Accounting - Process

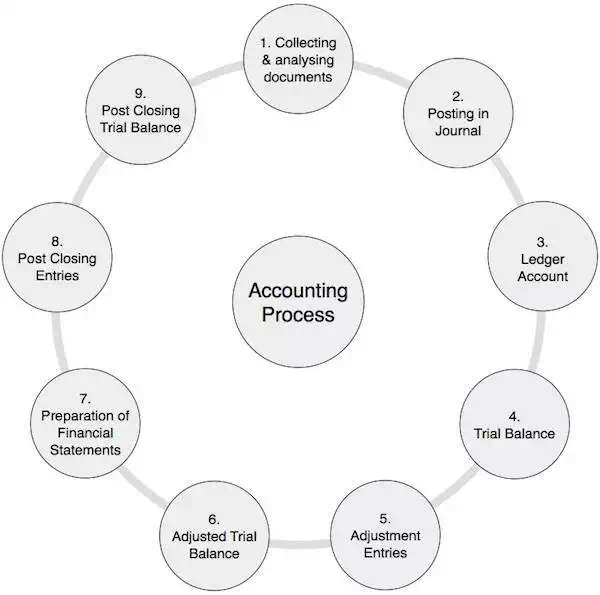

Accounting cycle refers to the specific tasks involved in completing an accounting process. The length of an accounting cycle can be monthly, quarterly, half-yearly, or annually. It may vary from organization to organization but the process remains the same.

Accounting Process

The following table lists down the steps followed in an accounting process -

|

1 |

Collecting and Analyzing Accounting Documents |

It is a very important step in which you examine the source documents and analyze them. For example, cash, bank, sales, and purchase related documents. This is a continuous process throughout the accounting period. |

|

2 |

Posting in Journal |

On the basis of the above documents, you pass journal entries using double entry system in which debit and credit balance remains equal. This process is repeated throughout the accounting period. |

|

3 |

Posting in Ledger Accounts |

Debit and credit balance of all the above accounts affected through journal entries are posted in ledger accounts. A ledger is simply a collection of all accounts. Usually, this is also a continuous process for the whole accounting period. |

|

4 |

Preparation of Trial Balance |

As the name suggests, trial balance is a summary of all the balances of ledger accounts irrespective of whether they carry debit balance or credit balance. Since we follow double entry system of accounts, the total of all the debit and credit balance as appeared in trial balance remains equal. Usually, you need to prepare trial balance at the end of the said accounting period. |

|

5 |

Posting of Adjustment Entries |

In this step, the adjustment entries are first passed through the journal, followed by posting in ledger accounts, and finally in the trial balance. Since in most of the cases, we used accrual basis of accounting to find out the correct value of revenue, expenses, assets and liabilities accounts, we need to do these adjustment entries. This process is performed at the end of each accounting period. |

|

6 |

Adjusted Trial Balance |

Taking into account the above adjustment entries, we create adjusted trial balance. Adjusted trial balance is a platform to prepare the financial statements of a company. |

|

7 |

Preparation of Financial Statements |

Financial statements are the set of statements like Income and Expenditure Account or Trading and Profit & Loss Account, Cash Flow Statement, Fund Flow Statement, Balance Sheet or Statement of Affairs Account. With the help of trial balance, we put all the information into financial statements. Financial statements clearly show the financial health of a firm by depicting its profits or losses. |

|

8 |

Post-Closing Entries |

All the different accounts of revenue and expenditure of the firm are transferred to the Trading and Profit & Loss account. With the result of these entries, the balance of all the accounts of income and expenditure accounts come to NIL. The net balance of these entries represents the profit or loss of the company, which is finally transferred to the owner’s equity or capital. |

|

9 |

Post-Closing Trial Balance |

Post-closing Trial Balance represents the balances of Asset, Liabilities & Capital account. These balances are transferred to next financial year as an opening balance. |