Cost Accounting - Elements of Cost

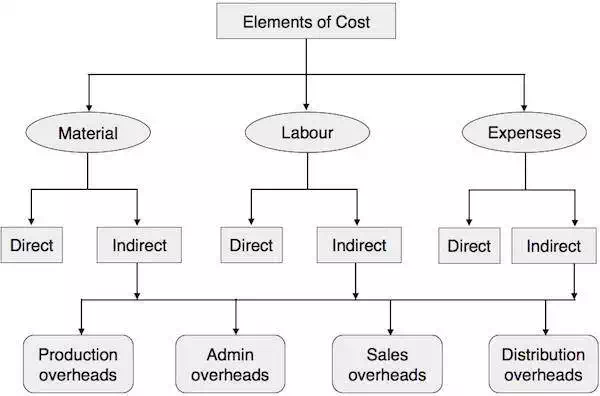

The following chart shows the various elements of cost and how they are classified.

Direct or Indirect Materials

The materials directly contributed to a product and those easily identifiable in the finished product are called direct materials. For example, paper in books, wood in furniture, plastic in water tank, and leather in shoes are direct materials. They are also known as high-value items. Other lower cost items or supporting material used in the production of any finished product are called indirect material. For example, nails in shoes or furniture.

Direct Labor

Any wages paid to workers or a group of workers which may directly co-relate to any specific activity of production, supervision, maintenance, transportation of material, or product, and directly associate in conversion of raw material into finished goods are called direct labor. Wages paid to trainee or apprentices does not comes under category of direct labor as they have no significant value.

Overheads

Indirect expenses are called overheads, which include material and labor. Overheads are classified as:

● Production or manufacturing overheads

● Administrative expenses

● Selling Expenses

● Distribution expenses

● Research and development expenses