Why monitoring Cash Flow is important for business

The cash flow report is the third component of a company’s financial statements. The report portrays how a company has spent its cash, and is often used in tandem with the other two key reports – the Profit and Loss and the Balance Sheet.

The cash flow report is important because it informs the reader of the business cash position. For a business to be successful, it must have sufficient cash at all times. It needs cash to pay its expenses, to pay bank loans, to pay taxes and to purchase new assets. A cash flow report determines whether a business has enough cash to do exactly this.

Having cash is a key requirement for a business to stay solvent. When a business has no longer enough cash to pay its dues, it is often declared bankrupt.

For the purposes of this introduction to accounting, we will not go through the actual preparation of an actual cash flow report. In fact in the business world, small businesses rarely produce a cash flow report, as profit and loss report is sufficient for their needs. It is unlikely that a small business such as a bakery will involve complex non cash transactions that would warrant such information. Therefore, it is considered a waste of time and money to have an accountant prepare a report that would be of little use to anyone!

On the other hand, for large entities such as Nike and Microsoft, having a cash flow report is imperative. Such companies will often have a significant amount of non-cash transactions, sometimes even billions of dollars in revenue that is simply owed to them but hasn’t been received in cash yet. In these situations, a profit and loss statement is not always sufficient and a cash flow report is valuable to many users, such as banks and shareholders.

Example:

Let’s imagine you start a business with $1,000.

With your $1,000 you buy a box of ingredients and bake cakes.

You sell all the cakes to a customer for $5,000.

The customer asks if he can purchase the cakes on credit, meaning he will pay for the cakes at the end of the month. You agree.

Let’s determine your cash position in this scenario.

Revenue: $5,000

Under accounting rules revenue is recognised when it is earned, not when it is received. Therefore, since you have made the sale to your customer, the sale must be recognised as revenue received.

Profit: $4,000

You spent $1,000 on the cakes and sold them for $5,000. This leaves you with a profit of $4,000.

Cash: ZERO!

Even though you have earned $5,000 in revenue and $4,000 in profit, you have ZERO CASH! This scenario can play out often in the business world, particularly with large corporations, which signifies the importance of producing a cash flow report.

The purpose of this lesson is to describe the merits of a cash flow report and when it may be necessary. However, you will probably find that the majority of small businesses don’t find this report necessary – a profit and loss statement is often all they require for their tax and planning needs.

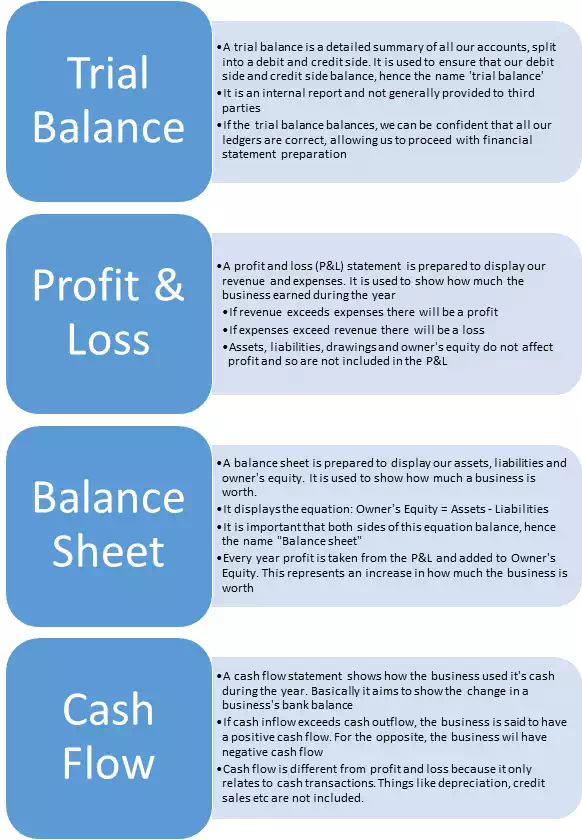

Appendix: Different types of accounting statements

|

|

Trial Balance |

Profit and Loss |

Balance Sheet |

Cash Flow Statement |

|

Accounts included |

All Accounts |

Revenue & Expenses |

Assets, Liabilities, Drawings and Owner’s Equity |

Bank |

|

Type |

For internal users |

For external users |

For external users |

For external users |

|

Key information displayed |

Confirmation that our debit accounts balance with our credit accounts |

Profit/Loss for the year |

Value of the business’s net assets |

Increase/decrease in bank balance |

|

Structure |

All debit accounts on left side, all credit accounts right side |

Revenue minus expenses equals profit |

Assets minus liabilities equals Owner’s Equity |

Starts with bank balance at start of the

year |