The Accounting Equation

The accounting equation! Probably sounds intimidating. Don’t worry, it really is as simple as ABC.

Here’s what it looks like.

Assets = Liabilities + Owners Equity

Or

A = L + OE

We already know what the words “Asset” and “Liability” mean from the previous lesson. Let’s quickly define this new term, “Owners Equity”.

Owner’s Equity

We can define Owners Equity as “the amount of money that you (the owner) have invested in the business.”

Whenever you contribute any personal assets to your business your owner’s equity will increase. These contributions can be any asset, such as cash, vehicles or equipment. For example, if you put your car worth $5,000 into the business, your owner’s equity will increase by $5,000. If you invest $10,000 of your savings into the business, your owner’s equity will increase by $10,000.

Likewise, if you take money out of the business your owner’s equity will decrease. For example, you go into your store and take $100 from the cashier to buy yourself a shirt. Because you are taking $100 out of the business, your owner’s equity will decrease by $100.

Let’s see if you can identify which of the following transactions will result in a change in owner’s equity:

Activity: For each of these transactions we could simply have a “yes” and “no” button. I’ll write the correct answer below for you to code.

Transaction 1:

You invest $1,000 of your personal savings into the business.

Change in owner’s equity? ![]() Yes

Yes![]() No

No

Transaction 2:

Your new oven breaks. You hire a repairman $50 to fix it.

Change in owner’s equity? ![]() Yes

Yes![]() No

No

Transaction 3:

You purchase a computer for the business using the business bank account.

Change in owner’s equity? ![]() Yes

Yes![]() No

No

Introduction to the accounting equation

Every single transaction that occurs in your bakery will be recorded using the accounting equation.

Before we go any further, there are 3 very important things to remember about the equation:

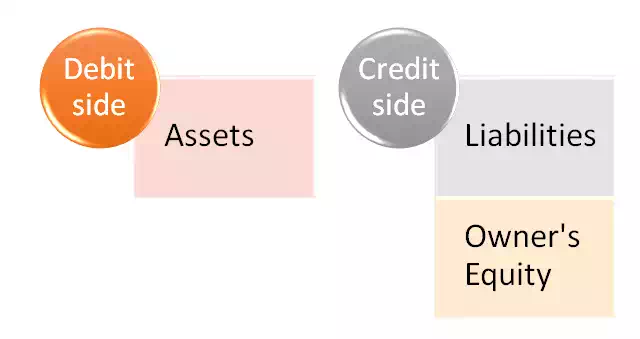

- The left side is referred to as “The Debit Side”

- The right side is referred to as “The Credit Side”

- The equation must always be in balance.

The two sides to the equation:

The Debit Side

The left side of the equation is known as the debit side. As you can see, the left side of the equation consists of Assets.

The Credit Side

The right side of the equation is known as the credit side. As you can see, the right side of the equation consists of Liabilities and Owners Equity.

Remember, the equation must ALWAYS balance.

Note: Throughout this lesson you will also notice that we refer to different “accounts”. An account can be thought of as a collection of related entries. For example, every entry that relates to our loan will be recorded in the “loan account”. Every transaction that relates to our oven will be recorded in the “oven account”. Might be part of the reason this subject is called “accounting”!

Let’s look at some examples to see the accounting equation in action.

Transaction 1

After making cupcakes in your Grandma’s kitchen your whole life, you decide to open a bakery. You use your $10,000 in savings to start your business.

Now let’s look at how this fits into the accounting equation.

Accounts affected:

You have just put $10,000 into the bank, which is an asset. This goes on the debit side.

Now that the debit side has gone up, we need to balance this with $10,000 on our credit side.

We know that our $10,000 investment represents an increase in owner’s equity, and owner’s equity will go on the credit side.

With these two entries, the equation is now balanced.

Let’s fit this into the accounting equation.

We started off with $0 = $0 + $0. Doesn’t get much easier than that!

Now it’s changed a little.

As you can see, we have +$10,000 on the left side (the debit side), and we have +$10,000 on the right side (the credit side). Because both sides went up by $10,000, we’re still in balance. Phew!

Still don’t get it? Don’t worry, it’ll click soon enough. Let’s look at another example.

|

Debit side |

Credit Side |

|

Bank +$10,000 |

Owner’s Equity +$10,000 |

Transaction 2

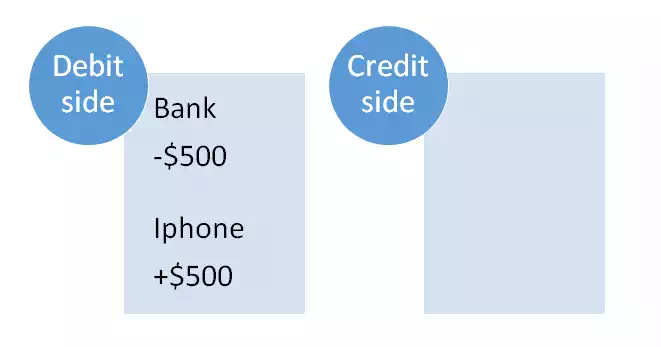

You need an iPhone to take delivery calls from all your crazy customers. You buy one off eBay for $500.

Accounts affected:

Remember in the first example we put money into the bank? Well, this time we’ll be using the bank again, only now we’ll be spending money. That means our bank account, an asset, is going to decrease.

Now that we know the Debit side has decreased, we need to record the second side of the transaction that will keep the equation in balance.

We’re going to create a new asset account called IPHONE, because we need to record the new phone as an asset. Remember, it cost $500, so the two sides of the transaction are:

BANK -$500 (Debit side decrease)

IPHONE+$500 (Debit side increase)

Our bank caused the debit side to decrease, but then our new phone caused it to increase. That means our debit side had no change in the end, and our equation still balances.

You may be wondering, why didn’t the credit side change in this example like it did in the previous example?

Remember, the credit side is only involved in transactions that relate to liabilities and owner’s equity. In this particular transaction, only assets were involved: we used an asset (bank) to purchase another asset (iphone).

We saw above that owner’s equity only relates to investments made personally by the owner. In this example, we used the business bank account to purchase a business asset. Therefore the owner was not involved. If we had used the owner’s personal bank account to buy the iPhone, then our owner’s equity on the credit side would have increased.

Still not getting it? Let’s do a few more examples.

Activity

Have a go at working out the two sides of each transaction. Remember, it needs to balance!

Transaction 3:

It’s time to go oven shopping, but first you need some cash. You visit Anne the loan officer and she gives you a loan of $10,000.

Drag & Drop the blocks into correct positions in table

- 10000$

- -10000$

- 10000$

- -10000$

- Bank

- Loan

Debit Side |

Credit Side |

||

Account |

Amount |

Account |

Amount |

Transaction 4:

It’s your lucky day. You just won a lottery prize of $5,000. You decide to invest your $5,000 into the business.

Drag & Drop the blocks into correct positions in table

- 5000$

- -5000$

- 5000$

- -5000$

- Bank

- Loan

- Owner's Equity

- Vehicle

Debit Side |

Credit Side |

||

Account |

Amount |

Account |

Amount |

Transaction 5:

We don’t want Anne to get angry. You better pay back some of the loan. You decide to pay back $1,000.

- 1000$

- -1000$

- 1000$

- -1000$

- Bank

- Loan

- Owner's Equity

- Vehicle

Debit Side |

Credit Side |

||

Account |

Amount |

Account |

Amount |

Transaction 6:

You need a computer to start taking internet orders and also to watch funny Youtube videos after work. You purchase a computer for $1,500.

- -1500$

- 1500$

- 1500$

- -1500$

- Bank

- Loan

- Owner's Equity

- Computer

Debit Side

|

Credit Side

|

Transaction 7:

Your oven got stolen! Time to purchase the new Bakemaster X Series! It costs you $2,000

- -2000$

- 2000$

- 2000$

- -2000$

- Bank

- Loan

- Owner's Equity

- Oven

Debit Side

|

Credit Side

|

After recording these 7 transactions, our accounts now look like this. We have all our assets listed on the debit side and all our liabilities and owner’s equity listed on the credit side.

Take a quick look back and see if you can follow how the numbers have changed.

|

DEBIT SIDE |

CREDIT SIDE |

|

Bank $20,000 |

Loan $9,000 |

|

Computer $1,500 |

|

|

Oven $2,000 |

Owner’s Equity $15,000 |

|

Iphone $500 |

|

|

Balance$24,000 |

Balance$24,000 |

Still in balance. Perfect!

In case you haven’t figured out how we got to these figures, we’ve broken it down step by step for you below.

Let’s use our Bank account as an example.

Our bank account started at $0. Then the following happened:

|

Transaction |

Running bank balance |

|

We put $10,000 into the business |

$10,000 |

|

We spent $500 on an iPhone |

$9,500 |

|

We got a loan of $10,000 from the bank |

$19,500 |

|

We invested another $5,000 in the business |

$24,500 |

|

We paid back $1,000 of the loan |

$23,500 |

|

We bought a new computer for $1,500 |

$22,000 |

|

We bought a new oven for $2,000 |

$20,000 |

As you can see, we added all transactions that related to the bank to arrive at our ending balance of $20,000. This is the same approach we took for all the accounts.