How to do a Journal Entry

OK soldiers. Time to do some real accounting!

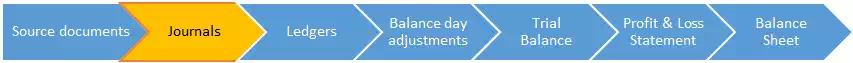

Everything we do from this point on will be stuff that real accountants and bookkeepers are doing in their offices at this very moment. That means this lesson will be a little more technical than the previous ones. Don’t let that spook you though. You’ll be surprised at how simple it can be! Now would be a good time for us to lay out the steps in the accounting process:

You’ll notice the above diagram shows the first step as “Source Documents”. Source documents are things such as receipts , invoices, bank statements and credit card statements that are collected during the year, so that we have all the information we need when the time comes for us do our accounting. Obviously in these lessons we won’t be asking you to go out and collect invoices and receipts, so we’ll conveniently “skip” that step for now.

The next step is entering journals. Every time a transaction occurs, it’s recorded using a journal entry.

A journal entry is simply a summary of the debits and credits of a transaction. Journal entries are important because they allow us to sort our transactions into manageable data. Imagine having a large stack of receipts and invoices from different shops, suppliers and customers. All the information you need is there, but it’s useless when it’s all messed up like that! Journal entries help us sort all this into meaningful information.

Here’s what a typical journal entry looks like:

Transaction: Pay an expense of $100.

Journal entry:

|

Dr |

Expense |

$100 |

|

Cr |

Bank |

$100 |

Let’s take a look at what this means.

First of all, Dr and Cr are simply abbreviations for Debit and Credit.

Every single transaction consists of two movements: a debit movement and a credit movement. Be careful not to confuse this with the debit and credit sides. These are two different things.

Debit and credit movements are used in accounting to show increases or decreases in our accounts. Therefore instead of saying there has been an increase or a decrease in an account, we say there has been a debit movement or a credit movement.

For example, in the previous lesson we learned to show the above transaction like this:

|

DEBIT SIDE |

CREDIT SIDE |

||

|

Account |

Amount |

Account |

Amount |

|

Expense |

+$100 |

||

|

Bank |

-$100 |

||

Now, instead of showing these as pluses and minuses, we will show them in a journal entry as debit movements and credit movements:

|

Dr |

Expenses |

$100 |

|

Cr |

Bank |

$100 |

The nature of each movement is explained below:

|

|

DEBIT SIDE (Assets, Expenses, Drawings) |

CREDIT SIDE (Liabilities, Revenue, Owner’s Equity) |

|

Increase |

Debit movement |

Credit movement |

|

Decrease |

Credit movement |

Debit movement |

Let’s apply this to our example:

When we pay expenses that means our expenses have increased. Also, when we pay expenses our bank account is obviously going to go down.

So in summary we need to record a transaction that will increase expenses and decrease bank.

Referring back to our matrix, we can see that to increase expenses we require a debit movement.

|

|

DEBIT SIDE (Assets, Expenses, Drawings) |

CREDIT SIDE (Liabilities, Revenue, Owner’s Equity) |

|

Increase |

Debit movement |

Credit movement |

|

Decrease |

Credit movement |

Debit movement |

We can also see that decreasing our bank requires a credit movement:

|

DEBIT SIDE |

CREDIT SIDE |

|

|

Increase |

Debit movement |

Credit movement |

|

Decrease |

Credit movement |

Debit movement |

Hence our journal entry will involve a debit movement to expenses, a credit movement to bank, just as we saw before:

|

Dr |

Expenses |

$100 |

|

Cr |

Bank |

$100 |

Now it’s your turn. Have a go at writing journal entries for the transactions we’ve had in the previous lessons. The first one has been done for you.

- Bank

- Rent

- Loan

- Service Income

|

|

DEBIT SIDE (Assets, Expenses, Drawings) |

|

CREDIT SIDE (Liabilities, Revenue, Owner’s Equity) |

|

|

Increase |

|

|

||

|

Decrease |

|

|

Transaction 1: You decide to start a business. To start the business off, you deposit $10,000 of your savings into the business bank account.

- Dr

- Cr

- $10000

- $-10000

- $10000

- $-10000

|

Bank |

|

|

Owners Equity |

|

Transaction 2: You buy your trusty iPhone off eBay for $500

- Dr

- Cr

- $500

- $-500

- $500

- $-500

|

Bank |

|

|

iPhone |

|

Transaction 3: You take out a business loan of $10,000.

- Dr

- Cr

- $10000

- $-10000

- $10000

- $-10000

|

Loan |

|

|

Bank |

|

Transaction 4: You put another $5,000 of your own money into the business.

- Dr

- Cr

- $5000

- $-5000

- $5000

- $-5000

|

Bank |

|

|

Owner's Equity |

|

Transaction 5: You pay back $1,000 of the loan (no interest).

- Dr

- Cr

- $1000

- $-1000

- $1000

- $-1000

|

Loan |

|

|

Bank |

|

Transaction 6: You purchase a computer for $1,500.

- Dr

- Cr

- $1500

- $-1500

- $1500

- $-1500

|

Bank |

|

|

Computer |

|

Transaction 7: You purchase your Bakemaster Oven for $2,000

- Dr

- Cr

- $2000

- $-2000

- $2000

- $-2000

|

Oven |

|

|

Bank |

|

Transaction 8: You buy some cake mix for your store for $3,000

- Dr

- Cr

- $3000

- $-3000

- $3000

- $-3000

|

Bank |

|

|

CakeMix |

|

Transaction 9: You pay interest on the loan of $1,000

- Dr

- Cr

- $1000

- $-1000

- $1000

- $-1000

|

Interest |

|

|

Bank |

|

Transaction 10: You sell a box of cakes for $1000.

- Dr

- Cr

- $1000

- $-1000

- $1000

- $-1000

|

Bank |

|

|

Sales |

|

Transaction 11: You pay your telephone bill of $300

- Dr

- Cr

- $300

- $-300

- $300

- $-300

|

Bank |

|

|

Telephone Expense |

|

Transaction 12: You sell another box of cakes for $2,000

- Dr

- Cr

- $2000

- $-2000

- $2000

- $-2000

|

Sales |

|

|

Bank |

|

Transaction 13: Your computer breaks. You pay a repairman $50 to fix it.

- Dr

- Cr

- $50

- $-50

- $50

- $-50

|

Bank |

|

|

Repairs |

|

Transaction 14: As the owner of the business, you withdraw $1,000 in cash for a personal holiday.

- Dr

- Cr

- $1000

- $-1000

- $1000

- $-1000

|

Bank |

|

|

Drawings |

|

Transaction 15: You purchase a car from

Johns Car Shop for $3,000. You purchase the car on credit, meaning you will pay

for it in full next month.

- Dr

- Cr

- $3000

- $-3000

- $3000

- $-3000

|

Car |

|

|

John’s Car Shop |

|

Congrats! We’ve just prepared journal entries from our business transactions. This is the first step in preparing a set of financial statements. In the next lesson, we’ll enter these journals into ledgers.

What is the difference between the debit and credit side and debit and credit movements?

|

Debit side |

Credit Side |

|

The debit side is the left side of the accounting equation. |

The credit side is the right side of the accounting equation. |

|

The accounts of the debit side are ASSETS, EXPENSES AND DRAWINGS. These are known as debit accounts. |

The accounts of the credit side are LIABILITIES, REVENUE AND OWNER’S EQUITY. These are known as credit accounts. |

For every transaction that occurs, two accounts will change. These two changes are known as a debit movement and a credit movement. The effects of these movements are shown below.

|

Debit movements |

Credit movements |

|

Increase the debit side |

Increase the credit side |

|

Decrease the credit side |

Decrease the debit side |

It is important you do not think of debit movements and credit movements as “pluses and minuses” or “good and bad”. This line of thinking is incorrect. Using the above chart you can see that a debit movement has the ability to both increase and decrease an account, as does a credit movement.

Therefore try and focus on the actual effect each movement has on the different accounts