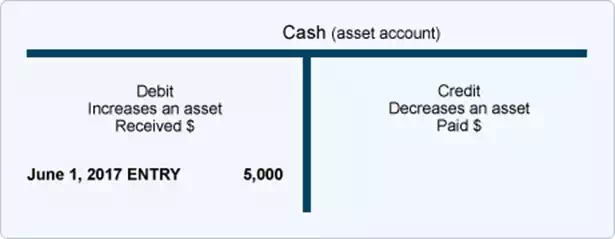

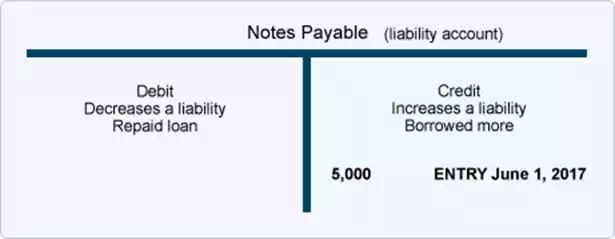

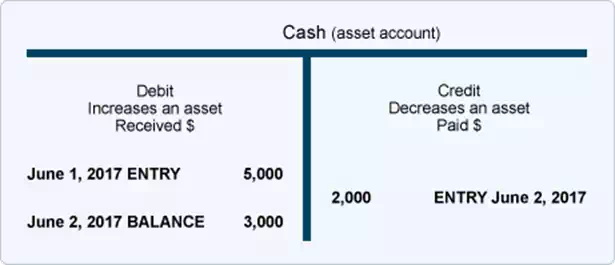

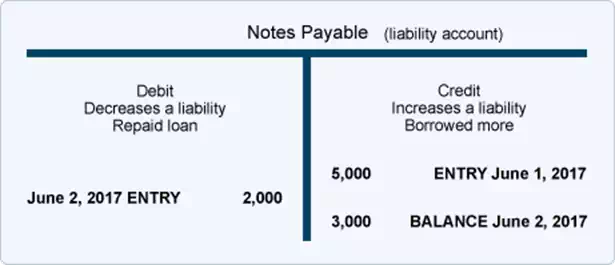

We will begin with two T-accounts: Cash and Notes Payable.

Let's demonstrate the use of these T-accounts with two transactions:

- On June 1, 2017 a company borrows $5,000 from its bank. This causes the company's asset Cash to increase by $5,000 and its liability Notes Payable to also increase by $5,000. To increase the asset Cash the account needs to be debited. To increase the company's liability Notes Payable this account needs to be credited. After entering the debits and credits the T-accounts look like this:

- On June 2, 2017 the company repaid $2,000 of the bank loan. This causes the company's asset Cash to decrease by $2,000 and its liability Notes Payable to also decrease by $2,000. To reduce the asset Cash the account will need to be credited for $2,000. To decrease the liability Notes Payable that account will need to be debited. The T-accounts now look like this:

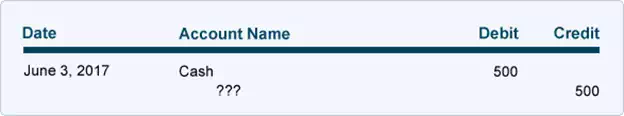

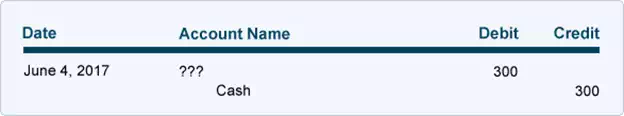

Another way to visualize business transactions is to write a general journal entry. Each general journal entry lists the date, the account title(s) to be debited and the corresponding amount(s) followed by the account title(s) to be credited and the corresponding amount(s). The accounts to be credited are indented. Let's illustrate the general journal entries for the two transactions that were shown in the T-accounts above.

Because cash is involved in many transactions, it is helpful to memorize the following:

· Whenever cash is received, debit Cash.

· Whenever cash is paid out, credit Cash.

With the knowledge of what happens to the Cash account, the journal entry to record the debits and credits is easier. Let's assume that a company receives $500 on June 3, 2017 from a customer who was given 30 days in which to pay. (In May the company recorded the sale and an account receivable.) On June 3 the company will debit Cash, because cash was received. The amount of the debit and the credit is $500. Entering this information in the general journal format, we have:

All that remains to be entered is the name of the account to be credited. Since this was the collection of an account receivable, the credit should be Accounts Receivable. (Because the sale was already recorded in May, you cannot enter Sales again on June 3.)

On June 4 the company paid $300 to a supplier for merchandise the company received in May. (In May the company recorded the purchase and the accounts payable.) On June 4 the company will credit Cash, because cash was paid. The amount of the debit and credit is $300. Entering them in the general journal format, we have:

All that remains to be entered is the name of the account to be debited. Since this was the payment on an account payable, the debit should be Accounts Payable. (Because the purchase was already recorded in May, you cannot enter Purchases or Inventory again on June 4.)

To help you become comfortable with the debits and credits in accounting, memorize the following tip:

· Whenever cash is received, the Cash account is debited (and another account is credited).

· Whenever cash is paid out, the Cash account is credited (and another account is debited).

Normal Balances

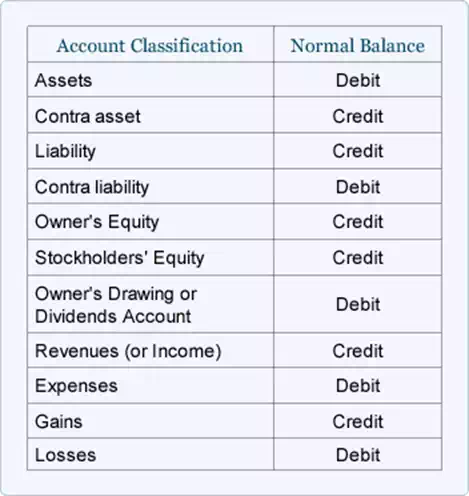

When looking at a T-account for each of the account classifications in the general ledger, here is the debit or credit balance you would normally find in the account:

Revenues and Gains Are Usually Credited

Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry.

The exceptions to this rule are the accounts Sales Returns, Sales Allowances, and Sales Discounts—these accounts have debit balances because they are reductions to sales. Accounts with balances that are the opposite of the normal balance are called contra accounts; hence contra revenue accounts will have debit balances.

Let's illustrate revenue accounts by assuming your company performed a service and was immediately paid the full amount of $50 for the service. The debits and credits are presented in the following general journal format:

Whenever cash is received, the asset account Cash is debited and another account will need to be credited. Since the service was performed at the same time as the cash was received, the revenue account Service Revenues is credited, thus increasing its account balance.

Let's illustrate how revenues are recorded when a company performs a service on credit (i.e., the company allows the client to pay for the service at a later date, such as 30 days from the date of the invoice). At the time the service is performed the revenues are considered to have been earned and they are recorded in the revenue account Service Revenues with a credit. The other account involved, however, cannot be the asset Cash since cash was not received. The account to be debited is the asset account Accounts Receivable. Assuming the amount of the service performed is $400, the entry in general journal form is:

Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit.

Expenses and Losses are Usually Debited

Expenses normally have their account balances on the debit side (left side). A debit increases the balance in an expense account; a credit decreases the balance. Since expenses are usually increasing, think "debit" when expenses are incurred. (We credit expenses only to reduce them, adjust them, or to close the expense accounts.) Examples of expense accounts include Salaries Expense, Wages Expense, Rent Expense, Supplies Expense, and Interest Expense.

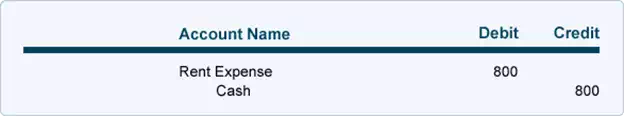

To illustrate an expense let's assume that on June 1 your company paid $800 to the landlord for the June rent. The debits and credits are shown in the following journal entry:

Since cash was paid out, the asset account Cash is credited, and another account needs to be debited. Because the rent payment will be used up in the current period (the month of June) it is considered to be an expense, and Rent Expense is debited. If the payment was made on June 1 for a future month (for example, July) the debit would go to the asset account Prepaid Rent.

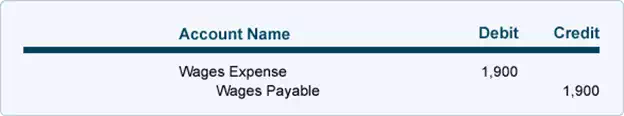

As a second example of an expense, let's assume that your hourly paid employees work the last week in the year but will not be paid until the first week of the next year. At the end of the year, the company makes an entry to record the amount the employees earned but have not been paid. Assuming the employees earned $1,900 during the last week of the year, the entry in general journal form is:

As noted above, expenses are almost always debited, so we debit Wages Expense, increasing its account balance. Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable. A credit to a liability account increases its credit balance.

To help you get more comfortable with debits and credits in accounting and bookkeeping, memorize the following tip:

· To increase an expense account, debit the account.

Permanent and Temporary Accounts

Asset, liability, and most owner/stockholder equity accounts are referred to as "permanent accounts" (or "real accounts"). Permanent accounts are not closed at the end of the accounting year; their balances are automatically carried forward to the next accounting year.

"Temporary accounts" (or "nominal accounts") include all of the revenue accounts, expense accounts, the owner drawing account, and the income summary account. Generally speaking, the balances in temporary accounts increase throughout the accounting year and are "zeroed out" and closed at the end of the accounting year.

Balances in the revenue and expense accounts are zeroed out by closing/transferring/clearing their balances to the Income Summary account. The net amount in Income Summary is then closed/transferred/cleared to an owner equity account, such as Mary Smith, Capital (or to Retained Earnings if the company is a corporation). The owner drawing account (such as Mary Smith, Drawing) is a temporary account and it is closed directly to the owner capital account (such as Mary Smith, Capital) without going through an income summary account.

Because the balances in the temporary accounts are transferred out of their respective accounts at the end of the accounting year, each temporary account will have a zero balance when the next accounting year begins. This means that the new accounting year starts with no revenue amounts, no expense amounts, and no amount in the drawing account.

By using many revenue accounts and a huge number of expense accounts, a company is certain to have easy access to detailed information on revenues and expenses throughout the year. This allows the management of the company to monitor the performance of all parts of the company. Once the accounting year has ended, the need to know the balances in these temporary accounts has also ended, so the accounts are closed out and reopened for the next accounting year with zero balances.

Bank's Debits and Credits

When you hear your banker say, "I'll credit your checking account," it means the transaction will increase your checking account balance. Conversely, if your bank debits your account (e.g., takes a monthly service charge from your account) your checking account balance decreases.

If you are new to the study of debits and credits in accounting, this may seem puzzling. After all, you learned that debiting the Cash account in the general ledger increases its balance, yet your bank says it is crediting your checking account to increase its balance. Similarly, you learned that crediting the Cash account in the general ledger reduces its balance, yet your bank says it is debiting your checking account to reduce its balance.

Although the above may seem contradictory, we will illustrate below that a bank's treatment of debits and credits is indeed consistent with the basic accounting principles you learned. Let's look at three transactions and consider the resultant journal entries from both the bank's perspective and the company's perspective.

Transaction #1

Let's say that your company, Debris Disposal, receives $100 of currency from a customer as a down payment for a future site cleanup service. When the money is received your company makes the following entry:

(Debris Disposal's journal entry)

Because it has received cash, Debris Disposal increases its Cash account with a debit of $100. The rules of double entry accounting require Debris Disposal to also enter a credit of $100 into another of its general ledger accounts. Since the company has not yet earned the $100, it cannot credit a revenue account. Instead, the liability account Unearned Revenues is credited because Debris Disposal has a liability to do the work or to return the $100. (An alternate title for the Unearned Revenues account is Customer Deposits.)

Now let's say you take that $100 to Trustworthy Bank and deposit it into Debris Disposal's checking account. Trustworthy Bank debits the bank's general ledger Cash account for $100, thereby increasing the bank's assets. The rules of double entry accounting require the bank to also enter a credit of $100 into another of bank's general ledger accounts. Because the bank has not earned the $100, it cannot credit a revenue account. Instead, the bank credits its liability account Deposits to reflect the bank's obligation/liability to return the $100 to Debris Disposal on demand. In general journal format the bank's entry is:

(Trustworthy Bank's journal entry)

As the entry shows, the bank's assets increase by the debit of $100 and the bank's liabilities increase by the credit of $100. The bank's detailed records show that Debris Disposal's checking account is the specific liability that increased.

Transaction #2

Let's say Trustworthy Bank receives a $1,000 wire transfer on your company's behalf from a person who owes money to Debris Disposal. Two things happen at the bank: (1) The bank receives $1,000, and (2) the bank records its obligation to give the money to Debris Disposal on demand. These two facts are entered into the bank's general ledger as follows:

(Trustworthy Bank's journal entry)

The debit increases the bank's assets by $1,000 and the credit increases the bank's liabilities by $1,000. The bank's detailed records show that Debris Disposal's checking account is the specific liability that increased.

At the same time the $1,000 wire transfer is received at the bank, Debris Disposal makes the following entry into its general ledger:

(Debris Disposal's journal entry)

As a result of collecting $1,000 from one of its customers, Debris Disposal's Cash balance increases and its Accounts Receivable balance decreases.

Transaction #3

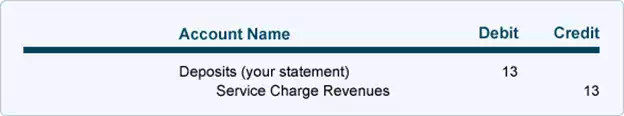

Many banks charge a monthly fee on checking accounts. If Trustworthy Bank decreases Debris Disposal's checking account balance by $13.00 to pay for the bank's monthly service charge, this might be itemized on Debris Disposal's bank statement as a "debit memo." The entry in the bank's records will show the bank's liability being reduced (because the bank owes Debris Disposal $13 less). It also shows that the bank earned revenues of $13 by servicing the checking account.

(Trustworthy Bank's general ledger)

On your company's records, the entry will look like this:

(Debris Disposal's general ledger)

Debris Disposal's cash is reduced with a credit of $13 and expenses are increased with a debit of $13. (If the amount of the bank's service charges is not significant a company may debit the charge to Miscellaneous Expense.)

Bank's Balance Sheet

Accounts such as Cash, Investment Securities, and Loans Receivable are reported as assets on the bank's balance sheet. Deposits are reported as liabilities and include the balances in its customers' checking and savings accounts as well as certificates of deposit. In effect, your bank statement is just one of thousands of subsidiary records that account for millions of dollars in Deposits that a bank owes to its customers.

Here are some of the highlights from this major topic:

· Debit means left.

· Credit means right.

· Every transaction affects two accounts or more.

· At least one account will be debited and at least one account will be credited.

· The total of the amount(s) entered as debits must equal the total of the amount(s) entered as credits.

· When cash is received, debit Cash.

· When cash is paid out, credit Cash.

· To increase an asset, debit the asset account.

· To increase a liability, credit the liability account.

· To increase owner's equity, credit an owner's equity account.

· To increase revenues, credit the revenues account

· To increase expenses, debit the expense account